Mountaintop Economics & Research, Inc.

10 Pleasant St.

#3

Greenfield, MA 01301 US

413-464-3704

billwood@plasticseconomics.com

plasticseconomics.com

IS THIS YOUR COMPANY?

As Seen On MoldMaking Technology

Mountaintop Economics & Research, Inc. Supplies the Following Products

- Books, Publications, Online Resources

- Consulting Services

Editorial, News, and Products

-

Plastics Machinery Expectations and Shipments Stay Strong

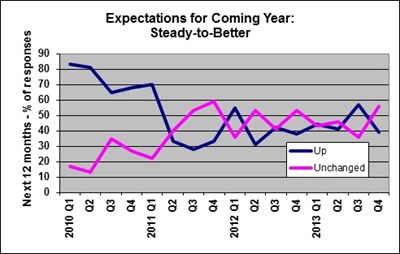

The Committee on Equipment Statistics of SPI conducts a quarterly survey of plastics machinery suppliers that asks about present market conditions and future expectations. Responses reveal an upbeat attitude that is broad-based across the industry. When asked about future expectations or market conditions, 87 percent of the respondents expect conditions to stay the same or even improve in the coming quarter, and 95 percent expect them to hold steady or get better during the next 12 months.

-

A Lot of Data, but One Conclusion: There is More Work to Do

This week is heavier than usual in terms of important economic data releases.

-

Flying Blind

Usually, I have the pleasure of using this blog to report on trends in the economic and market data that affect moldmakers. But since the government shutdown last week there has been very little data upon which to comment. So ...

-

The Government Shutdown: Short-term Pain, Long-term Disaster

OK, now I'm upset. Every workday morning I fire up my computer, log onto the Internet, and read all of the relevant economic data releases for that day. But when Congress decided to allow the shutdown of the federal government yesterday, one of the many bureaus that was closed was the Census Bureau. And since nobody is currently working at the Census Bureau, there is nobody there to release the data that they usually report every month.

-

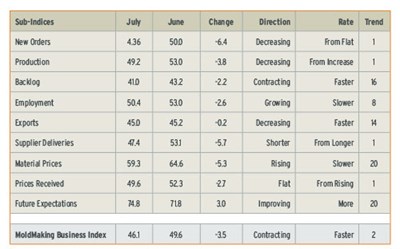

Total MoldMaking Business Index for August 2013

46.1

-

U.S. Economy Still Plodding Along, But 2014 Will Be Strong

There are still a few more weeks before the end of September, but the end of the third quarter is now in sight. And barring any dramatic change in the economic landscape, it is clear from the data that has been reported for the third quarter that the U.S. economy continues to grow at the same tepid pace that has prevailed since the Great Recession ended four years ago.

-

Demand for Consumer Goods Will Increase

A lack of final demand has been felt by all segments of the manufacturing sector, especially moldmakers. However, this situation is gradually improving, and an increasing number of indicators suggest that spending activity will accelerate in the coming months. One sector that has already experienced a nice increase in demand is the auto sector.

-

Capacity Utilization Rates for Plastics Processors Rising

Every month, the Federal Reserve Board compiles and reports data that measures the activity levels of U.S. plastics processors. One of the data series is the industrial production index for plastics products and the other is the capacity utilization rate for U.S. plastics and rubber processors. Both are crucial for moldmakers because they are good indicators of how fast the industry is growing (or contracting), and when new capacity needs to be added in order to keep up with rising demand.

-

2nd Quarter GDP Stats Indicate that Growth Is Accelerating

If you follow this blog you may recall that last week I warned readers that the rate of economic growth in the second quarter was likely to be quite low. Based on analyses of the monthly data series that measure macro economic activity in the U.S., the most reliable models were predicting that the growth rate for the total GDP figure sank as low as 0.5% in Q2. Well, I am happy to report that this prediction was too pessimistic.

-

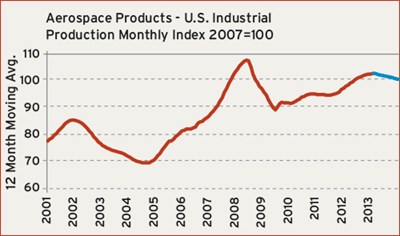

Aerospace/Defense and Energy/Power Generation

Total Output of Aerospace Products Will Decline This Year; U.S. Demand for Electricity Is Steadily Creeping Higher

-

Total MoldMaking Business Index for June 2013

50.1

-

End Market Reports: Computer and Medical

U.S. Computer Industry Emerging from Slump; Production of Medical Supplies and Equipment Is Accelerating

-

Total MoldMaking Business Index for April 2013

49.0

-

Total MoldMaking Business Index for March 2013

51.5

-

End Market Report: Automotive and Consumer, May 2013

Solid Year Expected for Automotive; Solid Year Expected for Automotive

-

Hot Runner Data Provides Insight into Mold Market

The Committee for Equipment Statistics of the Society of the Plastics Industry has started to compile and report data on the market for hot runners. This is a new data set, so the amount of statistical analysis that can be performed is limited. But the trend in market demand for hot runners should ultimately prove quite interesting to moldmakers.

-

End Market Report: Packaging and Aerospace

Packaging Outlook: Stable to Better; Aerospace Industry was Strong in 2012-- Can It Sustain the Momentum?

-

Total MoldMaking Business Index for February 2013

51.3

-

Electronics and Power Generation

U.S. Computer Industry Is in Early Stages of Recovery; Electric Power Industry Rebounds from Cyclical Low-Point

-

Total MoldMaking Business Index for January 2013

49.8

-

Medical & Consumer Products End Market Report 2013

Medical & Consumer Products

-

The Economy Went Flat in Q4, but Poised for Future Recovery

Trends may suggest sluggish growth in the near term, but in the long term these trends will result in a more healthy recovery. Our latest forecast calls for sub-par GDP growth in the first half of 2013, but the recovery will accelerate noticeably in the second half of this year. We expect the annual growth in real GDP to be at least 2.5% this year, and at least 3.5% in 2014.

-

Aerospace & Automotive

Aerospace Outlook: Steady Growth in 2013; Automotive Industry Will Remain a Bright Spot in 2013

-

Overall Business Remains Unchanged

Total Mold Business Index for November 2012: 45.8

-

Increase in Employment Levels; New Orders Decline

Total Mold Business Index for October 2012: 45.6

-

Automotive & Medical

Auto Industry Outlook: Continued Growth; Medical Industry Gains Will Stay Robust

-

Aerospace & Packaging

Production of Aerospace Products and Parts is Accelerating; Plastics Packaging Demand Will Exceed Growth in the Overall Economy

-

Future Expectations Remain Optimistic Despite Decline in Overall Activity

Total Mold Business Index for September 2012: 44.4

-

One Last Pitch before You Vote

This is my last blog posting before the election next Tuesday, so I thought I would offer a few final comments about the proper role of politics in our economy. You can call this my competitive philosophy for government.

-

What Should the Federal Government Do to Help the Economy?

There are a few things that our elected officials should do immediately in an effort to help the US economy. Keep in mind that the ultimate goal of US national economic policy should be one thing and one thing only: long-term productivity growth. We may think that we want unlimited healthcare, copious retirement benefits, and free entertainment for our citizens, but without sustained productivity growth in our economy over the long term we will not be able to afford any of these things.

-

Mold Prices Steady; Future Expectations Remain Optimistic

Total Mold Business Index for August 2012: 48.6

-

End Market Reports

Consumer Products & Medical

-

Future Expectations Remain Optimistic

Total Mold Business Index for July 2012: 48.9

-

Automotive/Transportation & Electronics/Computer

Light Vehicle Sales: Steady, Not Great; Computer Production Hits a Lull

-

Aerospace/Defense and Energy/Power Generation

Defense Suppliers Hoping to Avoid “Fiscal Cliff” and Energy Production Accelerating

-

Overall Activity Levels Advanced

Total Mold Business Index for June 2012: 54.5

-

The Mold Business Index: A One-Year Retrospective

Starting with July, 2011, here is how the MBI has looked for the past twelve months.

-

Computers/Electronics and Medical

Computers/Electronics Industries in Early Recovery and Medical Equipment Output Accelerates

-

Uptrend Extended

Total Mold Business Index for April 2012: 54.3

-

1st Quarter Indicators Portend Continued Growth for New Molds

A wise economist once said, “Predictions are difficult to make, especially about the future.” But as any shop owner/manager knows, it is impossible to run a business without them.

-

Uptrend Continues

Total Mold Business Index for March 2012: 52.7.

-

Automotive & Consumer Products End Market Report 2012

Automotive & Consumer Products

-

End Market Report: Aerospace/Defense & Packaging

Plastics Packaging Outlook: Moderate Growth in 2012, and Aerospace/Defense Spending Outlook.

-

Uptrend Accelerated

Total Mold Business Index for February 2012: 56.6

-

Business Levels: Moderate but Steady Improvement

Total Mold Business Index for January 2012: 53.9

-

Energy & Electronics End Market Report 2012

Energy & Electronics

-

Medical Equipment and Supplies; Consumer Goods End Market Report 2012

Medical Equipment and Supplies; Consumer Goods.

-

Business Levels Improve Moderately

Total Mold Business Index for December 2011: 52.0

-

End Market Reports

Market Outlook: Motor Vehicles; Market Outlook: Aerospace Products and Parts

-

Business Levels Steady to Better

Total Mold Business Index for November 2011: 53.0

-

Overall Business Levels Strengthen

Total Mold Business Index for October 2011: 55.7

-

A Better Future Will Be Built with Better Information

More information at a faster speed, the Mold Business Index is a giant step in raising your level of market intelligence.

-

Business Levels Steady-to-Higher

Total Mold Business Index for September 2011: 51.2

-

Overall Business Levels Improve

Total Mold Business Index for August 2011: 56.3.

-

Mold Business Index: Overall Business Levels Uneasily Steady

Total Mold Business Index for July 2011: 50.0

-

Overall Business Levels Expanding

Total Mold Business Index for June 2011: 55.3

-

Mold Business Index

Total Mold Business Index for May 2011: 53.5.

-

Data Indicates Continued Investment

The Mold Business Index (MBI) for April 2011 is 47.1.

-

Business Levels Continue to Expand

Total Mold Business Index for March 2011: 53.0.

-

Business Levels for Moldmakers Expanded

Total Mold Business Index for February 2011: 51.9.

-

Rising Gas Prices Are Good for Moldmakers and America in the Long Run

A commentary on the rise in gas prices on mold manufacturing, and why we need to take this opportunity to learn, grow and to become stronger as a nation.

-

ToolTalk: The Trend in Capital Spending for New Equipment Bodes Well for Mold Demand

So when it comes time for a mold shop to forecast its future business levels, one must seek out alternative indicators. One indicator that we consistently monitor is the trend in capital spending on industrial equipment.

-

Activity Levels Steady

Total Mold Business Index for December 2010: 48.9.

-

Higher Materials Prices Here to Stay

The question is no longer whether materials prices will continue to rise for North American moldmakers, but rather can manufacturers in this region survive or even thrive given these prevailing trends in the market conditions.

-

Mold Business Index Is Back!

In order to make profits, you need to arm yourself with the right market information.

-

Future Expectations Increasingly Optimistic

Total Mold Business Index for November 2010: 42.5

-

Overall Business Activity Held Mostly Steady

Total Mold Business Index for November 2009: 50.0

-

Creative Moldmaking

A few months ago, I suggested that MoldMaking Technology sponsor an art exhibit comprised of molds and tooling.

-

Gradual Recovery in the Coming Months

Total Mold Business Index for February 2010: 45.1

-

Materials Prices: Short-Term Pain May Result in Long-Term Gain

At first glance, the accompanying chart of steel prices tells a disturbing story.

-

Still Geared up for Gradual Recovery

Total Mold Business Index for March 2010: 44.7

-

Rising Corporate Profits Bode Well for Moldmakers

If you ask any red-blooded, patriotic American manufacturer what he or she is in business to make, the answer should be quick and simple.

-

Gradual Recovery Still Forecast

Total Mold Business Index for April 2010: 47.8

-

What about a Double-Dip?

U.S. economic growth in the first quarter was stronger than most forecasters expected, and the second quarter has also been pretty decent.

-

Forecast for Recovery Remains Unchanged

The Mold Business Index (MBI) for June 2010 is 45.1.

-

Stop Trying to Recover From the Past and Start Building for the Future

Recently I was in a meeting with a customer who had been hit hard by the past recession, and they were struggling to find their bearings.

-

Data Indicates Rise in Business Investment

Total Mold Business Index for July 2010: 53.6

-

Election Year Advice for Manufacturers

Here is one economist’s view of the effects of Washington DC on domestic manufacturing and how to fix it.

-

Mold Business Index: Underlying Data Show Strong Index Components

The total Mold Business Index is a weighted average of the Sub-Indices for new orders, production, employees, backlog, exports, and supplier deliveries. The Mold Business Index (MBI) for October 2010 is 51.3.

-

Manufacturing Solutions: Wait ‘Til Next Year

As 2010 comes to a close, Americans are still struggling with a high unemployment rate, low consumer confidence, declining house prices and an uncomfortably high level of uncertainty about the future.

-

Activity Levels Indicate Uptrend Starting

55.2 Total Mold Business Index for September 2009 The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports and supplier deliveries

-

Evidence Shows Cyclical Bottom Hit

41.3 Total Mold Business Index for May 2009 The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports and supplier deliveries.

-

Cycle to Hit Bottom in the First Half of 2009

38.6 Total Mold Business Index for December 2008 The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports and supplier deliveries.

-

Decline Less Severe Than Expected

42.5 Total Mold Business Index for November 2008 The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports and supplier deliveries.

-

Decline in Activity Levels Not as Severe

47.2 Total Mold Business Index for OCTOBER 2008 The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports and supplier deliveries.

-

Specialization and Automation Give Matrix an Edge on Competitors

Mold shop’s focus on high-tech capabilities and full-service operation earns it a niche in precision tools.

-

Custom Machining Builds Revenue at Strohwig

Moldmaker turns metal fabrication skills into a major profit center with aerospace work.

-

Economic Growth Slows; Expectations Positive 41.7 Total Mold Business Index for February 2008

Overall economic growth in the U.S. is sputtering so far this year, and this is constraining demand for new molds in the first quarter of 2008

-

Complex Parts Put a Premium on High-Tech Mold Design

Equipment and component suppliers are developing a range of products for advanced moldmaking needs.

-

Business Mostly Steady

Mold Business Index for October 2007

-

Business Activity Continues to Rise

Mold Business Index for September 2007

-

Business Conditions Mostly Steady

Mold Business Index for July 2007

-

Business Activity Levels Drop Again

Mold Business Index for April 2007

-

Business Activity Levels Slipped Again

Mold Business Index for March 2007

-

Activity Levels: Rate of Decline Moderates

Mold Business Index for February 2007

-

Seasonal Downturn in Business Activity

Mold Business Index for January 2007

-

Activity Levels Ended 2006 on an Up-Tick

Mold Business Index for December 2006

-

Stabilized Business Activity

Mold Business Index for November 2006

-

No Change in Activity Levels

Mold Business Index for October 2006

-

Activity Levels Remain Subdued

Mold Business Inex for September 2006

-

Business Holding Steady

Mold Business Index for Augut 2006

-

Business Activity Holding Steady

Business Mold Index for July 2006

-

Moderate Improvement in Business Activity

Mold Business Index for June 2006

-

Substantial Decrease in Business Activity

Mold Business Index for April 2006

-

Activity Levels Holding Steady

Mold Business Index for March 2006

-

Drop in Moldmaking Activity Accelerates

Mold Business Index for February 2006

-

Business Conditions Ease a Bit

Mold Business Index for January 2006

-

Overall Activity Levels in Positive Territory

Mold Business Index for December 2005

-

Activity Levels Ease Back

Mold Business Index for Novemebr 2005

-

Strong Three-Month Performance

Mold Business Index for September 2005

-

Solid Improvement in Moldmaking Activity Levels

Mold Business Index for June 2005

.jpg;maxWidth=300;quality=90)