Medical Equipment and Supplies; Consumer Goods End Market Report 2012

Medical Equipment and Supplies; Consumer Goods.

Medical Equipment and Supplies

By now, it should come as no surprise to anyone in either the plastics or moldmaking

sectors that demand in the U.S. for medical equipment and supplies

is growing. Our forecast calls for this industry to continue to grow at (should

we say it?) a healthy rate for the foreseeable future. Total U.S. output of these

products is expected to expand by 4% in 2012 after a gain of 4% in 2011. This

forecast is based on a continuation of three long-term market trends: 1) an

aging population; 2) increased access to healthcare products both domestically

and globally; and 3) continued advances in healthcare technologies.

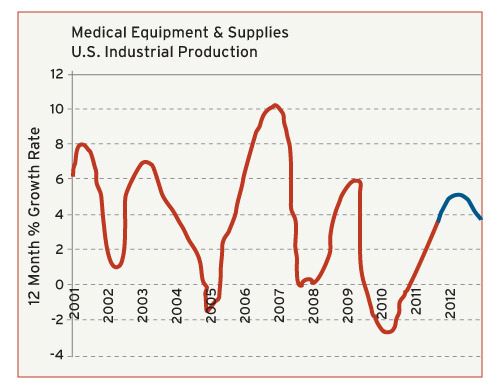

Since there is strong consensus amongst industry analysts that the

medical equipment and supplies sector will continue to grow, the question

then becomes: By how much? The chart is a graph of the rate of growth for

U.S. production (by volume) of these products. This graph illustrates a couple

of useful points. First, even in periods of overall recession, this industry does

well. Production of these medical products enjoyed vigorous growth during

the recession in 2001, and it dipped by only a modest 2% during the Great

Recession of 2009. Second, during the past 12 years, this industry has averaged

growth of about 4% per year. This is stronger than the overall growth in most

other industries and economic indicators (see Consumer Goods chart).

Consumer Goods

Our forecast for total U.S. production of consumer goods calls for a gain of

3% in 2012 following a rise of just over 2% in 2011. This forecast is based on a

continuation of the prevailing economic fundamentals that have the greatest

effect on consumer spending. These include: slow improvement in the employment

data; stability in house prices; a gradual increase in access to credit;

and slow but steady gains in household incomes. The risks to this forecast are

biased towards the downside at the present time, but overall we expect 2012

to be moderately better than 2011 for most suppliers of consumer products.

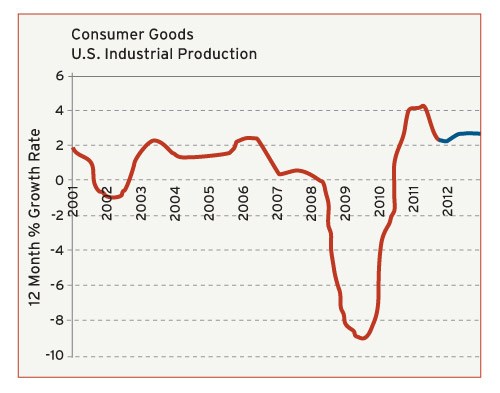

For the sake of comparison with the medical equipment and supplies industry

reported above, we have included a chart of the rate of growth in U.S output

of consumer goods. This chart shows that the total U.S. output of consumer

goods is vulnerable to recession in the overall economy. Production of these

goods declined by 1% during the recession of 2001, and output plunged by 8%

in the Great Recession of 2009. It should be noted that current production

levels of consumer goods in the U.S. are still not back to their pre-recession

levels. One other trend that bears mentioning is that, excluding the periods of

recession, the long-term growth rate for these products is only in the range of

1%-2%. This is close to the overall rate of population growth in the U.S. These

industries have been buffeted in recent years by imports from countries such

as China, but this trend should improve gradually in the coming years.

Related Content

-

Triple Threat: How One Shop's Success Resonates Across Three End Markets

When I revisited Eden Tool in New Freedom, PA, this past summer for a follow-up feature on this mold builder’s growth, I underestimated the story.

-

U.S. Economy Indicates Prospects for Moldmakers

An examination of the U.S. economy suggests its resilience against a recession, yet a mixed outlook for moldmaking and plastics persists.

-

MMT Chats: Mold Builder, Master Molder and Marble Maker? Part 1

MoldMaking Technology Editorial Director Christina Fuges introduces new MMT Editorial Advisory Board Member Mike Close, Sr. Tooling Engineer for SMC Ltd. in Devens, Massachusetts. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.