Automotive & Consumer Products End Market Report 2012

Automotive & Consumer Products

Automotive Sector Gaining Speed

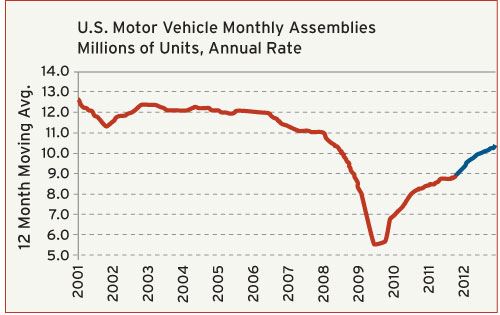

Solid gains in the monthly data from the first quarter have caused us to raise our forecast for the number of motor vehicles that will be assembled in the U.S. for the year as a whole. The latest forecast calls for a total of a least 10 million assemblies in 2012. This is a robust gain of 15% from the total number of assemblies in 2011, but as the chart illustrates, it still leaves the industry about 2 million assemblies per year short of the annual figures prior to the recession.

The auto industry is currently benefiting from pent-up consumer demand, a market shift towards more efficient autos due to high gasoline prices, and a gradually improving economy. We expect these conditions to persist for the remainder of this year and through 2013. However, there are downside risks to this forecast. The unemployment rate is still too high, and the current rate of economic growth is not yet sufficient to generate more rapid improvement in the jobless numbers. And if it continues unabated, the rising cost of gasoline may dampen sentiment and put a more severe pinch on consumer spending behavior. The payroll tax cut is scheduled to expire at the end of 2012, and this too could put a drag on the market for new cars in 2013 if conditions fail to meet expectations by this year’s end.

As of right now, the most likely outcome is that the markets and policymakers will find a favorable resolution to all of these issues and the recovery will remain intact. But we invite all moldmakers to monitor the trends in these data just to make sure that there are no significant changes to this outlook.

Output of Consumer Products Still Rising, but Growth Rate Decelerates

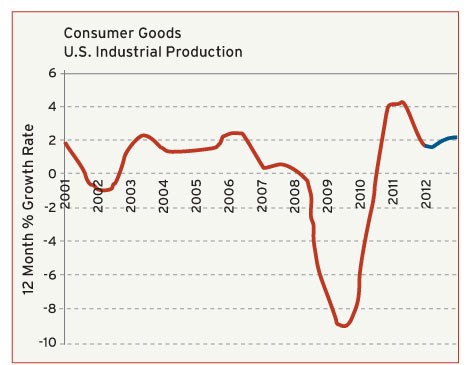

The total U.S. production of consumer products remains in an uptrend, but the rate of growth has decelerated in recent months. Total output expanded by 1% in the first quarter of this year when compared to the same quarter a year earlier. This is slower than the 2% rate of growth this sector registered for the entire year of 2011. Our forecast calls for the growth rate to nudge back up to the 2% level by this year’s end. For historical context, a gain of 2% this year would still leave total output of consumer goods about 5% below the pre-recession peak it hit in 2007.

Demand for many of the products in this category follows the trends in residential construction and real estate, and these sectors are just barely into their early recovery phase. We expect the total number of housing starts to increase by 15% in 2012, but this gain follows three years of virtually no advance from historically depressed levels. It will take at least another two years for construction and real estate activity to return to “normal” levels, and this will restrict demand for some consumer products.

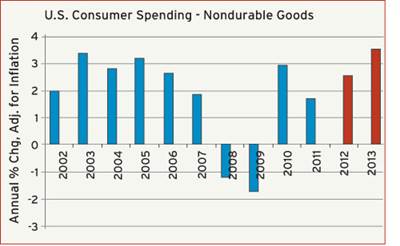

For those products that are not tied to construction, the next 12 months should be good, but not great. Unemployment levels will remain high, and this will result in stagnant income growth for most middle-class households. Household formations and the overall population will gradually increase, and this will put a floor under the demand for consumer products. There will also be a gradual increase in the number of these products that are “reshored” from the so-called low-cost manufacturers overseas. Unfortunately, these gains will be more than offset by the rapid rise in materials costs for manufacturers of these products. Overall, the net outcome will be a rather pedestrian rate of expansion in these markets.

Related Content

Hands-on Workshop Teaches Mold Maintenance Process

Intensive workshop teaches the process of mold maintenance to help put an end to the firefighting culture of many toolrooms.

Read MoreHow to Foster Innovation Through a Culture of Education, Mentoring

Dynamic Tool Corp. shares its strategy for building a team with the right attitude and aptitude to deliver innovation that meets customer expectations.

Read MoreHow to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

Read MoreConfronting the Mold Design Talent Drought

Recently, I reposted on LinkedIn the results of an informal survey we conducted, which revealed a shortage of skilled mold designers. It quickly gained a lot of traction. Given the response, I thought I'd summarize the feedback and keep the conversation going.

Read MoreRead Next

End Market Report: Aerospace/Defense & Packaging

Plastics Packaging Outlook: Moderate Growth in 2012, and Aerospace/Defense Spending Outlook.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More