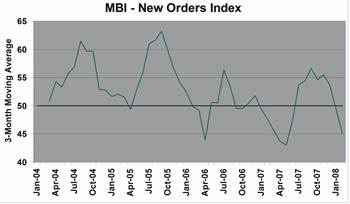

Business activity levels for North American mold builders were mostly steady in recent weeks. Our Mold Business Index (MBI) for October is 51.1. This is a 2.1-percentage point decrease from the September value of 53.2, but it is still in the positive range. Moderate gains in the Production and Backlog components were the bright spots in an otherwise stable set of responses. The negative news is that Supplier Delivery Times lengthened a bit, Materials Prices continued to rise and the Future Expectations value descended to 58.7 in October.

The recession continued in the residential construction and real estate sectors in October, but it is finally starting to look like the worst is behind us. It will take a few more quarters for these sectors to recover, but the residential construction data will start to be less of a drag on the overall economy during the next few months. Most of the major manufacturing indicators have stalled in recent weeks, but there is no strong evidence to suggest that the demand for manufactured goods will decline from its current level.

On the positive side, the low value of the U.S. dollar vis-à-vis the other major currencies has pushed export growth for U.S.-made goods. Global demand for plastics products is still rising, and capacity utilization rates for the plastics industry remain at a strong level. High energy prices are still a wild card in the short-term forecast, but at least for now the price of plastics resins has not risen as rapidly as the price of crude oil has.

Our Injection Molding Business Index (a measure of production levels for injection molders) posted a modest gain in the third quarter of this year, and it remains in the early stages of the next recovery phase. Our forecast continues to call for moderate growth of 3 percent for all of 2007.

The sub-index for New Orders of molds came in exactly at 50.0 in October, which means there was no change in the amount of new business when compared with last month. Future gains in the total MBI depend on continuing increases in new orders of molds. Production levels expanded again, as the latest Production sub-index was 56.5. The Employment component was 50.0, which means that there was no net change in overall payrolls last month. The Backlog component was again moderately higher at 56.5 in October.

The Mold Prices sub-index for the latest month was 43.5. This means that the prices received for new molds were lower. The prices paid for materials increased again, especially mold steel, as the latest sub-index for Materials Prices was 67.4. Supplier Delivery Times lengthened again, as this sub-index posted a value of 43.5.

|

October 2007

|

|||||

|

%

Positive |

% |

%

Negative |

Net % Difference

|

Sub-

Index |

|

| New Orders |

35

|

30

|

35

|

0

|

50.0

|

| Production |

35

|

43

|

22

|

13

|

56.5

|

| Employment |

13

|

74

|

13

|

0

|

50.0

|

| Backlog |

35

|

43

|

22

|

13

|

56.5

|

| Export Orders |

0

|

100

|

0

|

0

|

50.0

|

| Supplier Deliveries |

0

|

87

|

13

|

-13

|

43.5

|

| Materials Prices |

35

|

65

|

0

|

35

|

67.4

|

| Mold Prices |

4

|

79

|

17

|

-13

|

43.5

|

| Future Expectations |

39

|

39

|

22

|

17

|

58.7

|

| Total Mold Business Index for October 2007: 51.1. The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports and supplier deliveries. | |||||

Related Content

The Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreTop 10 Topics to Cover During an ISO 9001 Manufacturing Audit

Take a look at this practical hands-on approach to conducting a quality audit.

Read MoreMold Building Stats Improve Performance

Mold manufacturing is a numbers game rooted in measurement and data tracking to continuously improve.

Read MoreSteps for Determining Better Mold Prices

Improving your mold pricing requires a deeper understanding of your business.

Read MoreRead Next

Economic Growth Slows; Expectations Positive 41.7 Total Mold Business Index for February 2008

Overall economic growth in the U.S. is sputtering so far this year, and this is constraining demand for new molds in the first quarter of 2008

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More