Overall Business Remains Unchanged

Total Mold Business Index for November 2012: 45.8

For the fifth straight month, our survey indicates that overall activity levels continue to decline slowly. The Mold Business Index (MBI) for November 2012 is 45.8, which is a slight 0.2-point increase from the October value of 45.6, but a 7.2-point decrease from the 53.0 posted in November 2011.

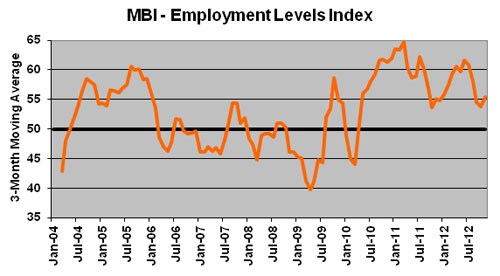

A drop was reported in the New Orders category for the seventh straight month. Yet despite the decline in new business during the past summer and fall, moldmakers continue to hire new workers. Supply conditions and Materials Prices were mostly unchanged. Mold Prices were steady-to-firmer, though the gains in prices received for molds are still not keeping pace with the increases in costs for most moldmakers. Future Expectations remain optimistic.

The policymakers in Washington are grappling with the incredibly difficult issue of avoiding the “fiscal cliff.” Never in my memory has both the short-term and long-term outlook for the U.S. economy been so dependent on a single act of Congress. IF Congress does what needs to be done, then the U.S. economy will quickly gain momentum. The distractions of the recent election notwithstanding, the major macro-economic indicators are showing promise. The stock market has steadily increased during the past three years. Corporate profits are at or very near all-time highs. The employment data is rising.

Most importantly, the recoveries in the housing and real estate sectors are accelerating. This is not only because the housing sector is a large end-market for many types of molded products, but also because it is the best indicator of Americans’ propensity to consume all types of products, including cars, appliances, electronics, home furnishings, etc. The trends in retail sales and consumer spending for durable goods—both of which are good indicators of the demand for molded products—are connected to the trends in the housing data.

The real problem is confidence levels, both amongst business leaders and consumers. But now that the election is over, there is some real pent-up desire to get back to the business of becoming more productive. This desire will be unleashed as soon as a solution to the fiscal cliff is passed.

The New Orders component is 43.9. The trend of declining new orders over the past few months continues to result in diminishing Backlogs, which registered 45.5. Production slipped back to 40.9, the lowest level in over three years. Once again, the only significantly positive factor in the latest survey was the Employment component that came in at 56.1.

The prices received for new molds continue to rise gradually. Mold Prices is 53.0. Materials Prices this month is 54.2. Supplier Delivery Times is 47.0. There was a significant decline in offshore orders last month, as the Export Orders sub-index is 42.4.

Related Content

-

Tackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

-

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

-

MMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

.jpg;maxWidth=300;quality=90)