The recent uptrend was extended in April with an MBI of 54.3, which is a 1.6-point increase over March’s 52.7, and a robust 7.2-point increase from 47.1 in April of 2011. Gains were reported for April in all of the business-activity categories when compared with the previous month. On the downside, the indicators of supply conditions got worse as Supplier Delivery Times expand and Materials Prices go higher. Mold Prices were steady, so yet again the price received for new molds did not keep pace with the increases in materials prices. Future Expectations remain optimistic.

Though some of the conditions at the periphery (i.e. the crisis in Europe) have changed a bit since last month, our outlook for the direction and pace of growth in the U.S. economy has not. Real GDP in the U.S. will grow at a pedestrian rate of close to 2.5% through the middle of 2013. It will then accelerate to the 4%-range by the middle of 2014. This rate of recovery will add about 2 million jobs per year to the nation’s total employment figures, and if the trend behaves as predicted, an unemployment rate of 6% will be achieved by late 2015.

There remain some significant downside risks to this forecast. The most immediate threat continues to be the home foreclosure crisis. This sector is making slow progress, and in another 12 to 18 months we should be well on the road to recovery. But there remains a possibility that house prices will sink further rather than rise as forecast. Until house prices are rising again, the economic recovery will not fully engage.

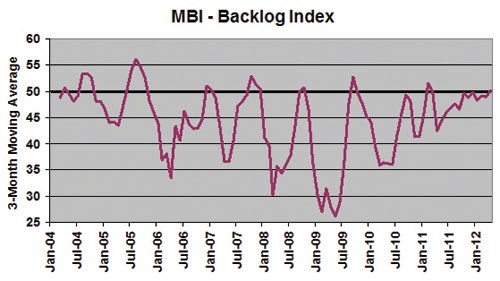

Congress must also deal more credibly with the nation’s long-term fiscal problems. I still believe that this situation will be successfully resolved, but only because we really do not have any other choice. In their never-ending efforts to get re-elected, the members of Congress have made the wrong choices for as long as possible, and now the only viable solution is to fix the problem. Despite all this, U.S. manufacturing has emerged as one of the true bright spots in the forecast. Demand for new molds improved moderately, as New Orders registered 54.8. Production eased a bit from last month at 53.6. At 59.5, Employment is still quite high. Overall trends indicate that work levels continue to grow and moldmakers still need new employees. Backlogs for moldmakers are steady-to-better at 51.2.

Mold Prices is 50.0, so mold prices are holding firm, but several respondents report strong pressure on prices persists. Prices paid for materials and components are still rising, with Materials Prices at 69.0. Supplier Delivery Times is 42.9, but it appears that the recent trend of expanding delivery times is stabilizing. There was a small gain in offshore orders, as Export Orders is 52.4.

Related Content

-

Dynamic Tool Corporation – Creating the Team to Move Moldmaking Into the Future

For 40+ years, Dynamic Tool Corp. has offered precision tooling, emphasizing education, mentoring and innovation. The company is committed to excellence, integrity, safety and customer service, as well as inspiring growth and quality in manufacturing.

-

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

-

Top 10 Topics to Cover During an ISO 9001 Manufacturing Audit

Take a look at this practical hands-on approach to conducting a quality audit.

.jpg;maxWidth=300;quality=90)