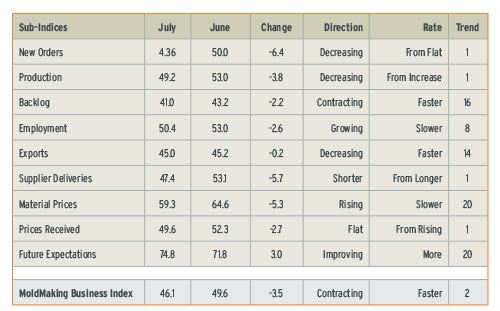

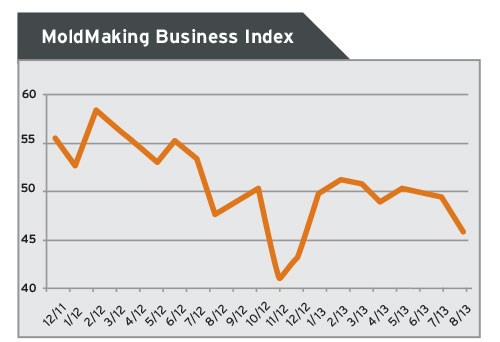

Our latest survey of the North American moldmaking industry indicates that overall activity levels declined in August when compared with the previous month. The MoldMaking Business Index for August 2013 is 46.1 (a value less than 50.0 indicates a decrease in business levels for the month). The latest index value is a 3.5-point decrease from the July value of 49.6, and it is a 2.0-point decrease from the 48.1 value posted in August 2012.

This is the first time this year that the Index dipped significantly below the breakeven level of 50.0. And the underlying indicators suggest that business conditions were more negative than the topline figure indicates because New Orders were down substantially in August and Production levels also declined.

The good news is that this month’s reading for our MoldMaking Business Index is a stark contrast to many of the major indicators that measure overall manufacturing levels in the U.S. The ISM Manufacturing Index in August posted its highest mark for the year, coming in at a robust 55.7. Demand for autos remained strong in August, and the recovery in the residential construction and real estate data is still robust.

Other macro-economic data reported recently suggest that the recovery in the U.S. economy is actually gaining momentum. According to the Bureau of Economic Analysis' second estimate, GDP growth accelerated to 2.5% in the second quarter, a marked improvement from the advance estimate of 1.7%, and substantially higher than the 1.1% rate reported for the first quarter. A rise in exports and nonresidential investment spending combined with a decline in imports sparked much of the second quarter growth.

Taking a closer look at the categories that comprise our Index, the New Orders component was a disconcerting 43.6 in the latest month. Our Index is not seasonally adjusted, which means that a lot of the decline in August may be the result of planned shutdowns and vacations and not because of weakening market demand. Time will tell, so stay tuned.

The Production sub-index of 49.2 indicates that work levels decreased for the first time this year. With new orders lower and production levels flat-to-down we should expect the small decline that was reported in backlogs--the Backlogs sub-index slipped to 41.0. The Employment component was 50.4, which means that moldmakers’ payrolls were mostly steady, but the recent rate of expansion slowed.

The prices received in the moldmaking sector were steady-to-down in August, as the Prices Received sub-index was 49.6. The upward momentum in materials prices persisted but the rate of increase decelerated, as the Materials Prices sub-index came in at 59.3. Supplier Delivery Times reversed their recent trend of gradual expansion. This component posted a 47.4 in August. Offshore orders remain weak with the Exports sub-index coming in at 45.0.

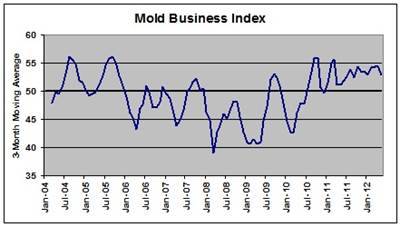

The MoldMaking Business Index is based on a monthly survey of subscribers to MoldMaking Technology magazine. Using the data from this survey, Gardner Research calculates a diffusion index based on 50.0. A value above 50.0 for the index indicates that business activity expanded when compared with the previous month, and a value below 50.0 means that business levels declined.

Related Content

OEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

Read MoreMMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreThe Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreRead Next

Total Mold Business Index for May 2012: 51.5

For the thirteenth consecutive month, overall activity levels for North American moldmakers increased in May. The Mold Business Index (MBI) for May 2012 is 51.5 (a monthly value over 50.0 indicates growth for the month). The latest MBI value is a 2.8-point decrease from the April value of 54.3, and it is a 2.0-point decrease from the 53.5 posted in May of 2011.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

.jpg;maxWidth=300;quality=90)