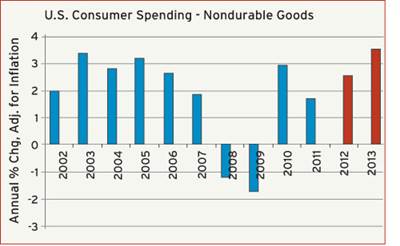

Demand for Consumer Products: Steady, Unspectacular Growth

When compared with the first half of 2011, U.S. output of consumer products has expanded by 1.6% so far in 2012. The growth rate for all of 2011 was a comparable 1.4%. So the market for U.S.-made consumer products is steadily improving, just not at a very rapid rate. Our forecast calls for this trend to continue through the end of this year, with annual growth for 2012 coming in at just under 2%. We expect growth to accelerate to just over 3% in 2013.

There are three factors that will have significant future effects on the processors who manufacture plastic consumer products. These are:

1) The pending recovery in the residential construction and real estate sectors. These sectors suffered severe damage when the housing bubble burst in 2008, and it will take them about another year before confidence is sufficiently restored. When they do rebound it will generate a strong boost in demand for many types of plastic consumer products.

2) The rising costs of resins and other materials. As the global economy recovers, the price of oil, resins, steel, and most other commodities used in the manufacture of consumer products will rise. It is also likely that the price of everything will else rise (this is also known as inflation), so manufacturers may be able to pass some of these costs on to their customers, but then again, maybe not. The pressures stemming from pricing strategy and cost management will intensify.

3) Competition from low-cost countries will moderate. The inherent advantages that arise from manufacturing close to the marketplace cannot be ignored forever. As the market conditions change, and ALL of the costs associated with getting a product to market are more accurately counted, the advantages of manufacturing overseas (especially in China) are rapidly diminishing for many types of products.

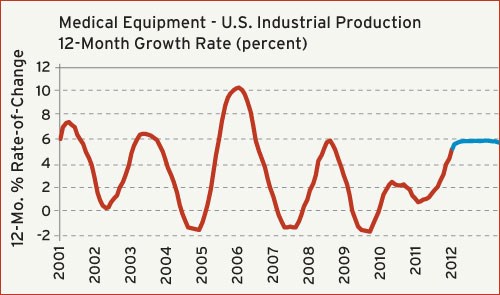

Growth in the Output of Medical Supplies Is Accelerating

Not only are the production levels of medical equipment and supplies in the U.S. growing, but the rate of growth has rapidly accelerated so far in 2012. So far this year, output of these products is running 7% ahead of the output from the comparable period in 2011. The growth rate was only 2% for all of 2011. Our forecast calls for this rate of growth to hold steady for the rest of this year. We expect an annual gain of 6% in 2012 followed by a rise of 4% in 2013.

We should assume for now that the Affordable Care Act (a.k.a. ACA or Obamacare) will proceed as planned. And for many of the manufacturers in the medical industry, this will be good for business. It has the potential to bring 40 to 50 million new customers into the market. The issues pertaining to healthcare in this country are based on three things: quality, access, and cost. The AC A primarily deals with access by mandating that everybody buy medical insurance. So once all of the citizens that currently do not have insurance are insured, it is quite likely that the demand for medical goods will rise.

This influx of newly insured customers will reinforce the market fundamentals that were already spurring demand for medical products in America. These fundamentals include: a growing population; an aging population; and the rapid innovation of new medical goods and services. On the surface, it is hard to see how the medical industry will not enjoy robust demand growth for years to come. But the ACA is fraught with assumptions that may prove to be flawed, and this may ultimately be its undoing.

I am not currently predicting that this will be the eventual fate of the ACA. That would be as foolish as trying to predict the outcome of the upcoming election (which could render the whole argument moot depending on who gets in). I will say that the outlook for the medical industry, and the processors who supply it, is far more dependent on political trends than economics at the present time.

Related Content

Mold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

Read MoreThink Safety: Eliminate Hazards Throughout the Shop

The tooling community is taking advantage of new products for safer mold shops and molding facilities.

Read MoreMMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreHow to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

Read MoreRead Next

End Market Report: Aerospace/Defense & Packaging

Plastics Packaging Outlook: Moderate Growth in 2012, and Aerospace/Defense Spending Outlook.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More