Aerospace & Packaging

Production of Aerospace Products and Parts is Accelerating; Plastics Packaging Demand Will Exceed Growth in the Overall Economy

Production of Aerospace Products and Parts is Accelerating

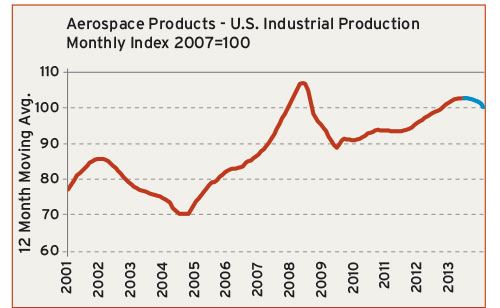

We have raised our forecast for the total U.S. output of aerospace products and parts. After slipping by 1% in 2011, total U.S. production of aircraft and parts is expected to grow by 6% in both 2012 and 2013. On the civilian side, this growth will be generated by rising export demand from emerging economies, and the need to replace older planes in the developed countries with the new generation of fuel-efficient models. For defense contractors, the fastest growth in demand will be for unmanned aircraft (a.k.a. drones).

As the accompanying chart illustrates, this industry came out of the Great Recession much sooner than many other U.S. industries, and it has been steadily rising ever since. The latest data show that total output of aircraft and parts expanded by 7% in the third quarter of this year when compared with the same quarter of a year earlier. That is the fastest quarterly growth in the past five years. We do not expect the rate of output to accelerate in the coming year, but we do think that the industry can sustain this momentum for a while.

Tightening supply conditions will become more of an issue as the overall economy regains its footing. Prices for many of the materials used in the aerospace industry and its supply chain are already quite high, and it is likely they will go higher in the coming year. The low value of the dollar is spurring demand for many U.S.-made goods, including aircraft and parts, but it is also pushing the price of most commodities higher. The biggest challenge in the coming years will be balancing uneven demand growth with slower delivery times and higher prices for metals, resins, and other materials.

Plastics Packaging Demand Will Exceed Growth in the Overall Economy

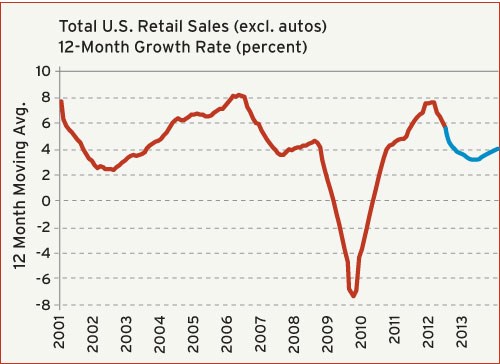

Global market demand for plastics packaging products will grow at a rate of 4%-5% in 2013 and beyond. Emerging markets and developing countries will experience the fastest growth, but gains in the developed countries will also be solid.

The largest markets for packaging products in the near term will continue to be North America and Europe. These markets are characterized by a large number of middle-class consumers and an aging population. Slower-than-average growth in retail sales of packaged goods will persist in these countries in 2013, and this will have a dampening effect on their overall levels of plastics packaging consumption in the near-term. But despite their sluggish economies, these markets will still experience rising demand for packaging products that are lightweight and sustainable.

Consumers in these markets are increasingly aware of the connections between fossil fuel consumption, greenhouse gas emissions, recycling, and their consumption of plastics packaging.

Many of the major retailers (i.e. Walmart) continue to build their marketing initiatives around the concept of sustainability. This will increase in the coming years. Plastics packaging products possess many attributes that are both sustainable and environmentally-friendly, and they will continue to penetrate into the markets of other materials such as glass, metal and paper. Issues with de-selection (such as bag bans) will persist, but thanks to rapidly improving technologies and heightened environmental awareness, the net consumption of the ever-improving array of plastics packaging products will steadily expand.

Related Content

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreThe Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreLeading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MoreThe Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MoreRead Next

End Market Report: Aerospace/Defense & Packaging

Plastics Packaging Outlook: Moderate Growth in 2012, and Aerospace/Defense Spending Outlook.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;maxWidth=300;quality=90)