Mold Business Index: Overall Business Levels Uneasily Steady

Total Mold Business Index for July 2011: 50.0

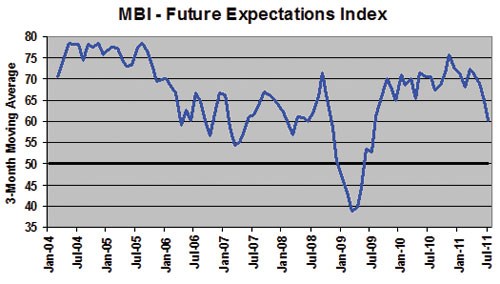

Overall business levels for North American moldmakers were uneasily steady last month. The Mold Business Index (MBI) for July 2011 is 50.0. This is a 5.3-point decrease from the June value of 55.3, and it is a 5.0-point decrease from the MBI value of 55.0 registered in July of last year. There was a solid rise in the Employment levels in July, while New Orders were unchanged overall. Supplier Delivery Times are a bit longer, but the spike in Materials Prices lost some momentum. There has been a big move downward in Future Expectations in recent months.

The U.S. economy cannot seem to catch a break. The summer started with a spike in gasoline prices and the supply disruptions that resulted from the tsunami and nuclear disaster in Japan. Then just when it looked like we had cleared those obstacles, we were hit by a one-two punch of the debacle over the debt limit combined with the financial turmoil roiling the European Union. This produced gut-wrenching swings in the equities markets and a large drop in the value of stocks in the first week of August.

Adding insult to this injury, the historical U.S. GDP data were revised substantially downward. It now appears that the recent recession was much deeper than previously thought, and the economic growth in the first half of this year was much weaker than originally reported. And in case anybody failed to notice, the housing market continued to decline while the unemployment rate remained stubbornly high.

But in spite of all of the problems caused by the politicians, the bureaucrats, and the Europeans, the U.S. manufacturing sector has held up remarkably well. We have lost some momentum, but nothing that cannot be recovered quickly as soon as the rest of the economy regains its footing. This is the scenario we expect for the second half of this year. The flood of bad news will abate, and Americans will return to the task of gradually rebuilding the economy. There is downside risk to this forecast, and the chance of another recession in the next six months has definitely increased. But this is still a less likely outcome than one of improving growth. Folks have good reason for pessimism at the present time; nevertheless, I am not yet ready to bet against the USA.

The New Orders component for our MBI shows that the number of new projects was unchanged in the latest month, as this sub-index for July is 50.0. This was only the second time this year that new orders for molds did not register a monthly increase. The latest Production sub-index posted a moderately weaker reading of 45.2. The Employment component is 61.9, indicating that hiring activity is still expanding for those shops who can find qualified candidates. Overall backlogs for moldmakers showed a small contraction, as the Backlog component this month is 42.9.

The Mold Prices sub-index for July is 45.2. This breaks a string of four consecutive months that overall mold prices were steady-to-higher. The prices paid for materials and components continue to rise, but at a slower rate than earlier this year. The sub-index for Materials Prices is 57.1. Supplier Delivery Times are again longer, as this sub-index is 40.5. There was no change in offshore orders for new molds, as the Export Orders sub-index is 50.0.

Once again by a wide margin, the most-cited problem confronting North American moldmakers in recent weeks is the shortage of skilled labor. Other problems receiving multiple mentions are: uncertainty about future business levels and the U.S. economy; pressure from customers for longer payment terms and shorter lead-times; and China.

Our Injection Molding Business Index (a measure of output levels for injection molders) posted another increase in the second quarter of 2011 when compared with the previous year. This Index grew by 7% in 2010, and the forecast calls for a gain of 5% in 2011. Gains in the Mold Business Index depend on sustained growth of 4% to 5% in the output of injection molded products. The trend in the moldmaking data lags the trend in the processing sector by six months.

The Mold Business Index is based on a monthly survey of North American mold makers. Mountaintop Economics & Research, Inc. conducts the survey, and then calculates a diffusion index based on 50.0. A value above 50.0 for the MBI indicates that business activity expanded in the previous month, while a value below 50.0 means that business levels declined.

Related Content

Making Mentoring Work | MMT Chat Part 2

Three of the TK Mold and Engineering team in Romeo, Michigan join me for Part 2 of this MMT Chat on mentorship by sharing how the AMBA’s Meet a Mentor Program works, lessons learned (and applied) and the way your shop can join this effort.

Read MoreTackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

Read MoreEditorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

Read MoreOEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

Read MoreRead Next

Mold Business Index: Underlying Data Show Strong Index Components

The total Mold Business Index is a weighted average of the Sub-Indices for new orders, production, employees, backlog, exports, and supplier deliveries. The Mold Business Index (MBI) for October 2010 is 51.3.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More