Business Levels Continue to Expand

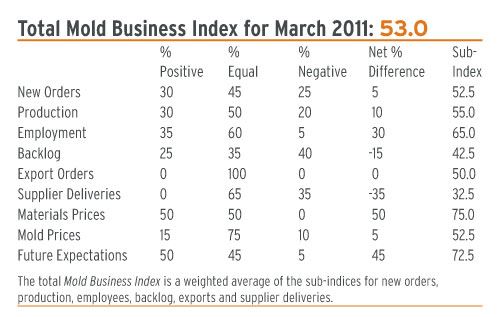

Total Mold Business Index for March 2011: 53.0.

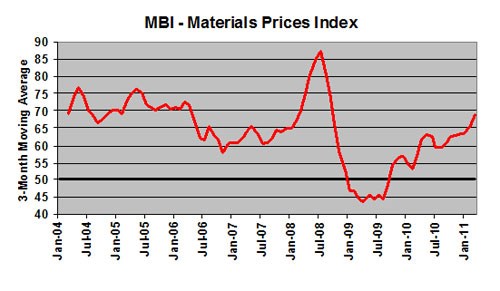

The Mold Business Index for March 2011 is 53.0. This is a slight 0.3-point decrease from the revised February value of 53.3, but it is a vigorous 7.7-point increase from the MBI value of 45.3 registered in March of last year. Supply conditions remain challenging as Supplier Delivery Times are again longer, and Materials Prices are rising at an accelerating rate. On the bright side, it appears that at long last Mold Prices are firming. Moldmakers remain quite optimistic about future business expectations.

Overall, the U.S. corporate sector is well positioned for solid growth in 2011. Financing costs are low and productivity rates are high, so firms continue to reap robust profits and accumulate cash. As the recovery gains momentum, companies will need to re-invest some of these profits in new workers and equipment if they are going to achieve future market share gains. But for a few more months at least, the growth rates will remain uneven across industries. With continued low mortgage rates and improved household finances, the housing and construction sector will finally turn around and be among the stronger industries later this year and into 2012.

The most significant threat to the plastics industry outlook is from rising energy and resins prices. Although a return to the high levels of 2008 is unlikely, the uncertainty about future resins prices is enough to dissuade some molders from investing and hiring. Transportation and vehicle manufacturing are the most vulnerable industries to sustained high fuel prices. Higher fuel costs will also drag on overall consumer spending.

Another looming risk comes from government spending cuts. Industries that depend on government contracts are among the most vulnerable. A much wider range of industries will feel the pain if lawmakers decide to resolve our country’s fiscal problems with tax increases this year.

The New Orders component for our MBI shows that the number of new projects is steady-to-higher, as this sub-index for March is 52.5. Several respondents report that repairs and other types of machining jobs are supporting production levels, and the latest Production sub-index is 55.0. The Employment component is 65.0, which means that hiring activity is becoming more aggressive. The Backlog component is a lackluster 42.5.

The Mold Prices sub-index for March is a heartening 52.5, which means that the downward pressure on mold prices is abating and prices should soon get firmer. The prices paid for most types of materials and components continue to go higher. The sub-index for Materials Prices is 75.0. Supplier Delivery Times are substantially longer, as this sub-index is 32.5. There was no change in offshore orders for new molds. By a wide margin, the most-cited problem confronting North American moldmakers in recent weeks is again the shortage of skilled labor.

Related Content

-

Predictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

-

MMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

-

Dynamic Tool Corporation – Creating the Team to Move Moldmaking Into the Future

For 40+ years, Dynamic Tool Corp. has offered precision tooling, emphasizing education, mentoring and innovation. The company is committed to excellence, integrity, safety and customer service, as well as inspiring growth and quality in manufacturing.