Data Indicates Continued Investment

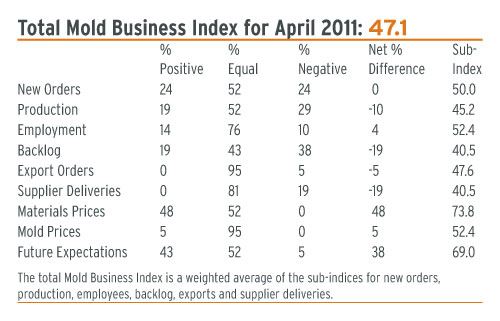

The Mold Business Index (MBI) for April 2011 is 47.1.

After four consecutive monthly increases, business levels for North American moldmakers slipped a bit in April. The Mold Business Index (MBI) for April 2011 is 47.1. This is a 5.9-point decrease from the March value of 53.0, and it is a 1.8-point decrease from the MBI value of 48.9 registered in April of last year. Decreases in overall Production levels and Backlogs were the causes for the decline in this month’s MBI. Two trends that persisted in recent weeks were lengthening Supplier Delivery Times and higher Materials Prices. Mold Prices were steady, and moldmakers remain quite optimistic in their Future Expectations.

The economic expansion in the U.S. moderated in the first quarter as government spending dropped substantially and consumer spending growth was less vigorous than it has been. The net result was that the economy grew a pedestrian 1.8%. This was a bit slower than the consensus expectation of a 2% gain, and it was noticeable deceleration from the fourth quarter’s 3.1% expansion. But if the oil markets behave as expected, this sluggish growth period should be short-lived. Despite higher oil prices, consumers increased their spending by a respectable 2.7% last quarter, the second-strongest showing since the recovery began. Winter weather was also a weight on consumer spending and businesses investment, but this will not affect future growth.

The most recent data on new orders for core capital goods showed a solid increase in March. This is a welcome indication that businesses will continue to invest heavily in capital assets, including equipment and tooling this year. As is the case with our MBI this month, the regional manufacturing surveys suggest that manufacturing orders leveled off in April, consistent with a modest slowdown in the factory sector.

The New Orders component for our MBI shows that the number of new projects remains steady, as this sub-index for April is exactly 50.0. Repairs and other types of machining jobs continue to support production levels, but there was a decline in recent weeks as the latest Production sub-index is 45.2. The Employment component is 52.4, indicating that hiring activity is rising at a slower pace. The Backlog component is again disappointing, coming in at 40.5.

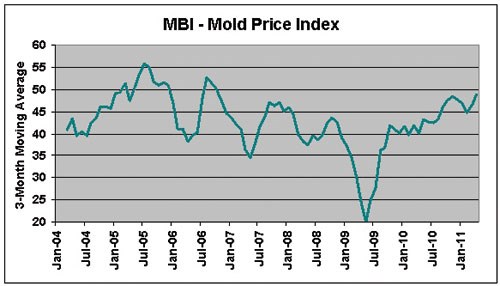

The Mold Prices sub-index for April is 52.4. This means that the downward pressure on mold prices has eased and prices are now firmer. The prices paid for most types of materials and components continue to go higher. The sub-index for Materials Prices is 73.8. Supplier Delivery Times are longer, as this sub-index is 40.5. There was little change in offshore orders for new molds, as the Export Orders sub-index is 47.6.

The most-cited problem confronting North American moldmakers in recent weeks is yet again the shortage of skilled labor. Other problems receiving multiple mentions include: materials prices; volatility of profitable new business; pressure from customers for longer payment terms and shorter leadtimes; and, uncertainty about the U.S. economic recovery.

Related Content

-

The Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

-

Think Safety: Eliminate Hazards Throughout the Shop

The tooling community is taking advantage of new products for safer mold shops and molding facilities.

-

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

.jpg;maxWidth=300;quality=90)