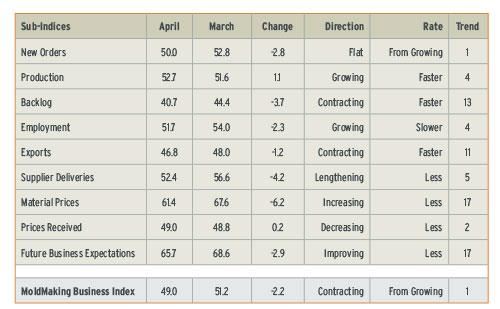

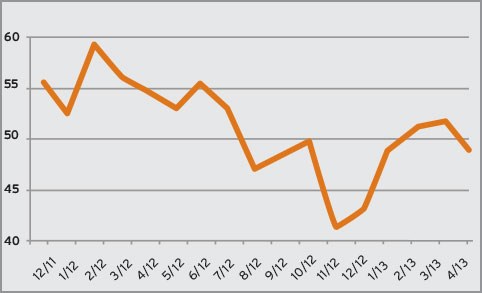

Our latest survey of the North American moldmaking industry indicates that overall activity levels slipped a bit in April. The MoldMaking Business Index for April 2013 is 49.0 (a value less than 50.0 indicates a decrease in business levels for the month). The latest index value is a 2.2-point decrease from the March value of 51.2, and it is a 5.8-point decrease from the 54.8 value posted in April 2013.

Though our Index came in modestly weaker than the previous month, it should not yet raise many concerns. If the index begins a more rapid downward trajectory, it would indicate that manufacturers were aggressively cutting back on production and investment. But the index would need to stay below the 45-level for a few months for this to be a major concern. GDP growth this quarter will likely come in below 2%, but it will gradually accelerate in the second half of the year. This quarter, the economy is digesting the fiscal drag caused by lower government spending and stagnant income growth for households.

The New Orders component came in at 50.0 in the latest month, which means that the level of new business was unchanged when compared with the previous month. The Production sub-index of 52.7 indicates that work levels increased moderately when compared with the previous month. Anytime you have a month in which new orders are flat, but production levels increase the logical result is a decline in backlogs. This is exactly what happened in April as the Backlogs sub-index fell to 40.7 for the month. The Employment component is 51.7, which means that payrolls were higher for the fourth straight month, but the rate of expansion is decelerating.

The prices received in the moldmaking sector weakened a bit in April. The Prices Received sub-index for March is 49.0. The upward momentum in the sub-index for Materials Prices continued to decelerate in recent weeks, and the Materials Prices sub-index eased back 61.4. So materials prices continue to rise, but the rate of the gains are moderating. Supplier Delivery Times are starting to stabilize, as this component registered 52.4 in April. Offshore orders extended their downward trend last month. The Exports sub-index was 46.8.

The MoldMaking Business Index is based on a monthly survey of subscribers to Moldmaking Technology magazine. Using the data from this survey, Gardner Research calculates a diffusion index based on 50.0. A value above 50.0 for the index indicates that business activity expanded when compared with the previous month, and a value below 50.0 means that business levels declined.

Related Content

-

The Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

-

Making Mentoring Work | MMT Chat Part 2

Three of the TK Mold and Engineering team in Romeo, Michigan join me for Part 2 of this MMT Chat on mentorship by sharing how the AMBA’s Meet a Mentor Program works, lessons learned (and applied) and the way your shop can join this effort.

-

Leading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

.jpg;maxWidth=300;quality=90)