Business Levels Steady-to-Higher

Total Mold Business Index for September 2011: 51.2

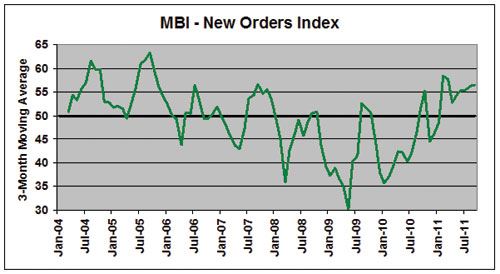

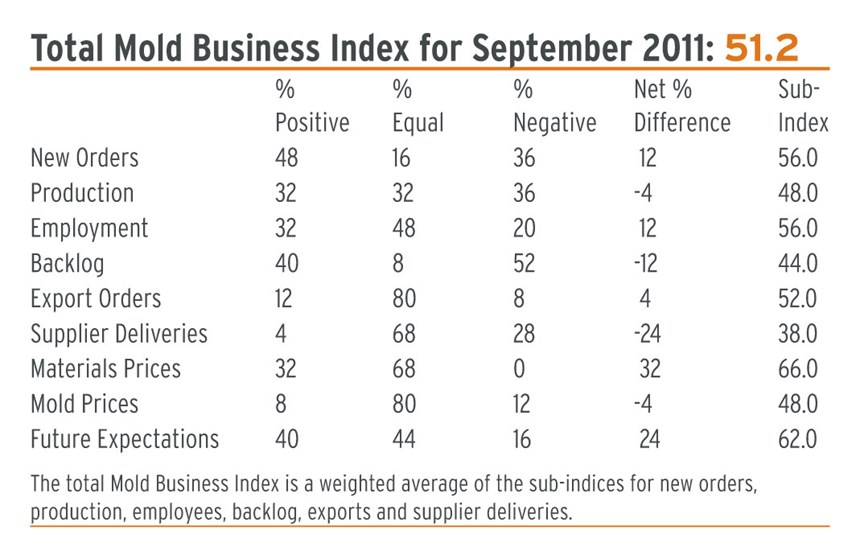

Overall business levels for North American moldmakers were steady-to-higher in September. The Mold Business Index (MBI) for September 2011 is 51.2 (a monthly value over 50.0 indicates growth for the month). The latest MBI value is a 5.1-point decrease from the August value of 56.3, and it is a 4.0-point decrease from the MBI value of 55.2 posted in September of 2010. Our MBI averaged 52.5 in the third quarter of 2011 year which is a slight improvement over the second quarter average of 52.0. Modest gains in New Orders and Employment levels were enough to offset the modest declines in Production levels and Backlogs in September. Future Expectations also posted a slight increase when compared with August.

The third quarter of 2011 got off to a shaky start, but the outlook got noticeably brighter by the end of September. Thus far, we have somehow muddled through the federal debt limit debacle and the threat of a European financial crisis. The stock market fell in the third quarter, but it did not crash. Consumer confidence indicators remained stuck at a level that corresponds with a deep recession in the economy, but the data that measures actual consumer spending continued to register moderate growth. Total construction spending in August (the latest available data) rose 1.4% from its July level, and was 0.9% higher than in August 2010. This was the first time in three years that construction spending has shown year-over-year growth.

For manufacturers, the data on total vehicle sales in September was much better than expected. The seasonally adjusted, annualized rate for vehicle sales last month was just over 13 million. This was the best monthly performance since April, and it suggests that the motor vehicle assemblies data will be stronger than expected in the fourth quarter. The Institute of Supply Management Manufacturing Index (previously known as the Purchasing Managers’ Index) also increased moderately in September. And finally, the data on weekly jobless claims fell sharply in the last two weeks of September, while the number of jobs rose moderately for the month.

So just to be clear, none of these trends point to an immediate acceleration in the recovery, but neither do they indicate that a recession is imminent. We expect the economy to remain in this slow-growth mode for another two or three quarters. This will correspond to real GDP growth of about 2% through the first half of 2012. The unemployment rate will remain uncomfortably high, and there will continue to be noticeable social unrest (i.e. the protest on Wall Street). The best indicator of when the recovery will start to accelerate will be a rise in monthly housing starts. Once these numbers ramp up, it will be a signal that the fundamental problems currently restraining the economy are sufficiently behind us.

The New Orders component for our MBI registered another gratifying increase in the latest month, as this sub-index for September is 56.0. At a value of 48.0, the latest Production sub-index indicates that overall production levels were flat-to-down in recent weeks. The Employment component is 56.0, indicating that employment levels continue to expand. Backlogs for moldmakers suffered a modest contraction, as the Backlog component this month is 44.0.

The Mold Prices sub-index for September is 48.0. This corresponds with a steady-to-lower movement in the prices received for new molds. The prices paid for materials and components continue to rise, as the sub-index for Materials Prices is 66.0. Supplier Delivery Times are getting longer, as the latest reading for this sub-index is 38.0. There was a small increase reported in offshore orders for new molds, as the Export Orders sub-index is 52.0.

Once again by a wide margin, the most-cited problem confronting North American moldmakers in recent weeks is the shortage of skilled labor. Other problems receiving multiple mentions are: uncertainty about future business levels and the U.S. economy; pressure from customers for longer payment terms, shorter lead-times, and lower mold prices; steel availability; project delays; customers who do not understand mold quality; and China.

The Mold Business Index is based on a monthly survey of North American mold makers. Mountaintop Economics & Research, Inc. conducts the survey, and then calculates a diffusion index based on 50.0. A value above 50.0 for the MBI indicates that business activity expanded in the previous month, while a value below 50.0 means that business levels declined.

Related Content

The Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreThe Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MoreMMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreMaking Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreRead Next

Mold Business Index: Overall Business Levels Uneasily Steady

Total Mold Business Index for July 2011: 50.0

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

.jpg;maxWidth=300;quality=90)