Uptrend Accelerated

Total Mold Business Index for February 2012: 56.6

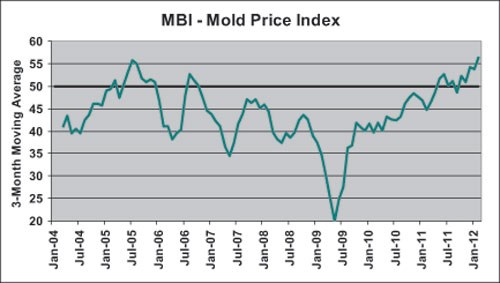

The recent uptrend in overall business levels for North American moldmakers was not only extended in February, it accelerated. The MBI is 56.6, which is a 2.7-point increase from January’s 53.9 and a 3.3-point increase from last February’s 53.3.

Strong gains were reported in all categories. The good news was tempered only by reports of longer Supplier Delivery Times and higher Materials Prices. The New Orders sub-index registered another solid gain this month, as did the sub-indices for both Production and Employment levels. For the third consecutive month, there was an increase reported in Mold Prices. Future Expectations remain quite optimistic.

The data measuring the overall U.S. economy are increasingly solid, and inflation-adjusted GDP is expanding at an annual rate of 2.5%. This pace is still a bit below the long-term potential for the U.S., but it is strong enough to encourage new hiring and lower the closely-watched unemployment rate. We expect that the unemployment rate will be below 8% by the end of 2012.

The relentless rise in the price of gasoline currently poses the most immediate threat to the recovery. If the conflict with Iran doesn’t escalate, then fuel prices should stabilize and the U.S. economy will continue to expand at a moderate rate this year. Then if we can get some competent policymaking after the November elections, the U.S. economy’s prospects will brighten substantially as we progress through the middle of this decade.

The data measuring consumer activity are gaining momentum. Retail sales are growing at a respectable pace of about 5%, and vehicle sales topped 15 million units (annualized rate) in February—fastest pace since before the recession. Home sales have firmed and inventories of homes for sale are in decline. In fact, stocks of new houses have never been lower. Data on house prices are still weak, but this is due to the backlog of foreclosures and short sales. Prices for non-distress sales are firming. Taking all of these factors into account, we are quickly gaining confidence that this recovery is developing into a self-sustaining economic expansion.

Demand for new molds expanded in February, as the New Orders component is 57.9. This follows a similar mark of 58.0 in the previous month. The Production sub-index is 59.2, and the Employment component is 61.8. These two components indicate work levels are rising and moldmakers still need new employees to meet demand. Backlogs for moldmakers were gratifyingly longer as the Backlog component this month is 52.6.

The Mold Prices sub-index for February is 56.6, which is very near an all-time high. The prices paid for materials and components also continue to rise, as the sub-index for Materials Prices is 72.4. Supplier Delivery Times are longer, as the latest reading for this sub-index is 30.3. There was a small rise in offshore orders for new molds, as the Export Orders sub-index is 51.3.

Related Content

-

Top 10 Topics to Cover During an ISO 9001 Manufacturing Audit

Take a look at this practical hands-on approach to conducting a quality audit.

-

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

-

Leading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

.jpg;maxWidth=970;quality=90)

.jpg;maxWidth=300;quality=90)