Overall Business Levels Strengthen

Total Mold Business Index for October 2011: 55.7

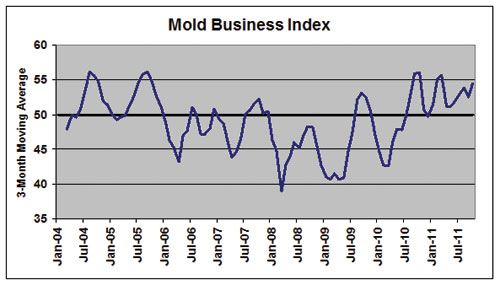

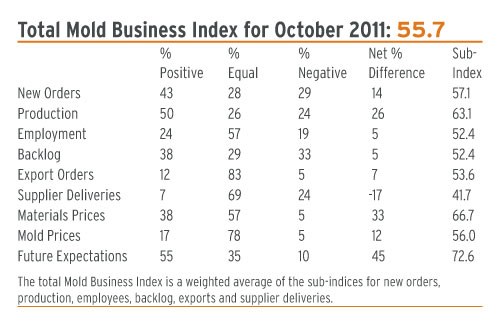

Overall business levels for North American moldmakers strengthened in recent weeks. The Mold Business Index (MBI) for October 2011 is 55.7 (a monthly value over 50.0 indicates growth for the month). The latest MBI value is a 4.5-point increase from the September value of 51.2, and it is a 0.2-point increase from the MBI value of 55.5 posted in October of 2010. Solid gains were registered in both New Orders and Production levels. Materials Prices continued to rise during the latest month, but Mold Prices were firmer as well. Future Expectations were sharply higher when compared with the previous month.

The gradual trend upwards in the major macroeconomic and end-market indicators persisted in recent weeks. Total GDP for the third quarter expanded by a 2.5%, and the most recent U.S. employment data also exhibited some positive momentum. To be sure, none of the data are strong enough yet to indicate that a recovery in the U.S. economy is assured, but the most likely scenario is still one of slow, but positive growth during the next two to three quarters. After a gain of 1.7% in 2011, our forecast calls for GDP growth of 2.4% in 2012 and 3.2% in 2013.

The most important indicator of economic health in the coming year will be the trend in construction activity, particularly in the residential sector. Growth in the housing starts data has been relatively flat since hitting bottom in the recession. The trend in housing starts is the best indicator of consumers’ ability and willingness to spend. It is also a good indicator of the banks’ willingness to lend and of local governments’ ability to hire teachers, policemen, firemen, etc.

Unfortunately, the housing sector is still in crisis due to the huge overhang of foreclosures coming to the market in the coming months. So it will take some more time before the economy can start hitting on all cylinders. But barring some unforeseen shock, the construction sector will stabilize in 2012, and it will once again start contributing to U.S. economic growth in 2013. Until then we will have to endure continued sluggishness in the employment data and also in the overall rate of economic growth.

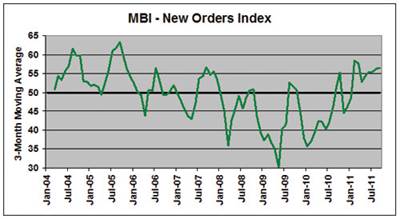

The critical New Orders component for our MBI registered a solid gain for the third consecutive month, as this sub-index for October is 57.1. The Production sub-index rebounded from a flat performance in September to a robust 63.1 in October. The Employment component is 52.4, indicating that employment levels continue to expand but at a slower rate than this summer. Backlogs for moldmakers expanded, as the Backlog component this month is 52.4.

The Mold Prices sub-index for October is 56.0 indicating that mold prices are starting to rise. The prices paid for materials and components also continue to rise, as the sub-index for Materials Prices is 66.7. Supplier Delivery Times are longer, as the latest reading for this sub-index is 41.7. There was another rise reported in offshore orders for new molds, as the Export Orders sub-index is 54.6.

The most-cited problem confronting North American moldmakers in recent weeks continues to be the shortage of skilled labor. Other problems receiving multiple mentions are: uncertainty about future business levels and the U.S. economy; pressure from customers for longer payment terms, shorter lead-times, and lower mold prices; the availability of steel and other materials; customers who do not understand mold quality; and China.

The Mold Business Index is based on a monthly survey of North American mold makers. Mountaintop Economics & Research, Inc. conducts the survey, and then calculates a diffusion index based on 50.0. A value above 50.0 for the MBI indicates that business activity expanded in the previous month, while a value below 50.0 means that business levels declined.

Related Content

MMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreThe Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MoreSteps for Determining Better Mold Prices

Improving your mold pricing requires a deeper understanding of your business.

Read MoreThe Critical Role of Management Representatives in ISO 9001

In ISO 9001 quality management systems, the Management Representative (MR) plays a crucial role. While the 2015 version of ISO 9001 no longer mandates this position, having a trusted management member serve as an MR remains vital for streamlining operations and maintaining quality standards.

Read MoreRead Next

Business Levels Steady-to-Higher

Total Mold Business Index for September 2011: 51.2

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read More