Substantial Decrease in Business Activity

Mold Business Index for April 2006

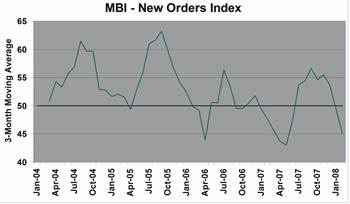

Overall business activity for North American moldmakers decreased substantially in April. Based on the latest survey for our Mold Business Index (MBI), the MBI value for April was 40.0. This is a 9.3 percentage point decrease from the March value of 49.3. All of the components that make up the MBI were either flat or down in the latest month, and the Materials Prices sub-index continued to climb due to fuel surcharges paid on the delivery of steel and other materials. The Future Expectations sub-index set an all-time low of 50.0 in April.

Yet despite the negative performance in the MBI during the first four months of this year, our forecast calls for improving market demand for new molds later in 2006. Some of the decline in the first part of the year was attributable to seasonal factors, and there is no doubt that the turmoil in the auto sector also is having a strong negative impact on the market. Nevertheless, other economic and industry indicators remain strong, and capital investment for new plastics equipment is still expanding. We believe that the trend in overall market demand for new molds will return to a gradual upward trajectory by the second half of this year. The major threat to this forecast is the high price of petroleum and other energy products.

The sub-index for New Orders of molds was a meager 32.5 in April, which means that the amount of new business decreased considerably when compared with the previous month. Total production activity also was down, as the latest Production sub-index was 37.5. Fewer orders mean that the industry’s overall backlog declined. The Backlog sub-index sank to 30.0 in April.

The latest Mold Prices sub-index was 30.0, which means that overall prices for new molds continue to fall. Unfortunately, the prices paid for steel continues to rise due to fuel surcharges, and the latest sub-index for Materials Prices stayed elevated at 67.5.

The Future Expectations sub-index hit an all-time low in April of exactly 50.0. This reading is down sharply from the trend in previous months, and it means that moldmakers expect overall business activity to remain at current levels in the coming year. This decline in optimism was accompanied by a sharp drop in the reported capital investment plans for moldmakers.

The most cited problem confronting North American moldmakers at the present time is offshore competition, particularly from China. Other problems receiving multiple mentions were: the troubles suffered by the Big 3 automakers; the high costs of materials and energy; less favorable payment terms; longer delivery times for materials; and, a shortage of skilled labor.

|

April 2006

|

|||||

|

|

%

Positive |

% |

%

Negative |

Net % Difference

|

Sub-

Index |

| New Orders |

30

|

5

|

65

|

-35

|

32.5

|

| Production |

30

|

15

|

55

|

-25

|

37.5

|

| Employment |

15

|

60

|

25

|

-10

|

45.0

|

| Backlog |

20

|

20

|

60

|

-40

|

30.0

|

| Export Orders |

0

|

90

|

10

|

0

|

45.0

|

| Supplier Deliveries |

5

|

90

|

5

|

0

|

50.0

|

| Materials Prices |

35

|

65

|

0

|

35

|

67.5

|

| Mold Prices |

0

|

60

|

40

|

-40

|

30.0

|

| Future Expectations |

35

|

30

|

35

|

0

|

50.0

|

| Total Mold Business Index for April 2006: 40.0. The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports and supplier deliveries. | |||||

Related Content

The Critical Role of Management Representatives in ISO 9001

In ISO 9001 quality management systems, the Management Representative (MR) plays a crucial role. While the 2015 version of ISO 9001 no longer mandates this position, having a trusted management member serve as an MR remains vital for streamlining operations and maintaining quality standards.

Read MoreHow to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

Read MoreMold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

Read MoreMaking Mentoring Work | MMT Chat Part 2

Three of the TK Mold and Engineering team in Romeo, Michigan join me for Part 2 of this MMT Chat on mentorship by sharing how the AMBA’s Meet a Mentor Program works, lessons learned (and applied) and the way your shop can join this effort.

Read MoreRead Next

Economic Growth Slows; Expectations Positive 41.7 Total Mold Business Index for February 2008

Overall economic growth in the U.S. is sputtering so far this year, and this is constraining demand for new molds in the first quarter of 2008

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More