Business Levels Improve Moderately

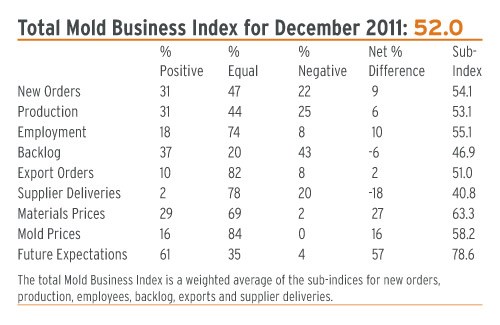

Total Mold Business Index for December 2011: 52.0

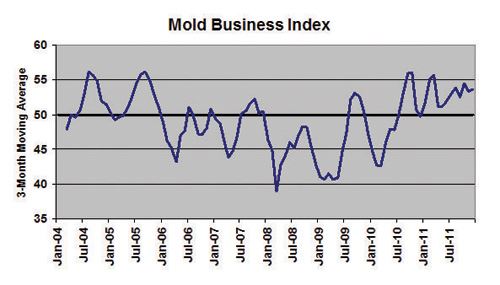

Overall business levels for North American moldmakers improved moderately as 2011 came to a close. The Mold Business Index (MBI) for December 2011 is 52.0 (a monthly value over 50.0 indicates growth for the month). The latest MBI value is a 1.0-point decrease from the November value of 53.0, but it is a 0.6-point increase from the MBI value of 51.4 posted in December of 2010. The crucial New Orders sub-index registered a solid gain this month, and gains were also reported in Production and Employment levels. Supplier Delivery Times were markedly longer in recent weeks, while Materials Prices continued to rise. There was a noticeable increase in Mold Prices in December, and Future Expectations were also stronger.

The U.S. economy likewise showed strength as 2011 ended, as total GDP grew by about 3% in the fourth quarter. Factors contributing to this growth included: respectable holiday and vehicle sales; solid business investment in new equipment; and a gain in construction spending. The labor market was surprisingly strong, with the new jobs data escalating to more than 200,000 in the month of December. The unemployment rate ended the year at a three-year low of 8.5%.

The manufacturing sector was also a large part of the economic growth story at the end of 2011. The ISM manufacturing index, which had sputtered through much of the year, came back with a flourish in December. U.S. manufacturing has been a significant source of job and output gains during the recovery when other parts of the economy have disappointed. The employment subcomponents of both the ISM index and our MBI indicate that factories and machine shops have been adding workers for the better part of the past two years.

The data from the construction sector indicate that demand for new homes has hit bottom, and is poised to improve gradually. The gains in residential construction will be slow in 2012, but they should be just enough to inspire confidence that a recovery is imminent. Unlike previous business cycles, housing will be the last major part of the economy to recover this time around. The construction data will ease upward in the near term, and it will start to gain momentum once we put together a string of strong GDP and employment gains.

After posting a small decline in the previous month, the New Orders component for our MBI rebounded in December. The latest reading for this sub-index 54.1. The Production sub-index stayed in positive territory by recording a value of 53.1 this month. The Employment component is 55.1, indicating that employment levels continue to rise. Backlogs for moldmakers were steady-to-smaller as the Backlog component this month is 46.9.

The Mold Prices sub-index for December is a gratifying 58.2 indicating that mold prices were higher overall. The prices paid for materials and components also continue to rise, as the sub-index for Materials Prices is 63.3. Supplier Delivery Times are getting even longer, as the latest reading for this sub-index is 40.8. There was little change in offshore orders for new molds, as the Export Orders sub-index is 51.0.

By a very wide margin, the most-cited problem confronting North American moldmakers in recent weeks continues to be the shortage of skilled labor. Other problems receiving multiple mentions are: pressure from customers for longer payment terms, shorter lead-times, and lower mold prices; uncertainty about future business levels and the U.S. economy; the policy makers in Washington DC; the prices and lead times for steel, components, and other materials; profitability; and China.

The Mold Business Index is based on a monthly survey of North American mold makers. Mountaintop Economics & Research, Inc. conducts the survey, and then calculates a diffusion index based on 50.0. A value above 50.0 for the MBI indicates that business activity expanded in the previous month, while a value below 50.0 means that business

Related Content

Tackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

Read MoreThe Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MoreMaking Mentoring Work | MMT Chat Part 2

Three of the TK Mold and Engineering team in Romeo, Michigan join me for Part 2 of this MMT Chat on mentorship by sharing how the AMBA’s Meet a Mentor Program works, lessons learned (and applied) and the way your shop can join this effort.

Read MoreHow to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

Read MoreRead Next

Business Levels for Moldmakers Expanded

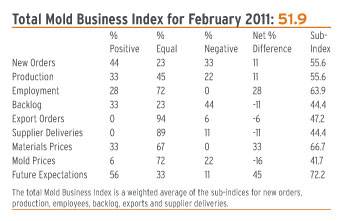

Total Mold Business Index for February 2011: 51.9.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;maxWidth=300;quality=90)