Business Levels Steady to Better

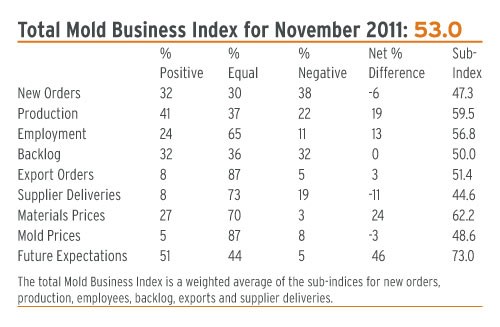

Total Mold Business Index for November 2011: 53.0

Overall business levels for North American moldmakers were steady-to-better in recent weeks. The Mold Business Index (MBI) for November 2011 is 53.0 (a monthly value over 50.0 indicates growth for the month). This is a 2.7-point decrease from the October value of 55.7, but a gratifying 10.6-point increase from the 42.4 posted in November of 2010.

The crucial New Orders sub-index was down modestly this month, but substantial gains were registered in both Production and Employment levels. Materials Prices were higher in recent weeks, while Mold Prices were mostly steady. Future Expectations remained at a high level.

As 2011 comes to an end, the U.S. manufacturing sector continues to be a bright spot in the economic outlook for 2012. And not only is manufacturing supporting the recovery, but the overall economy appears to be gradually gathering momentum. Real GDP growth will come in between 2 and 3 percent for the fourth quarter, which is at least as good (and maybe a little better) than the third quarter. The recent trends in the data measuring employment, retail sales, vehicle sales and construction spending indicate that another recession is unlikely, and that slowly accelerating growth will most likely prevail over the next few quarters.

If global policymakers are able to make any progress in resolving the European debt crisis, then the financial markets should continue to improve. This will set the stage for U.S. economic growth in 2012 and beyond that is both more robust and more reliable than we had in 2011. We do not expect the economy to boom in the foreseeable future, but we do think that incremental improvements in the economic fundamentals will increasingly dispel the environment of doubt and uncertainty that currently exists.

After several months of solid gains, the New Orders component for our MBI was flat-to-down in November, 47.3. The Production sub-index remained strong, 59.5. The Employment component is 56.8, indicating employment levels continuing to expand at a vigorous clip. Backlogs for moldmakers were unchanged, registering a 50.0.

The Mold Prices sub-index for November is 48.6 indicating that mold prices were uneasily steady. The prices paid for materials and components also continue to rise, but the rate of increase is easing a bit as Materials Prices posted 62.2. Supplier Delivery Times are moderately longer, 44.6. There was another small rise reported in offshore orders for new molds, as the Export Orders sub-index is 51.4.

By a very wide margin, the most-cited problem confronting North American moldmakers in recent weeks continues to be the shortage of skilled labor.

Related Content

-

Mold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

-

MMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

-

Tackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.