Mold Business Index

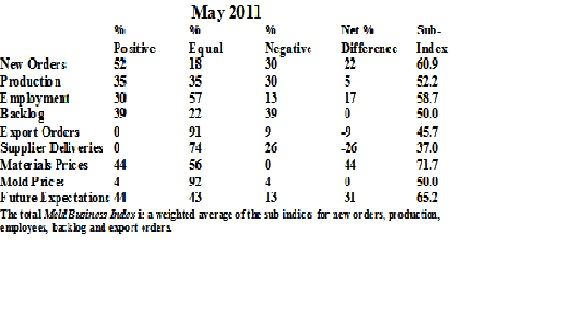

Total Mold Business Index for May 2011: 53.5.

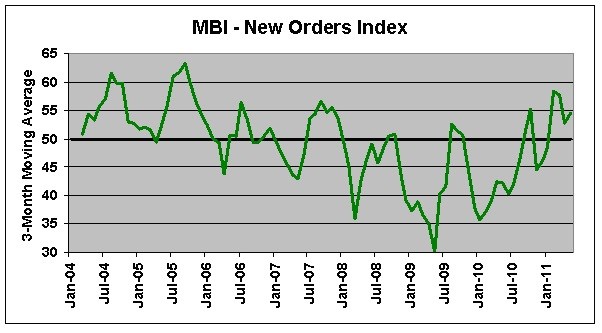

Overall business levels for North American moldmakers rebounded in May after suffering a small decline in April. The Mold Business Index (MBI) for May 2011 is 53.5. This is a 6.4-point increase from the April value of 47.1, and it is a 4.0-point increase from the MBI value of 49.5 recorded in May of last year. A significant gain in New Orders and another rise in Employment levels were the main factors in the increase in this month’s MBI. Supplier Delivery Times are still getting longer, and Materials Prices are still rising.

From a short-term perspective, the rate of economic growth in the U.S. continues to decelerate, and this loss of momentum is evident in the manufacturing sector. Just to be clear, activity levels in most sectors are expanding, they are just not growing at the pace required to create the number of new jobs necessary to get unemployed workers back to work and also employ all of the new workers that are entering the work force. But this trend of deceleration we have experienced during the first half of 2011 should be temporary, and the pace of overall economic activity, manufacturing output, and job creation will accelerate during the second half of this year.

This forecast is based on expected improvement in three key economic factors. First, the price of oil and gasoline must continue to decline. At four dollars for a gallon of gas, the overall loss to the U.S. economy is about $150 billion a year. That is the equivalent of one full percentage point in total GDP for the year, and the lack of consumer confidence that results could be even greater. The second factor is the short-term disruptions to both supply chains and economic activity we have suffered that are the result of the earthquake disaster in Japan, and the flooding and tornadoes here in the U.S. Ultimately, these catastrophes will be a boost to the GDP data in both Japan and America, because the clean-up and rebuilding efforts will increase economic activity. But for now, these disruptions have put the brakes on economic activity.

And finally, Congress should decisively act to raise the federal government’s debt ceiling, and then begin the painful process of getting our nation’s fiscal situation in order. Washington must eliminate deficit spending, but threatening to default on its debt obligations is not the way to do it. The uncertainty that this is causing in the financial markets is irresponsible and dangerous.

The New Orders component for our MBI shows that the number of new projects increased, as this sub-index for May is 60.9. The latest Production sub-index posted a steady-to-better reading of 52.5. The Employment component is 58.7, indicating that hiring activity is still rising for those shops lucky enough to find qualified candidates. Overall backlogs for moldmakers were unchanged, as the Backlog component this month is exactly 50.0.

The Mold Prices sub-index for May is exactly 50.0. This marked the third consecutive month that overall mold prices held firm. The prices paid for most types of materials and components continue to go higher. The sub-index for Materials Prices is 71.7. Supplier Delivery Times are longer, as this sub-index is 37.0. There was a decline in offshore orders for new molds, as the Export Orders sub-index is 45.7.

The most-cited problem confronting North American moldmakers in recent weeks is the shortage of skilled labor entering the industry. Other problems receiving multiple mentions include: the lack of profitable new business; pressure from customers for longer payment terms and shorter lead-times; and uncertainty about the U.S. economic recovery.

Our Injection Molding Business Index (a measure of output levels for injection molders) posted a solid increase in the first quarter of 2011 when compared with the previous year. This Index grew by 7% in 2010, and the forecast calls for a gain of 5% in 2011. Gains in the Mold Business Index depend on sustained growth of 4% to 5% in the output of injection molded products. The trend in the mold making data lags the trend in the processing sector by six months.

The Mold Business Index is based on a monthly survey of North American mold makers. Mountaintop Economics & Research, Inc. conducts the survey, and then calculates a diffusion index based on 50.0. A value above 50.0 for the MBI indicates that business activity expanded in the previous month, while a value below 50.0 means that business levels declined.

Data source: Mountaintop Economics & Research, Inc.

Related Content

Think Safety: Eliminate Hazards Throughout the Shop

The tooling community is taking advantage of new products for safer mold shops and molding facilities.

Read MoreMMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreThe Critical Role of Management Representatives in ISO 9001

In ISO 9001 quality management systems, the Management Representative (MR) plays a crucial role. While the 2015 version of ISO 9001 no longer mandates this position, having a trusted management member serve as an MR remains vital for streamlining operations and maintaining quality standards.

Read MoreWhat is Driving Mold Lifecycle Management Digitalization?

OEMs are looking to partner with suppliers to share and track data across the supply chain for advanced intervention and process management.

Read MoreRead Next

How to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More