Automotive/Transportation & Electronics/Computer

Light Vehicle Sales: Steady, Not Great; Computer Production Hits a Lull

Light Vehicle Sales: Steady, Not Great

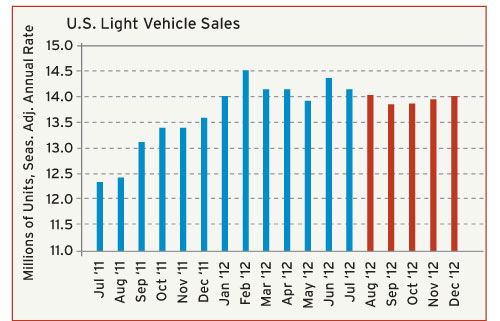

Despite the sluggish growth rate for the U.S. economy overall, market demand for new light vehicles (cars, light trucks, minivans, and SUVs) has held up pretty well this year. After rising steadily during the second half of 2011, monthly sales volumes have hovered very close to the level of 14 million units (annualized) so far in 2012. This level is still well below the 17-18 million units per year that were sold in the halcyon days prior to the Great Recession, but if sales hold in this range for the rest of 2012 it will represent a healthy gain of 15% over last year’s total. We expect that sales volumes will be steady-to-better in the near-term, and the annual total for 2012 will be very close to 14.5 million units.

There are several positive factors generating demand for new cars and light trucks. They include: gradual gains in consumer incomes; moderate improvements in access to credit; and a rising number of new models being released. But the biggest factor is most likely pent-up demand which is based on the fact that the average age of cars on the road in America is almost 11 years. Americans are driving their cars much longer than they used to on average, but we have pushed this trend to the prudent limit and there is now a growing number of vehicles that need to be replaced. So barring an unforeseen shock to the economy, new vehicle sales will continue to rise gradually in the coming 12 months.

Energy prices are a wild card in this forecast, and there is no doubt that the long-term trend in the price of gasoline will have an effect on the types of cars and trucks that are demanded in the coming years. But as long as the changes in the price of fuel stay within a predictable range, demand for new vehicles will continue to expand steadily.

Computer Production Hits a Lull

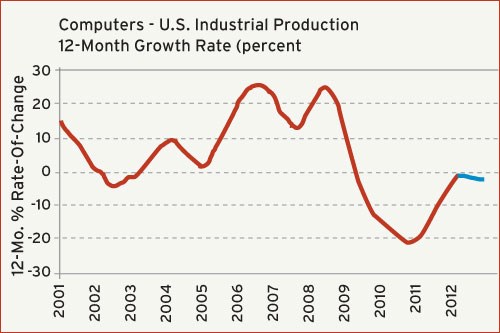

Since the last time we reported on the computer end-market, there was a substantial downward revision to the data compiled by the Federal Reserve Board that measures U.S. production of computers and related equipment. According to the new data, output of these products from American factories has declined for three straight years. The worst year was 2010 when U.S. production of computers plummeted by more than 20% when compared with the previous year. In 2011, output fell by another 6%. It looks like the downward spiral is decelerating, but for through the first half of 2012 this industry is still registering a decline of 1% from the same period last year. Our latest forecast calls for a decline of 3% in 2012, but we expect a solid increase in 2013.

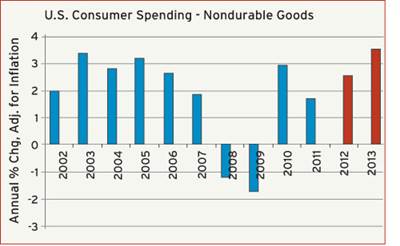

The good news is that market demand for high-tech products continues to grow. The bad news is that the products that are in greatest demand—smartphones and tablets—are not manufactured in North America. This situation will not last forever, but it will likely persist through the coming year. As for electronic products made in this country, consumer spending for all types of products will gradually accelerate in 2013, and this will lift demand for U.S.-made computers and related equipment. Part of this increase will be generated by the aggregate gains in consumers incomes that will be the result of improving employment figures. Consumers with new jobs will have more money to spend on computers, and the companies that hire them will also have to purchase more computers for the workplace. This trend will become much more evident in 2013 once the Presidential election is over and Congress successfully averts the “fiscal cliff” disaster looming at the end of this year.

Related Content

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreMaking Mentoring Work | MMT Chat Part 2

Three of the TK Mold and Engineering team in Romeo, Michigan join me for Part 2 of this MMT Chat on mentorship by sharing how the AMBA’s Meet a Mentor Program works, lessons learned (and applied) and the way your shop can join this effort.

Read MoreDynamic Tool Corporation – Creating the Team to Move Moldmaking Into the Future

For 40+ years, Dynamic Tool Corp. has offered precision tooling, emphasizing education, mentoring and innovation. The company is committed to excellence, integrity, safety and customer service, as well as inspiring growth and quality in manufacturing.

Read MoreThe Critical Role of Management Representatives in ISO 9001

In ISO 9001 quality management systems, the Management Representative (MR) plays a crucial role. While the 2015 version of ISO 9001 no longer mandates this position, having a trusted management member serve as an MR remains vital for streamlining operations and maintaining quality standards.

Read MoreRead Next

End Market Report: Aerospace/Defense & Packaging

Plastics Packaging Outlook: Moderate Growth in 2012, and Aerospace/Defense Spending Outlook.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More