End Market Report: Automotive and Consumer, May 2013

Solid Year Expected for Automotive; Solid Year Expected for Automotive

Solid Year Expected for Automotive

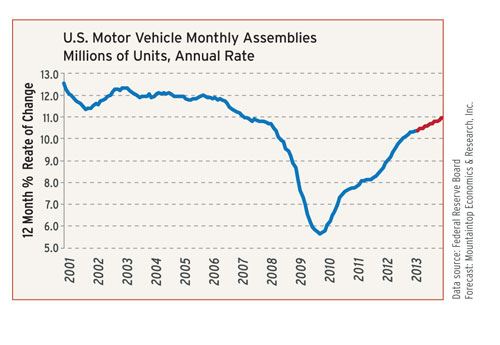

Our latest forecast calls for total motor vehicle assemblies in the US to reach 11.0 million units in 2013 which will represent a 7% annual. For the record, there were 10.3 million units assembled in 2012, and this was a jump of nearly 20% when compared with the total from 2011. As the chart below illustrates, 2013 is expected to be the fourth consecutive year in which this sector has experienced solid growth. And if our forecast for 2013 is correct, total assemblies in the US will still be one million units shy of their pre-recession level which consistently hit about 12 million units per year.

The average age of all of the motor vehicles in the US is still quite high by historical standards. So there is pent-up demand from consumers and small businesses who are awaiting better economic conditions. We expect the overall economy to grow by 2.5% this year and 3.5% next year. This trend of gradual improvement will be sufficient to foster steady growth in motor vehicle demand for the foreseeable future. The US market’s ever-rising awareness of the issues pertaining to energy independence and carbon emissions will continue to spur demand for lighter, more fuel-efficient vehicles and also vehicles that use non-traditional power sources such as natural gas, bio-diesel, and electricity.

There will be rising demand for small trucks and utility vehicles from contractors and other construction workers generated by the accelerating recovery in the residential construction sector. Until last year, the construction sector was a drag on overall economic activity. But this trend was clearly reversed in the second half of 2012, which means that a proper economic recovery can now finally start to unfold. Trends in the housing market are a primary factor in rising household wealth, and also in improving access to credit for most consumers and small businesses.

Output of Consumer Goods Still Underperforming

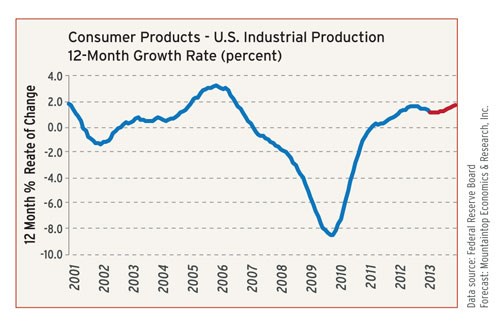

Total US industrial production of household consumer goods (excluding high-tech, autos, and energy) is forecast to expand 1.7% in 2013. This follows an increase of 1.4% in 2012. These rates are lower than the overall rate of growth in the US economy. Total GDP, after adjusting for inflation, grew by 2.2% in 2012, and we expect it to increase by 2.5% in 2013. Historical analysis indicates that growth in demand for consumer goods correlates closely with growth in the overall economy. The slower growth in US consumer goods production in recent years is due to the fact that many types of these goods are still being imported.

The problem with imports and our overall trade deficit in consumer products will take a long time to solve, but there are several near-term factors that will also affect US manufacturers this year. The most obvious are the persistent trends of agonizingly slow growth in both new job creation and personal incomes. The lackluster labor market has resulted in a decline in overall labor force. It will take at least another year or two before we get more robust improvement in the employment data. Until then, gains in consumer spending for all types of goods will be constrained.

Another short-term negative factor is the recent dip in consumer confidence that is due to the problems emanating from policymakers in Washington DC and the recent rise in payroll taxes. It will take a few months for most middle-class households to adjust to the fact that their paychecks are now a couple of hundred bucks lighter each pay period. Some of this direct hit to consumer pocketbooks might eventually be mitigated by lower energy prices or rising home values, but for at least the first half of this year it will curtail their spending on consumer goods.

Related Content

MMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreThe Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MoreMaking Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreMaking Mentoring Work | MMT Chat Part 2

Three of the TK Mold and Engineering team in Romeo, Michigan join me for Part 2 of this MMT Chat on mentorship by sharing how the AMBA’s Meet a Mentor Program works, lessons learned (and applied) and the way your shop can join this effort.

Read MoreRead Next

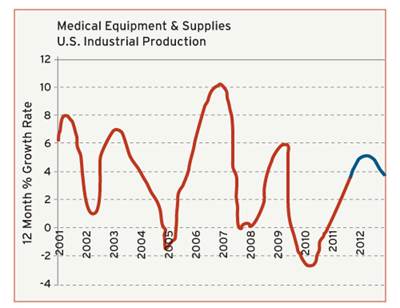

Medical Equipment and Supplies; Consumer Goods End Market Report 2012

Medical Equipment and Supplies; Consumer Goods.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More