Business Levels: Moderate but Steady Improvement

Total Mold Business Index for January 2012: 53.9

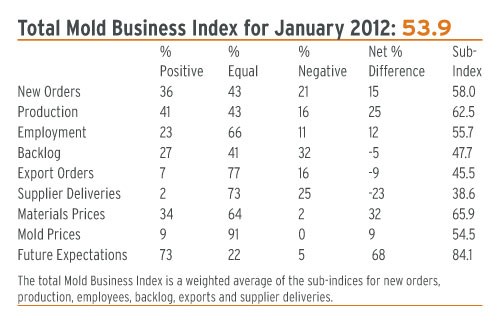

Overall business levels for North American moldmakers remain on a trend of moderate, but steady improvement at the start of 2012. The Mold Business Index (MBI) for January 2012 is 53.9—a 1.9-point increase from December’s 52.0, but a 6.6-point decrease from January 2011’s 60.5.

Once again, the crucial New Orders sub-index registered a solid gain, as did Production and Employment levels. Supplier Delivery Times continued to stretch out, while Materials Prices continued to rise. For the second month in a row, there was a rise reported in overall Mold Prices. Future Expectations were significantly stronger.

Moldmaking is not the only industrial sector in the U.S. that is gaining momentum. Relatively cheap natural gas, a steel-hungry energy sector and steadily rising labor costs in China are generating widespread gains in American factory payrolls. The recent escalation in the data on manufacturing jobs is even more impressive given the fact that the long-term trend in manufacturing employment in this country is downward. Rising productivity would likely have reduced factory payrolls over the past few years, even without the Great Recession. This means that the manufacturing sector has returned to a level that is very close to its pre-recession trend.

If the U.S. economy can avoid a shock in the coming months from either the European debt fiasco or a disruption from Persian Gulf oil flows, the current recovery will continue to gain momentum. The discernable rise in the underlying rate of job creation in America will go a long way toward starting the self-sustaining phase of the cyclical recovery. This phase occurs when reliable gains in the employment data result in rising consumer confidence and consumer spending. This, in turn, produces even more hiring—and the cycle continues. The gain of 243,000 new jobs in January is the latest figure in a trend that has gained steam since last August. The U.S. is still well below full employment, but the recent improvement is a strong indication that we are finally heading in the right direction.

Demand for new molds accelerated, with New Orders at a strong 58.0, up from 54.1 last month. Production exhibited the biggest gain of all the components with a 62.5. Employment is 55.7, indicating levels continue to rise. Backlogs for moldmakers were mostly steady at 47.7. The Mold Prices sub-index is 54.5, and it is worth noting here that there were no respondents who reported a decline in mold prices. Prices paid for materials and components also continue to rise, with Materials Prices at 65.9. Supplier Delivery Times are getting even longer, as the latest reading is 38.6. There was a moderate decline in offshore orders for new molds, as the Export Orders sub-index is 45.5.

Related Content

-

How to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

-

Tackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

-

OEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.