Overall Activity Levels Advanced

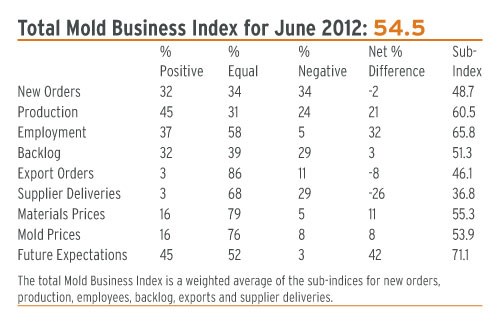

Total Mold Business Index for June 2012: 54.5

Though the headline value for our MBI indicated an overall rise in activity in recent weeks, there was once again some underlying weakness. For the second straight month, a small decline was reported in the important New Orders category. This was offset by solid gains in the Production and Employment levels. Supply conditions remain on an unfavorable track as Supplier Delivery Times expanded and Materials Prices were higher. Mold Prices were steady-to-better, and Future Expectations remained optimistic.

The macro-economic data released in recent weeks continues to indicate that the U.S. economy is slogging through a midyear slump. Despite a decline in the price of gasoline, consumer spending during the second quarter was not sufficient to offset the combined weakness in business investment and exports. Our current forecast for real GDP in the third quarter calls for close to the same rate of growth that we got in the second quarter—just about 2.0%. Of concern to moldmakers is the fact that this forecast reflects a trend of weaker orders for manufactured goods. The problems in Europe are starting to show up in the data on export demand, while slow growth in consumer income levels is still a restraint on domestic consumption.

But while economic growth may be slow, it is not yet time to start predicting the next recession. There is still time for policymakers to make some beneficial decisions. Regardless of the results in November’s election, I expect Congress to pass a bill that will avoid the dire consequences of the “fiscal cliff” on January 1st. In the near-term, it is likely that the Federal Reserve Board will engage in further quantitative easing. In June, they moved in this direction when it was decided to extend the maturity extension program (a.k.a. Operation Twist) through the end of the year.

Weakness in the factory sector’s health was suggested the ISM manufacturing survey for June. This index dropped below the break-even level of 50 for the first time since July 2009. A plunge in the new orders index led the composite down 3.8 points to 49.7. Production also moderated, and the survey also confirmed that the European recession and slowing growth in China are weighing on manufacturers. The export orders index fell to its first sub-50 reading since 2009.

Demand for new molds slowed modestly again in June, as the New Orders component for our MBI registered 48.7. This category needs to show monthly increases if we are going to generate upward momentum in the overall index. At 60.5, the Production sub-index indicates that moldmakers remain busy despite the fact that new orders have leveled off. The Employment component advanced to 65.8, the highest level in the past twelve months. The Backlog component registered a small gain this month to 51.3.

The Mold Prices sub-index for June is 53.9. Mold prices are starting to rebound gradually, but respondents still report that strong pressure on prices persists. The prices paid for materials and components are still rising for some shops, but the upward momentum in prices is fading. The sub-index for Materials Prices is 55.3. The Supplier Delivery Times component is 36.8, so delivery times are still getting longer. There was another small decline in offshore orders, as the Export Orders sub-index is 46.1.

The most-cited problem confronting North American moldmakers in recent weeks is the shortage of skilled labor. Other problems receiving multiple mentions are: demands from customers for longer payment terms, shorter lead-times, and lower mold prices; uncertainty about the U.S. economy and the federal government; and foreign competition, particularly from China.

The Mold Business Index is based on a monthly survey of North American mold makers. Using the data from this survey, Mountaintop Economics & Research, Inc. calculates a diffusion index based on 50.0. A value above 50.0 for the MBI indicates that business activity expanded when compared with the previous month, and a value below 50.0 means that business levels declined.

Related Content

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreLeading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MoreTop 10 Topics to Cover During an ISO 9001 Manufacturing Audit

Take a look at this practical hands-on approach to conducting a quality audit.

Read MoreMMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreRead Next

Reasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read More

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)