Uptrend Continues

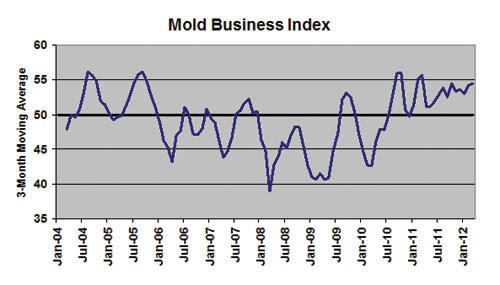

Total Mold Business Index for March 2012: 52.7.

The recent uptrend in overall business levels for North American moldmakers was extended in March, but the pace of expansion decelerated. The Mold Business Index (MBI) for March 2012 is 52.7. This is a 3.9-point decrease from February’s 56.6, and a slight 0.3-point decrease from the 53.0 in March 2011.

Gains were reported in the Production and Employment categories, while New Orders, Backlogs and Export Orders held mostly steady. Supplier Delivery Times continue to get longer and Materials Prices continue to get higher. For the fourth straight month there was a rise in Mold Prices, but the price of molds is still not keeping pace with the increases in materials prices. Future Expectations remain optimistic.

The current economic recovery in the U.S. is nearly three years old, but we are still not enjoying a full-fledged expansion. Such is the legacy of a recession caused by a financial crisis. It will likely take another two years before we can say that the economy is hitting on all cylinders. Real GDP is presently expanding at an annualized pace of 2.0%-2.5%, and this will probably be the yearly average for the next couple of years. At this pace, the economy is generating enough net new jobs to cut gradually into unemployment. The jobless rate will fall below 8% later this year.

The outlook calls for the economic data to turn a bit softer in the upcoming summer months as the effects of the warm winter fade and higher gasoline prices take a toll on consumer spending. The good news is that the economy’s underlying fundamentals will also continue to improve gradually. We expect that consumers will continue to support moderate growth. Core retail sales, excluding gasoline, are growing at a solid pace, and vehicle sales are surprisingly strong. Consumer spending on services has also performed better in recent months.

There are two key factors that will have a major effect on the overall growth rate in the coming year: 1. Fiscal policy—what Congress does after the election will have a major impact on economic growth in 2013 and beyond; and, 2. A revived housing market, and the good news is that housing is finally making progress. It is slow, but it is progress nonetheless.

Demand for new molds held firm in March, as the New Orders component is 52.3. Production is 55.7 and Employment is 60.2. These two components indicate work levels are expanding and moldmakers still need new employees to meet the current level of demand. Backlogs for moldmakers are mostly steady at 46.6.

The Mold Prices sub-index for March is 56.8, thus it remains very near the all-time high. The prices paid for materials and components also continue to rise, as the sub-index for Materials Prices is 68.2. Supplier Delivery Times are longer at 37.5, and there was a small decline in offshore orders, as the Export Orders is 48.9.

Related Content

-

MMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

-

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

-

Tackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

.jpg;maxWidth=300;quality=90)