Custom Machining Builds Revenue at Strohwig

Moldmaker turns metal fabrication skills into a major profit center with aerospace work.

For more than a quarter century, Strohwig Industries did most of its business as a toolmaker specializing in injection molds. But hard times in the moldmaking industry as a result of offshore competition and price pressure took a toll on sales.

“Foreign competition was driving the injection mold industry down and our profitability was dropping almost weekly,” says Dan Glass, Director of Sales.

Strohwig (Richfield, WI) decided to look for more lucrative opportunities, and eventually selected a market where it could capitalize on its machining expertise: aerospace. In only three years the company branched out successfully in this field, and at almost the same time built up custom machining sales in other areas, primarily components for energy-related markets.

“Five years ago we were 75 percent injection molds—now that’s down to 30 percent,” Glass says. Though aerospace is just 5 percent of business, custom machining as a whole accounts for 20 to 25 percent of sales, and another market, die-cast dies, has doubled to around 50 percent.

Strong Increase in Sales

As a result, the company projects annual sales growth in the 10 to 15 percent range for the foreseeable future. Sales in 2007 were about $34 million, according to Glass, a 10 percent gain from 2006. Strohwig’s performance last year nudged it into the Top 20 list of U.S. moldmakers compiled by at least one source, he notes.

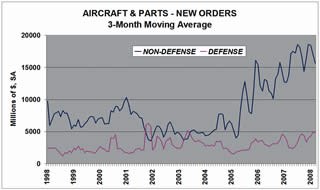

Strohwig Industries is one of a small number of North American moldmakers that are leveraging their metalworking talents in new industries to increase business and profitability. Aerospace is a major opportunity due to a global surge in demand for commercial and military aircraft and components. Between 2008 and 2026, experts say the market for new commercial airliners alone could total $2.8 trillion (see, May 2008, page 70).

Best of all, observers say, is that few mold companies are aware of the opportunities aerospace offers, so the field is not crowded.

Glass says the company targeted aerospace after seeing local suppliers not only getting business from the industry, but “making some pretty good money at it.” Founder and co-owner Wolf Strohwig was intrigued and sent one of his executives to local classes that taught companies how to work in the industry. Sold on the prospects for new business, Strohwig invested in aerospace certification, a process somewhat similar to ISO that took about a year to complete.

Armed with AS 9100 certification, Strohwig went after business. Glass says that military and civilian aircraft manufacturers, along with the U.S. Dept. of Defense and individual military services, have Web sites that list job opportunities and solicit requests for proposals. “But they are mostly looking for finished products, like airplane seats. That wasn’t the way for us to go,” he notes. “We just wanted to machine the metal.”

Working with the Primes

So the company turned to the prime contractors, which are readily identifiable through contract awards—firms such as Lockheed Martin, Northrop Grumman and General Dynamics—as well as aircraft manufacturers like Boeing and Airbus that need subcontractors to do fabrication work. Strohwig executives also began attending trade shows and conferences to make contacts.

The efforts paid off. Strohwig’s machining expertise and AS 9100 certification attracted attention, and the company soon had its first aerospace work.

Strohwig operates as a “third-tier supplier,” Glass says. Consequently, the AS 9100 certification hasn’t been critical to the work it does, primarily because a prime contractor or manufacturer assumes responsibility for quality procedures and paperwork, which is usually quite a lot. Nevertheless, certification opens doors. “Contractors are interested in us because we are aerospace-certified, even though most of the parts we machine for them don’t require it. Certification has been more of a sales benefit for us.”

Glass doesn’t disclose the types of aerospace parts Strohwig machines. Many times, in fact, “we don’t know anything about them.” But they are shipped to the company in all forms: castings, weldments and raw blocks of steel, along with detailed instructions for machining them.

Some components are huge. Strohwig routinely machines pieces that are 20 to 40 feet long and weigh as much as 100,000 pounds. The company has made substantial investments in horizontal machining centers since expanding into aerospace, buying six CNC boring bars in the past two years with 35 to 45 feet of travel, at a cost of $2 to 3 million each, as well as smaller vertical units.

The machining centers are loaded with features. Chief among these are five-axis motion, multiple high-speed spindles that automatically change out and roughing and finishing heads.

Automation, though, is not a major requirement, at least when it comes to part handling on the large machines. With components up to 40 feet long and weighing as much as 50 tons, automation is not feasible, Glass says.

High-speed machining, though, is a requirement, since many parts have ribs and other intricate details. Machining tolerances run into the thousandths of an inch.

Delivery Affects Machine Orders

Strohwig generally specifies machines that can be installed by a specific date. “Deciding on suppliers depends on their delivery schedule,” Glass notes. He says it takes about a year to receive a machining center, tool it up, train people to run it and start operations.

The company has been buying Italian machining systems like Pragma, which is manufactured by FPT Industrie (U.S. representative is FPT North America Inc., Canton, MI). OKK (Glendale Heights, IL) has been the choice for a number of small, low-rpm, machining centers. Strohwig buys most of its equipment through distributor Dynamic Machine Tool Ltd. (O’Fallon, MO).

The company began investing in large machining systems shortly after going into aerospace. Glass says that when customers first heard about Strohwig’s machining capabilities, demand was so great that many wanted to reserve machine time for as much as a year. Two years ago Strohwig built a 40,000-square-foot addition to its plant and installed the six CNC bars. Business was strong enough that it recouped the cost of each unit in 1 to 2 years, Glass says.

Machining capabilities also gave the company the momentum to expand beyond aerospace. Glass says that most of the custom machining Strohwig does is in energy-related industries: windmill components, generators, natural gas pumps, mining equipment and earthmovers.

Energy, like aerospace, is a growing industry, especially in alternative areas like wind power. Robert Dumont, President of the Tooling, Manufacturing and Technologies Assn. (Farmington Hills, MI), says the giant wind turbines that are appearing in North America (and are a feature of European landscapes) have more than 800 moving parts that are machined, mostly in Europe. “American manufacturers are recognizing that this is an opportunity because wind technology is catching on,” he remarks.

The custom machining business is growing so much that Strohwig recently broke ground for another addition, 50,000 square feet, which will be complete next spring and increases plant size to 205,000 square feet. Glass expects that more large machining systems will be installed in the space.

This is a far cry from what the company started with 30 years ago. Wolf Strohwig was a foreman at Triangle Tool (Milwaukee, WI) who left to form his own mold shop. The first building was a barn with a pair of small Bridgeport machines and a couple of lathes. Strohwig asked an apprentice at Triangle, Larry Glass, who was also his brother-in-law, to join him in the venture. Glass said he would come in but only as a partner, a relationship that continues to the present.

Strohwig Industries, which now has about 150 employees, has been a family business ever since, and will likely stay that way for some time since Dan Glass is Larry’s son.

Test the Waters

Moldmakers interested in aerospace machining should consider a few points, Glass says.

“Before investing money in certification, they should get some work and see if they like it.” The field offers numerous opportunities and, as Strohwig’s experience shows, can be a stepping stone to other custom machining work. But it requires a high skills set and the resources in equipment and manpower to meet the tolerances, quality procedures and delivery schedules that are critical to the industry.

There is also a lot of paperwork, even if a contractor or manufacturer handles most of it. “Smaller companies may struggle with that,” he remarks. “We need a guy full time to do the paperwork. If you’re a 10-man shop, that’s going to be difficult.”

The rewards in terms of increased business and greater profitability, though, are considerable. Aerospace parts are unlikely to be shipped offshore for machining, especially the large components; demand is strong and will stay that way for some time; and payment, at least in Strohwig’s experience, is prompt.

![]()

Related Content

Cross Training, In-House Capabilities and Collaborative Design Move Helm Tool Forward

Cross-training, bringing it all in-house, molding and collaborative design are essential to Helm Tool's success.

Read MoreUnique Mold Design Apprenticeship Using Untapped Resources

To help fill his mold design skills gap, Jeff Mertz of Anova Innovations, is focused on high schools and underprivileged school districts, a school that has lower graduation and college entrance rates. The goal is a student-run enterprise.

Read MoreConfronting the Mold Design Talent Drought

Recently, I reposted on LinkedIn the results of an informal survey we conducted, which revealed a shortage of skilled mold designers. It quickly gained a lot of traction. Given the response, I thought I'd summarize the feedback and keep the conversation going.

Read MoreMaking Mentoring Work | MMT Chat Part 2

Three of the TK Mold and Engineering team in Romeo, Michigan join me for Part 2 of this MMT Chat on mentorship by sharing how the AMBA’s Meet a Mentor Program works, lessons learned (and applied) and the way your shop can join this effort.

Read MoreRead Next

Berrien Tool Coalition: A Marketing Edge

This group of companies delivers a full-systems approach to manufacturing—art to part and every-thing in between.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More