Aerospace & Automotive

Aerospace Outlook: Steady Growth in 2013; Automotive Industry Will Remain a Bright Spot in 2013

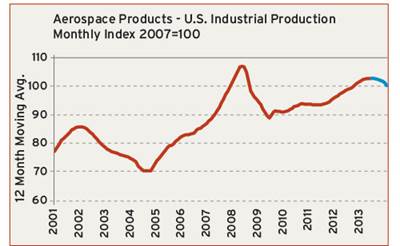

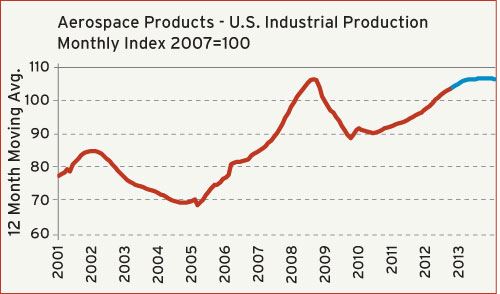

Aerospace Outlook: Steady Growth in 2013

One industry that has not suffered any ill effects from either the uncertainty surrounding the fiscal cliff deliberations or the destruction of Hurricane Sandy is aerospace products. In the third quarter of 2012, total U.S. production of aerospace products and parts expanded by a solid 6% when compared with the previous year. For the year-to-date, output of these goods is up an impressive 8% over 2011. Our latest forecast calls for a rise of 8% for all of 2012 followed by an increase of 5% in 2013.

On the non-defense side, industry consolidation is still a prevalent theme within the industry, and so is energy efficiency. There are still concerns about the long-term profitability for commercial air carriers. Through consolidation, companies are able to eliminate redundancies and re-negotiate unfavorable contracts. This may create some short-term gains, but the best prospects for future profitability rely on improving efficiency. Moving more people at a lower cost is their best hope. This will require investing in newer, lighter aircraft that are manufactured from composite and plastic materials.

For suppliers to the defense industry, the outlook is mixed. It is quite likely that orders for some of the older types of aircraft will be scaled back or even eliminated. But one area that will continue to grow is unmanned aircraft (a.k.a. drones). These aircraft already use a high proportion of plastic and composite parts, and demand for these parts will increase as spending on these types of aircraft ramps up.

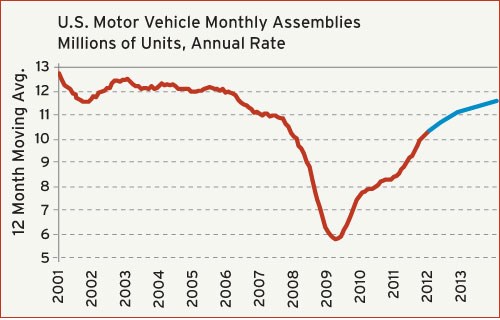

Automotive Industry Will Remain a Bright Spot in 2013

Since hitting bottom in 2009, the automotive industry has been a stellar performer for the U.S. manufacturing sector. In the third quarter of 2012, the total number of motor vehicles assembled in the U.S. jumped by nearly 15% when compared with the third quarter of the previous year. For the year-to-date total car and truck builds are running 22% ahead of the same period in 2011. Our forecast calls for an annual gain of 20% in motor vehicle assemblies in 2012 followed by a 10% rise in 2013.

As the chart shows, the U.S. auto industry has enjoyed several consecutive years of robust growth, but there is still a large amount of pent-up demand in the market. Household income levels have risen very slowly—if at all—during the past four years, and at the same time access to credit has been tight. So the average age of a car in the U.S. is about 10 years. Income levels (along with the employment figures) are slowly rising, and access to credit is gradually getting easier. These improving fundamentals will spur demand for new vehicles for the foreseeable future. The auto industry will also benefit from the long-term trend toward vehicles that are more energy-efficient.

A factor that will amplify the demand for motor vehicles in the short term is the recovery effort in the Northeast that is the result of Hurricane Sandy. A large number of motor vehicles were destroyed during the hurricane, and a large number of additional construction and delivery vehicles will be required in order for these areas to get cleaned up and rebuilt. The effects of Sandy are already showing up as significant increases in the monthly data on vehicle sales.

Related Content

Editorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

Read MoreMMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreMold Builder Uses Counter-Intuitive Approach for Mold Challenges

Matrix Tool Inc. answers customers’ hard questions with creative solutions for cavity spacing, tool sizing, runner layout and melt delivery that reveal the benefits of running in a smaller press size at lower cavitation but higher yield.

Read MoreLeading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MoreRead Next

Aerospace & Packaging

Production of Aerospace Products and Parts is Accelerating; Plastics Packaging Demand Will Exceed Growth in the Overall Economy

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;maxWidth=300;quality=90)