Wipfli LLP

7733 Forsyth Blvd.

Suite 1200

St. Louis, MO 63105 US

314-480-1223

mike.devereux@wipfli.com

wipfli.com/manufacturing

IS THIS YOUR COMPANY?

As Seen On MoldMaking Technology

Wipfli LLP Supplies the Following Products

- Consulting Services

- Data Management Services

Editorial, News, and Products

-

Harbour Results, Wipfli Complete Collective Transaction

Collaborative union will provide access to expanded services and a broader suite of advisory and integrated solutions in the manufacturing sphere.

-

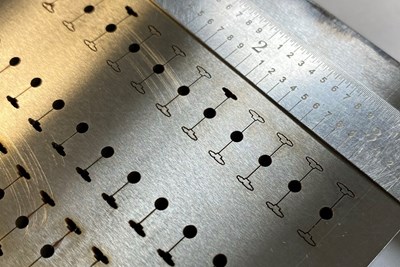

How to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

-

Up Close and Personal With Precision Molds and Molding

MoldMaking Technology's Christina Fuges and Tony Deligio with Plastics Technology were onsite together at the Dynamic Group in Ramsey, Minnesota, to see how its moldmaking and molding capabilities come together to grow the business as part of an AMBA Facility Tour.

-

Harbour Results, AutoForecast Solutions Release Battery-Electric Vehicle Market Study

The study analyzes the transition from an industry dominated by the internal combustion engine to battery-electric mobility and its impact on the supply chain, which will have ripple effects from automakers to tool and die shops.

-

New Michigan Technical Center for YCM Alliance

YCM Alliance held a grand opening of its new Technical Center in Sterling Heights, Michigan, last week, which is the first in a series of centers designed to showcase and demo machining solutions for die and mold machining, ultra-high-speed machining and general parts machining.

-

Manufacturing Industry Optimistic Despite Market Challenges According to Study

This study conducted by Harbour Results Inc. in February 2023 collected feedback from approximately 320 manufacturing facilities.

-

Lisa Lehman Joins Harbour Results Inc. as Business Development Manager

Lehman will align current, prospective clients with HRI’s market intelligence and consultative services.

-

What Electric Vehicles Mean to Mold Builders

Harbour Results CEO Laurie Harbour on why EVs make the situation at mold and tool shops more challenging.

-

North American Tooling Spend Forecasted to Reach $8.3 Billion in 2025

Recent automaker profits are funding an increased number of new vehicle launches over the next few years, according to Harbour Results’ latest in-depth study, which in turn is expected to drive up tooling spend growth.

-

MGS Mfg. Group's Paul Manley Recognized as Wisconsin Titan 100 Recipient

The 2023 Wisconsin Titan 100 honor MGS Mfg president and CEO as a leader shaping the future of the Wisconsin business community.

-

30 Under 30 Honors Program: Mentoring in the Next-Generation of Moldmaking Professionals

Young professionals are vital to the moldmaking industry, and it is important to acknowledge those making strides in shaping the industry's future. MoldMaking Technology recognizes the industry's young talent through its 30 Under 30 Honors Program.

-

Harbour Reports Tooling Industry Growth Despite Challenges

The Q1 2022 Harbour IQ Manufacturing Pulse Study indicates that the tooling industry rebounded in 2021, with companies seeing year-over-year revenue growth.

-

Year-End Tax and Cash-Flow Planning

Three proactive tax planning strategies to impact cash flow and income tax liabilities.

-

Harbour Results Expands Team with Manufacturing, Plastics Expert

Plastics industry veteran Gene Mussel will support additional strategic and operational consulting business for the consulting firm.

-

Understanding the Implications of Tax Filing Extensions and COVID-19

These tax tips will help mold builders take advantage of filing extensions and increased benefits from tax law updates.

-

30 Under 30 Class of 2021: Design/Engineering/Program Management

MoldMaking Technology covers the next-generation moldmakers recognized under the 30 Under 30 Honors Program that engineering, design or program managers at their company.

-

MMT Chats: 30 Under 30 Honoree, Passionate about Connecting Data and Trends to Moldmaking

MoldMaking Technology Editorial Director Christina Fuges invites Harbour Results Engagement Manager Cara Walton a guest on this MMT Chat. She shares her journey to the research side of moldmaking, and her motivation to share data and trends to help mold builders solve problems. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

-

30 Under 30 Class of 2021: Women Impacting Mold Manufacturing

MoldMaking Technology celebrates the next generation of women making an impact in mold manufacturing with its 30 Under 30 Honors Program.

-

30 Under 30 Class of 2021: Midwestern Moldmaking Talent

MoldMaking Technology celebrates the next generation of young professionals based in the Midwest that are making an impact in mold manufacturing.

-

Fraud Risk Management Strategies for Mold Shops

Mold builders must understand fraud so they can reduce the risk and improve profitability and efficiency.

-

Evaluating the Impact of Changes in Tax Rules and Accounting Methods

A look at regulations the Treasury Department released that are impacting mold builders.

-

Tax Relief to Help Manage the Impact of COVID-19

U.S. Congress and Treasury have provided relief to mold shops since the beginning of the coronavirus via accelerated deductions, new tax credits, guidance around these benefits and extensions on the time to file and pay taxes.

-

Tax Reform for Mold Builders: 30 Months After Enactment

A review of the impact the Tax Cuts and Jobs Act of 2017 has had on mold builders over the past two years.

-

Harbour Results Announces Results From COVID-19 Study

Harbour Results, Inc., conducted a study to better understand how the COVID-19 pandemic is impacting small- to medium-sized manufacturers, both production and tooling.

-

MMT Chats: MoldMaking Technology and Harbour Results Connect on COVID-19 and the Importance of Leadership, Focus

MoldMaking Technology Editorial Director Christina Fuges chats with Laurie Harbour of Harbour Results about the current state of moldmaking amid COVID-19 and what mold builders should be doing today in their businesses to ensure growth in the aftermath.

-

Readjusting to the New Normal of Automotive Tooling

“Control what you can control,” Laurie Harbour of Harbour Results says because on top of our current economic uncertainty, government volatility, tariffs and trade there also is a shift happening in the automotive industry that demands flexibility from today’s mold builders.

-

How to Start Planning Your Business Exit

Now is the time to start the planning process for exiting your business whether you plan to exit within the next year or 10 years from now.

-

Cost Segregation Study: A Lucrative Tax Strategy

A cost segregation study will maximize a mold shop’s depreciation benefits, decreasing current tax liability, improving cash flow and increasing after-tax profits.

-

Do a Technology Risk Assessment to Protect Your Shop

The road to protecting your shop’s information starts with a technology risk assessment that identifies areas to protect and areas to consider public knowledge.

-

PODCAST: Interview with Our Tax Guy, Mike Devereux

MMT Editorial Director Christina Fuges sat down with The Manufacturing Alliance Podcast for a lively conversation with Mike Devereux of Mueller Prost who brings tax knowledge and expertise to the brand’s monthly The Bottom Line column.

-

Understanding the New Flow Through Deduction

The qualified business income deduction of the Tax Cuts and Jobs Act gives mold shops a 20-percent deduction of qualified business income to all non-corporate taxpayers, but it comes with some qualifications, restrictions, and limitations.

-

New Tax Rules for Employee Parking Expenses

The qualified transportation fringe with the greatest impact on mold builders is qualified parking provided to their employees at no cost.

-

Tax Reform: Changing the Rules of Business Losses

The Tax Cuts and Jobs Act has changed the way many mold builders account for their business losses. The new rules impact the tax treatment for business losses regardless of a company’s structure.

-

Understanding Business-Meal Deductions

Mold builders must account for meals and entertainment separately, as no deduction is allowed for entertainment in 2018 and beyond.

-

How to Reduce a Mold Shop’s Top Effective Tax Rate

U.S. Treasury and the IRS proposed rules on new flow-through deductions.

-

The Impact of Tax Reform on Bonus Depreciation

Tax reform made the following changes to the bonus depreciation rules: a new 100-percent bonus depreciation percentage, an expanded definition of eligible property to include used depreciable property, and an extended placed-in-service phase-out date from before January 1, 2020, to before January 1, 2027.

-

Tax Reform Limits and Eliminates Popular Deductions

The Tax Cuts and Jobs Act of 2017 made several changes to the manner in which mold shop determine taxable income.

-

The Impact of Tax Reform on Capital Expenditures

The Tax Cuts and Jobs Act includes a provision for how mold builders should account for capital expenditures.

-

How Tax Reform Impacts the Accounting Methods of Mold Shops

The Tax Cuts and Jobs Act of 2017 code may broaden the accounting methods available to mold builders with average annual gross receipts of less than $25 million for the prior three tax years.

-

Tax Reform Impact on Research Incentives

Tax reform changes the benefits of the R&D tax credit and the alternative minimum tax.

-

The Bottom Line: Taxation of Mold Builders: 1998 vs. 2018

Tax laws are much more favorable for mold shops today than they were 20 years ago.

-

The Bottom Line: The Impact of Tax Reform on Moldmaking

The Tax Cuts and Jobs Act of 2017 should decrease a moldmaker’s overall tax liabilities.

-

Bottom Line: Personal Goodwill Indicates the Value of a Mold Shop for Sale

Carefully evaluating corporate and personal assets uncovers opportunities for significant tax savings when selling a mold business.

-

The Bottom Line: Identifying the Value Drivers for a Mold Shop

Paying attention to the basic value drivers that promote sustainable growth helps mold shops build value in their businesses.

-

The Bottom Line: Income Tax Nexus: Are You Protected?

Companies engaging in certain activities across state lines create a tax nexus, meaning that the company must pay income taxes in those states.

-

The Bottom Line: Increase Your Retirement Investments Value

Strategies to increase your Roth 401(k) for retirement.

-

The Bottom Line: An R&D Tax Credit Update

This credit seems to be the most significant way a mold builder can reduce its income tax liabilities.

-

The Bottom Line: New IRS Audit Strategy

This strategy focuses on 13 issues that the agency believes will generate the most tax revenue. Here are the three most relevant ones to mold builders.

-

Stake Your Claim with R&D Tax Credits

It’s tax time. Are you getting all you can from the R&D Tax Credit for your business?

-

The Bottom Line: Changes to Revenue Recognition Requirements

Once effective, the ASC 606 standard will replace about 180 pieces of industry and transaction-specific rules under U.S. Generally Accepted Accounting Principles.

-

The Bottom Line: Hiring Tax Incentives

The Work Opportunity Tax Credit (WOTC) is a voluntary employment tax incentive program sponsored by the federal government since 1978.

-

The Bottom Line: Correcting Errors on Income Tax Returns

Any company can make mistakes when filling out a tax return, but sometimes those mistakes can work in your favor.

-

The Bottom Line: Deducting Meals and Entertainment Expenditures

Is your shop in compliance?

-

The Bottom Line: Hire a Veteran!

The Work Opportunity Tax Credit provides an incentives for hiring former members of the armed services.

-

The Bottom Line: Weathering the State Tax Nexus Storm

Under this concept, a company has sufficient physical presence in a state for that state to subject that company to taxes.

-

The Bottom Line: A Method to the Tax Madness

Every shop must adopt a method of accounting for activities within its business, and cash and accrual methods are two commonly used ones.

-

The Bottom Line: Tax Extenders Package

The Protecting Americans from Tax Hikes Act of 2015 retroactively extended many important tax provisions and modified others.

-

New Property Regulations - Capitalization vs. Expense

Federal and state income tax compliance can be a burden for mold builders. The tax code and related guidance changes daily, creating both opportunities and exposure. This series aims to provide industry-specific guidance to help mold builders minimize these burdens within the letter of the law.

-

New Regulatory Impacts

New guidelines from the U.S. Treasury may affect when moldmakers can claim the R&D tax credit.

-

Tax Benefits from Manufacturing in the U.S.

The IRS has issued recent guidance related to the domestic production activities deduction (DPAD) that may be particularly favorable to moldmakers.