The Bottom Line: New IRS Audit Strategy

This strategy focuses on 13 issues that the agency believes will generate the most tax revenue. Here are the three most relevant ones to mold builders.

The IRS Large Business and International Division (LB&I) has announced a new audit strategy focused on 13 issues, from foreign company reporting requirements to shareholder stock basis in S corporations, which it believes will generate the most tax revenue using the remaining agency resources from the Congressional budget cuts. The LB&I works with companies that have greater than $10 million in total assets.

Most, if not all, mold builders will not be affected by all 13, but here are the three most relevant issues:

Related-party transactions. Generally, transactions between related parties must be executed at arm’s length under the rules of the Internal Revenue Code. An arm’s-length transaction is a transaction in which the buyer and seller of a product or service act independently and have no relationship with one another. The concept is in place to ensure both parties are acting in their own self-interest and not to determine the transfer price to manipulate earnings between related companies.

This new initiative identifies transactions between related parties that provide companies a means to transfer funds from a corporation to related pass-through entities (S corporations, partnerships and limited liability companies). For example, if the owner of a mold shop forms a separate entity to purchase real estate and a building, then rents the building to another mold builder, was the rent determined at the fair market value? If it was not determined at arm’s length, the IRS may adjust the amount of rent charged to the mold builder.

The IRS has dedicated resources to this issue to determine the level of compliance in related-party transactions of companies in the mid-market segment. Therefore, mold builders that own or operate multiple entities should take careful consideration in determining the transaction amount related to transactions between the related parties.

S corporation losses claimed in excess of basis. Shareholders (owners) of S corporations must have sufficient basis in order to be able to deduct their proportionate share of ordinary losses incurred by the S corporation. Shareholders may have both stock basis (the basis of the shareholder’s company stock) and debt basis (amounts loaned to the S corporation directly by the shareholder). With limited exceptions, stock basis is equal to the amount that the shareholder paid for the stock in the S corporation, increased by items of income and gain, and reduced by items of loss.

This means that a shareholder may deduct his pro rata share of an S corporation’s losses only to the extent of the total adjusted basis in the S corporation stock. The adjusted stock basis is determined by taking into account the increases and decreases in basis for his share of the S corporation income for the year and its adjusted basis in any indebtedness of the S corporation to the shareholder. For example, loans made from shareholders directly to the S corporation.

LB&I has found that shareholders may claim losses and deductions to which they are not entitled because they do not have sufficient stock or debt basis to absorb these losses. The IRS is arming its revenue agents with technical content to aid in their examination of company losses in excess of the shareholder’s basis.

The IRS will be conducting issue-based examinations (IRS audits that focus on just one issue) to ensure companies are properly limiting their S corporation losses to the shareholder’s stock and debt basis is the S corporation. In addition, the IRS intends on creating a new form to assist shareholders in properly computing their basis.

Micro-captive insurance arrangements. The IRS recently added micro-captive insurance company arrangements to the transactions of interest list, requiring those that participate in micro-captives to file appropriate disclosures via the reportable transaction/tax shelter disclosure forms. Years ago, the IRS began to require companies to report their involvement with tax shelters and other transactions that had the potential for tax avoidance (transactions of interest).

In a micro-captive transaction, a company directly or indirectly owns an interest in an operating entity. In addition, the company or persons related to the company own an entity that has elected to be treated as a small captive insurance company (“captive”) under IRC §831(b). Generally, a captive insurance company is an insurance company formed for the sole purpose of insuring the risks of related companies. Captives that have premium revenue of less than $2.2 million may elect to be taxed only on taxable investment income. That is, the captive does not pay income tax on its non-life insurance premium revenue. In this arrangement, the operating company claims a deduction for insurance premiums paid. The captive excludes the premium income from its taxable income.

In order for the transaction to qualify as insurance and allow for a deduction for insurance expenditures, the insurance company must act like an insurance company. That is, the insurance company must actuarily determine premiums at arm’s length, share risk among multiple customers and shift risk from the insured (the operating company) to the insurance company.

However, if the transaction does not meet the insurance company requirements, the operating company is not entitled to deduct the amount of the insurance premium payment. In addition, if the captive does not qualify as an insurance company, the captive must be treated as a domestic insurance company, subject to tax at the regular corporate tax rates.

While the IRS has recognized that related parties may use captive insurance companies for risk management purposes that do not involve tax avoidance, it believes companies are using such arrangements to claim the tax benefits of captives in a related party transaction. That is, the IRS believes that many captives, along with their related party counterparts, are not shifting and sharing risk. So, the IRS will be conducting issue-based examinations to ensure that captives and their related parties are engaging in transactions for permitted business purposes and not using the captive arrangements as a means of avoiding income or estate tax.

With the IRS’ new focus on these issue-based campaigns, mold builders should ensure they are in compliance with the Internal Revenue Code. Moldmakers receiving letters from the IRS or notice of examinations related to these issues should work with their CPAs and attorneys to ensure they are treating these items properly.

Mueller Prost

Related Content

Editorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

Read MoreMMT Chats: 4 Keys to a Successful Mold-Building Operation: Innovation, Transparency, Accessibility and Relationship

MoldMaking Technology Editorial Director Christina Fuges chats with Steve Michon, co-owner of Zero Tolerance in Clinton Township, Michigan, about the excitement of solving problems, the benefits of showing gratitude, the real struggle with delegation and the importance of staying on top of technology. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MoreTackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

Read MoreHow to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

Read MoreRead Next

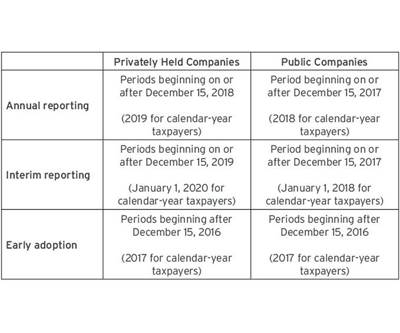

The Bottom Line: Changes to Revenue Recognition Requirements

Once effective, the ASC 606 standard will replace about 180 pieces of industry and transaction-specific rules under U.S. Generally Accepted Accounting Principles.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More