How to Start Planning Your Business Exit

Now is the time to start the planning process for exiting your business whether you plan to exit within the next year or 10 years from now.

The exiting planning process is a challenge for many mold shop owners because they love what they do, and it is very hard to imagine not coming into the shop every day. Developing your succession plan will force this very uncomfortable thought process, which may change how, why and when you plan to exit the company. Here are some factors to consider when developing or refining your succession plan.

Determining and Maximizing Value

What is your mold shop worth? The value you perceive may not be the same as a potential buyer or next-generation owner, so understanding the value of the company and the drivers of value are key to maximizing your benefit upon exit.

First, benchmark your shop against others in the industry. The benchmarks should look at financial and operational metrics. These operational metrics are what drive the financial results and many times, are the leading indicators to determine your shop’s value. Second, work with a business valuator to determine the value drivers of your shop, as the current or historic value is not sufficient. This exercise will help you understand why your shop is worth a certain amount. The why will help you determine where you should focus your efforts to increase that value.

Work with a business valuator to determine the value drivers of your shop, as the current or historic value is not sufficient. This exercise will help you understand why your shop is worth a certain amount. The why will help you determine where you should focus your efforts to increase that value.

Blocking and Tackling

Ensuring that your books and accounting records are clean is important. What type of internal controls do you have in place concerning cash or accounts payable? How quickly do you “close the books” each month? Is your ERP capable of providing information you need to run and improve your business? Do you have proper oversight concerning your shop’s assets?

Having internal controls in place (and well documented) will help you run the day-to-day operations of your shop and lend to credibility and confidence to your reporting, which you’ll need to make decisions impacting the growth and profitability of your business.

External or Internal Succession

Evaluate the type of transfer that may take place when you exit your shop. The transfer could be internal, such as family members or key employees set to take the reins of your shop once your exit begins. Or, you may sell the company to an unrelated third party. Both types of transfers come with their challenges, and you will likely position your company differently once you determine which route is best for you.

If the goal is to transfer your business to family members, you will need to evaluate several considerations. Is the family member capable of running the shop at the same level that you have? Does the family member have the wherewithal to purchase the company, or will there be a gifting aspect to the transaction? Will the estate tax have an impact on the transfer of your business to the next generation if not transferred at fair market value? Can you use trusts (such as an intentionally defect grantor trust) or other planning techniques to transfer current or future value of your shop tax efficiently?

You may encounter some of the same issues if transferring the business to key employees. Do they have the means of purchasing the company? Are they capable of running the business? Do they want to take on the risk of being a business owner? While you may think of these key employees as family, the thought process is different in transferring the company to a key employee vs. transferring to a son or daughter.

Sometimes it makes sense to re-capitalize your business into voting and non-voting shares. This allows you to begin transfering some of the company to family members or key employees without you giving up control.

If the goal is to transfer your shop to a third party, you may want to consider preparing formal documentation that will assist in conveying the value of your shop. This may include preparing a confidential information memorandum, quality of earnings analysis in advance of due diligence and documentation of your intangibles (customer relationships, workforce, proprietary techniques or processes, etc.).

External Transfers

Unlike internal transfers, external transfers have their own set of factors to evaluate. Is the buyer strategic, geographic or financial? This will impact the multiple you could receive for your shop. Does the buyer want all or only some of your business? You may want to change the structure of your company if you plan to keep some of the operations.

Does the buyer want to buy stock or the assets of the business? Sellers, typically, would prefer to sell their stock, as the gain would be taxed at capital gains tax rates. However, buyers would prefer to purchase assets so that they may depreciate and amortize the value of the company over time for income tax purposes.

The changes to bonus depreciation brought about by tax reform further encourage asset deals since used equipment may now qualify for bonus depreciation, as long as the shop purchases the asset from an unrelated party.

Begin now before you lose your passion. Understand and document your goals. These may range from establishing a legacy to being charitable, providing security for you or your heirs. Once you’ve outlined your goals, start to build your succession plan and be relentless at keeping it up to date.

Also, external buyers may require that you have your financial statements audited. However, if you don’t know whether a future buyer will require an audit and your bank only requires that you have reviewed financial statements, ask your CPA to observe your inventory count at year-end so that they may go back and audit the financial statements should a future buyer require this step.

You may also want to have your income tax returns reviewed for areas of opportunity or exposure. For example, missed tax incentives, such as the R&D tax credit or missed tax deductions. You want to be sure you’ve exhausted all appropriate areas of the tax code to ensure you haven’t paid too much in income taxes. Looking for areas of exposure may also make the deal flow smother. For example, you don’t want to get into due diligence with a buyer only to find out that you should have filed tax returns in six other states in which your shop was doing business.

Begin now before you lose your passion. Understand and document your goals. These may range from establishing a legacy to being charitable, providing security for you or your heirs. Once you’ve outlined your goals, start to build your succession plan and be relentless at keeping it up to date.

About the Contributor

Michael J. Devereux II, CPA, CMP, is a partner and director of manufacturing, distribution and plastics industry services.

Mueller Prost

314-862-2070

tgrace@muellerprost.com

mdevereux@muellerprost.com

muellerprost.com

Related Content

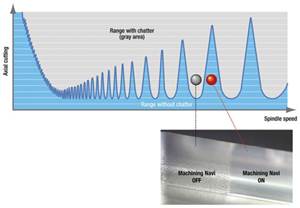

How to Eliminate Chatter

Here are techniques commonly used to combat chatter and guidelines to establish a foundation for optimizing the moldmaking process.

Read MoreMaintaining a Wire EDM Machine

To achieve the ultimate capability and level of productivity from your wire EDM on a consistent, repeatable and reliable basis, regular maintenance is a required task.

Read MoreHow to Correctly Size a Hydraulic Cylinder

This week Randy shares steps for correctly sizing a hydraulic cylinder on a mold.

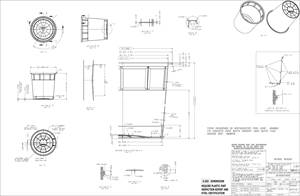

Read MoreIt Starts With the Part: A Plastic Part Checklist Ensures Good Mold Design

All successful mold build projects start with examining the part to be molded to ensure it is moldable and will meet the customers' production objectives.

Read MoreRead Next

Do a Technology Risk Assessment to Protect Your Shop

The road to protecting your shop’s information starts with a technology risk assessment that identifies areas to protect and areas to consider public knowledge.

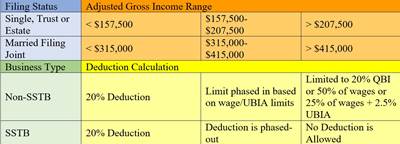

Read MoreUnderstanding the New Flow Through Deduction

The qualified business income deduction of the Tax Cuts and Jobs Act gives mold shops a 20-percent deduction of qualified business income to all non-corporate taxpayers, but it comes with some qualifications, restrictions, and limitations.

Read MoreTax Reform Impact on Inventory Deductions

The changes made to Internal Revenue Code (IRC) §471 Rules for Inventory of the Tax Cuts and Jobs Act (“Act”) present some tax-savings opportunities for “small” mold shops with regards to work in process (WIP) and finished goods.

Read More.jpg;maxWidth=970;quality=90)

.jpg;maxWidth=300;quality=90)