Manage

The Bottom Line: New Rules for S Corporations Offer Flexibility with Profit Taxes

The Protecting Americans from Tax Hikes Act (PATH Act) permanently shortened the S Corporation “built-in gain holding period,” making it more attractive for corporations to elect status as an S Corporation and the treatment that such a status incurs. This gives mold shops more flexibility as to how they are taxed on their profits and the eventual sale or transition of their businesses.

Read MoreMexico: Manufacturing Mecca to the South

A mold-building perspective on Mexico’s manufacturing opportunities, trends and challenges.

WatchMaking Molds in Mexico

Making molds in Mexico is a significant part of what Integrity Tool and Mold is focused on, and this video is perfect for illustrating how some companies are making molds in the Southern-most region of North America.

WatchBeing Proactive about Hot Runner Maintenance

Successfully selecting, integrating and maintaining hot runner systems demands proactive involvement from original equipment manufacturers, molders and mold builders.

Read MoreTechnology Tuesday: Equipment of the Leadtime Leaders

Cruise through this slideshow to see what technology Leadtime Leaders use to make significant contributions to their fields.

Read MoreTechnology Showcase: On Display at EMO 2017

EMO is a large, international metalworking tradeshow with thousands of exhibitors. Check out the slideshow to see what will be on display!

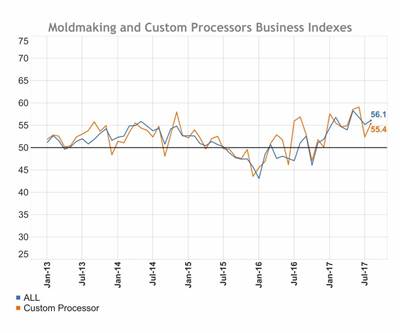

Read MoreGBI: MoldMaking for July 2017—55.2

The Gardner Business Intelligence Moldmaking Index is up 16 percent from one year ago.

Read MoreExtra Large Wire EDM Capacity Places Shop on Path for Growth

The constant need for larger, more efficient machining capability pushed Extreme Wire EDM Services to approach GF Machining for a larger wire EDM solution.

Read MoreThe True Cost of Cobots

Defining expectations and determining the ROI of collaborative robots help guide sound investment choices.

Read More