Mexico: Manufacturing Mecca to the South

A mold-building perspective on Mexico’s manufacturing opportunities, trends and challenges.

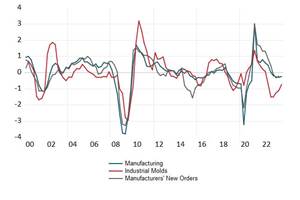

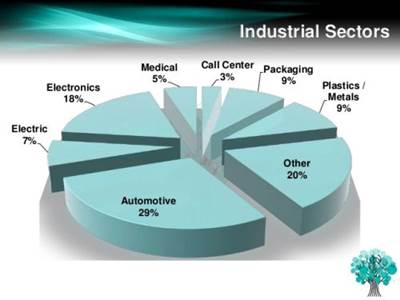

Manufacturing in Mexico is growing, particularly for automotive manufacturers, but also for aerospace, medical device and electronics original equipment manufacturers (OEMs) who are seeking near-shore access to supply-chain resources, lower production costs and favorable trade relations. We wanted to find out how some North American moldmakers are taking advantage of this growing opportunity.

U.S. Moldmakers Supply Mainly Across Border

While we at MoldMaking Technology acknowledge that we are not familiar with every U.S. mold shop, our concerted efforts to locate mold manufacturing companies that are based in the United States and that have additional moldmaking operations in Mexico yielded none. Additional inquiries with shops building molds for customers in Mexico indicated that because of Mexico’s direct proximity to the South, there does not seem to be a need among U.S. moldmakers to have mold manufacturing facilities in Mexico today.

Fairway Injection Molds (Walnut, California) supplies molds to Mexico customers that produce medical, cosmetics, caps and closures and personal care products. Some are relatively simple, four-cavity molds and some are larger, more complex unwinding stack molds with in-mold closing. Dave Cockrell, vice president and general manager, says that Fairway has shipped many two- and three-shot, high-cavitation molds to Mexico as well. “Fairway has long supported our U.S.-based customers that have operations in Mexico, but other opportunities have opened up over the years through networking, and because our existing key contacts relocated to new companies,” he says. “Roughly 35 percent of our shipped work orders end up in Mexico to mold products for local consumption and for export to global markets.”

It’s important to do business with established, successful, global companies that are well organized and staffed.

Fairway Injection Molds provides all sales and support services for the molds it exports to Mexico from its Walnut facility. The company has sales people, moldmakers and mold processing technicians who are fluent in Spanish, which has proven to be very helpful.

Cockrell says there have been a few challenges. “We had to overcome the language barrier, which we have been proactive in solving by adding Spanish-speaking team members, but worker training is still an issue. For example, we had a couple of our moldmakers in a customer facility for mold start-up and training. They observed toolroom workers who potentially were causing damage to mold inserts during a mold PM. Apprentice moldmakers learn to use soft hammers and not steel hammers, to use brass or aluminum drifts instead of steel, to not wipe polished molding surfaces with dirty rags, etc. Our moldmakers discovered that their toolroom staff consisted of temporary workers who were rotated out after six months. Our moldmakers spent a little extra time showing their workers proper techniques, and we shared our concerns with company management. The company management eventually trained and retained full-time workers, but I’m sure they have the same struggles in Mexico to find qualified people that we have in the United States.”

Similarly, Ameritech Die and Mold (Mooresville, North Carolina) has been building molds for production in Mexico since agreeing to supply a Tier 1 automotive customer that opened a plant there in 2005. Steve Rotman, president, says his company has shipped as much as 20 percent of its U.S.-built molds over the border, and all of them are for producing automotive parts that will be used locally and globally. Mold maintenance and repair occurs either at the Mexico customer’s facility or with a nearby vendor, and usually Ameritech can ship spare parts if damage is severe.

As with Fairway Injection Molds, the language barrier initially challenged Ameritech’s ability to do business in Mexico, but Rotman says that has improved greatly in recent years. International business inspired many locals to learn English, plus English-speaking transplants are becoming more commonplace. Current challenges exist mainly with vetting customers and managing shipping and logistics. “We typically quote free on board (FOB) Mooresville, meaning all shipping costs are the responsibility of the customer from our dock forward,” he says. There are freight-forwarding firms on the border with which a company could establish a contract to ensure safe and on-time delivery of molds once they are built, but Ameritech has not had any reason to set up a relationship like that. “Our customers already have their own methodologies and contacts with whom they ship.”

Rotman says he believes that with the right business model, there are strong opportunities for moldmakers to do business in Mexico. “It’s important to do business with established, successful, global companies that are well organized and staffed,” he says, noting that these types of companies typically follow the general business model that U.S. companies recognize and therefore are easier to vet. “We have had great relationships with the Mexican management teams we have worked with,” Rotman says.

Canadian Moldmakers Establish a Presence in Mexico

It was easier to locate Canadian mold shops that have mold manufacturing facilities in Mexico. For example, Integrity Tool & Mold Inc. (Windsor, Ontario) established its first facility in Queretaro in October 2012 to provide engineering changes, repairs and maintenance for molds that its Ontario, Canada, and Pulaski, Tennessee, plants made for use in Mexico. Wayne McLaughlin, plant manager in Mexico, says, “We started building new molds here in 2013 and today, 70 percent of our revenue in Mexico is generated from new molds. The value for our customers comes from knowing that the molds we build here will be supported here.”

Integrity specializes in building molds mainly for automotive products, including lighting, under-hood, interior trim and exterior parts. McLaughlin says that 99 percent of the molds built in Mexico are for Tier 1 automotive customers like Flex N Gate, Magna, Valeo, ABC Group, Hella, Faurecia and others. “We recognized the automotive growth potential for Mexico,” he says. “GM, Ford, FCA, Audi, Mercedes, BMW and other automakers we work with are comfortable having access to our capabilities in Mexico.” But it wasn’t a matter of simply erecting a building and buying a few CNC machines, he says. “They were okay with us providing local support for the molds that we built and sent to Mexico, but it was a different situation when it came to us designing and building new molds here. We had to prove to them, with world-class quality and on-time delivery, that we could meet their needs like we do in Canada and the United States. Once we did, our percentage of new builds in Mexico increased 70 percent.”

Integrity’s first facility in Mexico had 20,000 square feet, and it was expanded to 40,000 square feet in 2015. The company is ramping up a second facility located just down the road because the first facility, which has 125 employees, is at capacity. “The second plant gives us an additional 118,000 square feet, which is triple the size of the first plant,” McLaughlin says. “We did this because our goal is to add more mold manufacturing capacity, full mold validation and tryout services.” Integrity already has several injection-molding presses, including Haitian 320-ton and 1200-ton machines and Krauss-Maffei Corporation 550-ton, 2300-ton 1K, and 2300T 4K machines. All equipped with six-axis robots.

McLaughlin asserts that while there are cost savings, Mexico is not a low-cost country, despite what many may think. “North America doesn’t stop at the U.S. Southern border. Skilled labor in Mexico—it’s somewhat comparable to the rest of North America. Our guys are CNC operators, EDM operators and mold designers, so they’re skilled employees.” Integrity has an in-house training program to build a skilled workforce. Some trainees go to Canada for instruction, and Canadian instructors also travel to Mexico. Additionally, Integrity is a founding member of the AMMMT (a new, Mexico-based moldmaking association), which is working with local schools to develop more specific curricula for moldmaking. “At the end of the day, it’s more the convenience of having no time delay at the border or shipping costs, plus local support from a growing supply base,” he says, adding that a lot has changed over the last five years. Word is getting around that Mexico is a growing market and several supplier companies have established facilities in Queretaro, including Finkl & Sons Co, A., Bohler-Uddeholm Corporation, Ellwood Specialty Steel, DME/Milacron, Synventive Molding Solutions, HRSflow and Mold-Masters / Milacron, Tenibac and Mold-Tech. “Those are key indicators,” McLaughlin says. “When companies of their caliber are investing in new locations, they’re looking into the same crystal ball as we are, envisioning the future. They’re not doing it just because there’s a little blip in market predictions for Mexico. They’re thinking long-term and so are we.”

While a few Canadian shops are manufacturing molds in Mexico, others are shipping molds across the border. StackTeck Systems Limited (Brampton, Ontario) does not have an additional moldmaking facility in Mexico, choosing instead to build all its molds in Canada and export about 95 percent of them to customers all over the world. The company maintains a regional office in Guadalajara, Mexico. At that office, a team of representatives provides sales and support services to customers primarily in the packaging industry. Support services include on-site meetings, frequent visits, attendance at mold start-ups, assistance in problem solving, quote preparations, maintenance guidance and so on. Christopher Day, who has a Bachelor of Science in Engineering, is one of these representatives. He is the one who first established the office in 2000 after having worked at the company’s Canadian plant for about three years. “It was a good time to make the move, because there started to be an influx of foreign companies establishing operations in Mexico in addition to the European and Asian competitors, who were knocking at our customers’ doors. By opening our Mexico office, we strengthened relationships with many existing customers who are there.”

North America doesn’t stop at the U.S. Southern border.

Day says that Mexico has seen a lot of growth in recent years, mainly because of the huge influx of automotive sector business, which brought more competition from mold shops from around the world. It also brought molding shops, standard component suppliers and machine tool suppliers. “In our region, the industry is in constant growth mode. I find that Mexico is a very active market in the plastics industry, as I have seen it grow over the last 10–15 years. I now see state-of-the-art molding facilities complying with ISO industry standards, using SAP systems (manufacturing and supply chain management software), establishing quality control departments, and more. There are sophisticated tooling technology systems at many injection plants today, including four-level and automated in-mold labelling molds (some of which StackTeck builds), multi-material applications, clean room servo motor molds and more that were not as widespread in the past.”

“Mexico was the first place in the world where StackTeck established a local regional office with an exclusive StackTeck representative outside of Canada. We have experienced continued growth in demand from customers there,” says Jordan Robertson, general manager of business development.

Asked about challenges related to cultural differences, Robertson says Day was the right person to establish a presence for StackTeck in Mexico. He worked at StackTeck Canada and knew the company’s products and capabilities, plus he was born there and could naturally work side by side with customers. “I think because of that, we were more fortunate than a lot of other companies when it comes to opening a new office in another country.” He adds that the company works very hard to avoid cultural or language barriers and currently has 10 people on staff who speak Spanish fluently, including product managers, sales managers, finance personnel, a marketing and sales coordinator and an estimator. The website is available in both languages as well. StackTeck has been very active at trade shows in Mexico for 13 years, particularly at Plastimagen in Mexico City. Day says it has been interesting to see how that show has grown, not only in participation from Mexican companies, but from Latin American companies and companies from other countries, too.

Mexican Moldmakers Share Same Challenges, Opportunities

Antonio Mendoza, president of the mold manufacturing company Moldes Mendoza (Zapopan, Jalisco, Mexico) came into the trade in the same way that many of his fellow North American moldmakers did. “My father worked in the United States as a machinist in the aerospace industry for more than 40 years. In 1972, he came back to Mexico and opened his own tool shop. It was not for moldmaking until a customer came to ask him if he could build a mold for plastic injection. My father told the customer that if he could draw the mold, then he could make it. That’s how it started,” he says. “My father started making everything from mold bases to leader pins and bushings, ejector pins and so on, because no ready-made components were available in Mexico at that time.” Mendoza says that his father’s company was small but became very successful because of his father’s skills in manufacturing complex and close-tolerance parts. Additionally, the shop was successful because there were very few moldmaking companies in Mexico. Antonio decided to work with his father, and today the company has 65 employees working in a 21,500-square-foot facility.

Moldes Mendoza builds molds for the automotive, medical, closures, food container and dispensing industries. Mendoza says that his company has grown, on average, about 10 percent every year since it first opened. In addition to building new molds, Moldes Mendoza also provides maintenance and repair services.

When asked about the challenges in running a mold manufacturing business, Mendoza’s response sounds like almost every other North American moldmaker’s reply to the same inquiry. “Even with all the automotive manufacturing going on in Mexico, it is slow now. The main reason is because competitors in China and Portugal offer prices that are lower than all of ours.” One bigger and ongoing challenge, though, is finding and retaining skilled workers. “It is very difficult,” he says. “We have to train people from the ground up who have hardly any education. The ones with degrees only want to develop apps or become a movie star.” Mendoza adds that mold manufacturing companies like his are among the highest-paying companies in Mexico. They offer a growth plan for employees, and many who came in off the streets have worked their way up and are now mold designers. Those who do not want to put in the hours and learn leave or are asked to leave.

Big tool shops from the United States, Canada, Portugal and Spain have been interested in installing facilities here to take a piece of the market.

To help train the next generation of Mexican mold builders, Mendoza became an instructor. He also helped establish the Asociación Mexicana para la Manufactura de Moldes y Troqueles (AMMMT), the first national trade organization dedicated to representing moldmaking and die making in Mexico. “We have more than 50 member-companies that are working with the government to get educational institutions to implement programs for metalworking. Our other focus is on technology. We are investing in automation and a more efficient business structure,” he says.

Maquinados Industriales Ayala, SA de CV (Soledad de Graciano Sánchez, San Luis Potosí, Mexico) is a manufacturer of blow molds for industrial and automotive industry customers. Like Moldes Mendoza, Maquinados Industriales Ayala is an AMMMT member. Manuel Ayala Duran founded the family-owned business in 1985. According to Duran’s son, Jorge, the director general, it was the dream of the former university professor to have his own business and to have his sons, Jorge and Manuel, working beside him. Today, Maquinados Industriales Ayala is housed in a 10,000-square-foot facility and has 44 employees. Among them are 16 moldmakers, six engineers, eight apprentices and nine mold technicians.

Jorge Ayala says his company has grown by more than 120 percent over the last five years, and he expects to see similar growth in the coming five years. He says local production and local service is a big advantage for customers, and those moldmakers who have pursued the opportunity to serve customers in Mexico have succeeded in most cases. “The mold industry in this country is needed mainly for mold maintenance and repair and engineering changes, and this is a large focus for our company,” he says, citing that Mexico imports about $2.233 million USD in molds and dies from other countries, while internally less than 10 percent of the molds and dies in production are built in Mexico. “Big tool shops from the United States, Canada, Portugal and Spain have been interested in installing facilities here to take a piece of the market.”

For Ayala, the key to continued success in Mexico is dependent on the implementation of modern technologies like lean manufacturing to provide customers with quality solutions and on-time deliveries. This, he says, is ultimately dependent on the ability to develop and maintain skilled employees via effective training programs. “Our internal training entails a combination of observing and studying new skills followed by practical application. We invest more than 300 hours of shop time on this important task,” he says.

“Growing with modern technologies and retaining talent are big challenges for Mexico, just as they are in the rest of the manufacturing world,” Ayala says. “We, like everyone else, are challenged to implement better, more ambitious training programs because talent is in such high demand by big industries.” He says that currently, the government seems to be interested in supporting training programs through the Ciateq Consorcio, which, together with other related entities, has formed the Consorcio Moldes, Troqueles y Herramientas, or Molds, Dies and Tools Consortium. The consortium provides solutions to market demands, in the way of skills training and business administration programs, in San Luis Potosí and throughout the entire state. “Also, we are working extensively with universities and other educational institutions, directly and through the AMMMT, to provide more effective metalworking programs,” he says.

Related Content

Hammonton Mold, ADOP France Forge Strategic Partnership in Injection Blow Moldmaking

Hammonton Mold Inc., a leading full-service mold shop based in New Jersey specializing in injection blow molds (IBM), proudly announces its official partnership with ADOP France, a prominent IBM mold manufacturer based in Normandy, France.

Read MoreNavigating Economic Resilience and Consumer Trends

Consumer behavior provides mold builders insight into the evolving market dynamics of goods and services that helps strategic planning.

Read MoreDomestic Collaboration Yields Efficiency and Budget Gains For Innovative Tooling Project

Pyramid Molding Group and Lettuce Grow partner to develop optimal tooling for a compact Hydroponic Farmstand.

Read MoreInternational Partnership Improves IBM Preform Precision

Hammonton Mold Co. and ADOP France team up to bring injection blow mold preform design and service to the next level.

Read MoreRead Next

‘Reshoring’ Benefits Mexico, Too

Another molder is betting on Mexico getting its share of the “reshoring” trend from Asia to NAFTA.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read More