The Growing Range of Applications and Technologies in Additive Fabrication

A look at the growing range of applications and technologies in additive fabrication, as well as the challenges that organizations face when trying to understand and make use of this fast-developing technology.

Additive fabrication refers to a group of technologies used for building physical models, prototypes, tooling components and finished production parts—all from 3-D CAD data, medical scans or data from 3-D object-scanning systems. Unlike machining processes, which are subtractive in nature, additive systems join together liquid, powder or sheet materials to form parts. Shapes that may be difficult or impossible to manufacture by other methods can be produced by additive systems. Based on thin, horizontal cross sections taken from a 3-D computer model, they produce plastic, metal, ceramic or composite parts, layer upon layer.

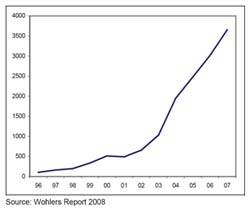

After nearly 20 years of research, development, and use, the industry continues to grow with the addition of new technologies, methods and applications. Additive processes have had a powerful effect on design and manufacturing and this effect will continue to expand in the coming years.

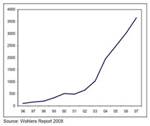

Industry Growth

The industry has remained solid over the past three years, with average annual growth of 23.2% during this period. 3-D printers continue to drive much of the demand for additive systems and materials. A 3-D printer is a low-cost variation of additive fabrication technology that is easier to use, less expensive to operate and office friendly. Strong sales from services have also contributed to growth in the recent past.

By most measures, additive fabrication has developed and evolved impressively and is having a favorable impact on design and manufacturing around the world. In 2006, 35 manufacturers around the world sold additive systems—the same as 2005. In 2004, 34 manufacturers sold systems and in 2003, 28 manufactured and sold systems. Last year, 11 of them sold fewer than 10 systems each, while nine sold more than 50 each. Sixteen companies improved unit sales from 2005 to 2006, compared to 17 the year before.

Years ago, the machine manufacturers felt little competitive pressure to lower prices. This is not true today. Over the past three years, prices have been forced downward, even as capabilities improve. As sales volumes swell, prices will drop further. This trend will continue as companies introduce 3-D printers that are priced under $10,000.

The use of systems for rapid manufacturing (RM) is gaining momentum. Successfully fabricating end-use parts is much more challenging than building parts for modeling and prototyping, so RM will require time to develop. Yet, rapid manufacturing has caught the attention of many and is expected to become the largest application of additive technology in the future.

Industries Benefiting from the Technology

Twenty-nine system manufacturers and 56 service providers responded to a survey for this data. These 85 companies provided information based on knowledge of their customers—an estimated 5,000 to 7,000 total customers. The responses were used to produce the information in the figures.

Of the 29 system manufactures that responded, eight were from the U.S., six from Germany, five from Japan, four from China, three from Sweden, and one each from Canada, Israel and Italy. Of the 56 service providers that participated, 30 were from the U.S., five from Germany, three from India, two each from Australia, Belgium, England, South Africa and Turkey, and one each from Brazil, Canada, Italy, Japan, Malaysia, New Zealand, Sweden and Thailand.

The survey asked each company to indicate which industries they serve and the approximate revenues (as a percentage) that they receive from each. The following chart shows the results. As you can see, consumer products and electronics is the leading sector, similar to the past two years. Motor vehicles, government/military and industrial machinery experienced small increases, while academic institutions, consumer products and electronics and medical/dental experienced small declines (see Figure 1).

“Architectural and GIS” was added this year, which partly accounts for a drop of 5.2 percentage points in the “Other” category. Last year, it was 11.2%. “Other” includes a wide range of niche industries, such as non-consumer sporting goods, commercial marine products and various other industries that do not fit into the named categories.

Market Penetration Worldwide

Figure 2 shows the cumulative systems installed by country from 1988 through the end of 2006. Used system sales have been excluded from the totals so that no machine is counted twice. The manufacturers of additive systems contributed most of the data used to produce this chart.

The percentages for the majority of the countries remained mostly unchanged except for Japan, which declined from 15.1% to 14.3%. The U.S. and Germany also experienced small declines, while Italy saw a small increase. The “Other” segment grew by nearly 1%.

3-D Printers

Wohlers Associates estimates that Stratasys, Z Corp., 3D Systems, Objet Geometries, Envisiontec and Solidimension sold 3-D printers valued at an estimated $114 million in 2006, up 16.6% from 2005. Growth was 32% in 2005 and 98% in 2004.

3-D printers account for 72.5% of all additive systems sold in 2006. This is up from 70.3% in 2005, 68.3% in 2004 and 55.2% in 2003. 3-D printers represent nearly half (49.8%) of all additive fabrication systems installed worldwide through the end of 2006.

Growing a large installed base is more important than ever as companies build businesses around recurring revenues from consumables. Also, the larger the customer base, the easier it is to sell future products and services. Recent sales activity by Stratasys and Z Corp. show that these two companies are leading the pack in achieving this goal.

Rapid Manufacturing

Over the past few years, the term rapid manufacturing has gained acceptance. It is generally used to refer to the direct production of finished goods using additive fabrication techniques. The idea is to use freeform additive processes to deliver end-use parts directly from digital data, thus eliminating all tooling.

It is difficult to imagine a manufacturing approach that has such a broad range of potential applications as RM. The flexibility and reconfigurability of the systems mean that the same process can be used in many industries, including aerospace, automotive, medicine and consumer products.

The real key to rapid manufacturing is the elimination of molds, dies and other forms of tooling, and the consequent eradication of many manufacturing restrictions that tooling presents. Other than the time and cost savings that occur, a host of benefits are created that are only now being explored and understood. The RM processes themselves are the enablers for radically different approaches to design, manufacturing and supply chain management.

The Centre for Rapid Prototyping & Manufacturing at Central University of Technology, Free State (Bloemfontein, South Africa) completes more than 650 industrial projects per year. When it was asked to manufacture a housing for an infrared camera000 (see Figure 3), it turned to plastic laser sintering from EOS. A production run of only 10 to 15 units per year could not justify the expense of tooling, even for a product selling for $60,000 to $84.

Laser sintering made it possible to include custom features in the camera without impacting the manufacturing cost of the housing. The surface of the housing was sanded and sprayed repeatedly to give it the desired color and finish.

Research and Development

Research in additive fabrication is broad-based and international. It continues to transition from form models and prototypes to functional components. Research efforts are widening the field to include biomedicine, electronics, micro and mesoscaled products, and embedded sensors. Many advances are being made in materials, particularly metals.

Process improvements are critical to the advancement of the technology. Trends in process improvement focus upon material response to additive fabrication, powder-flow studies, tolerance and machine automation through feedback control. Other process improvements include the design and manufacture of deployable structures, residual stress analysis, part quality and process optimization.

Colleges and universities are pushing the limits and exploring new concepts while mapping the underlying theory to support emerging systems for additive fabrication. Through the years, educational and research institutions worldwide have played a crucial role in all aspects of additive fabrication-related education and research. Academia has assisted in the startup, education, collaboration, process advancement and the development of new applications. Academia will continue to be a critical part of additive processes in the future.

The Future

Additive fabrication has developed into three basic categories:

- 3-D printing for product design and concept modeling.

- Mainstream systems for fit and function applications and for master patterns.

- Rapid manufacture of custom and short-run production parts.

As these categories and sub-industries develop, the machines and their manufacturers will become much more specialized.

The market for 3-D printing will continue to expand as prices are forced downward and part quality improves. Many models and prototype parts that are now being outsourced and produced on expensive additive systems will be built on relatively inexpensive machines inside companies. This practice will expand dramatically in the future as demand grows for quick, low-cost design and modeling aids.

The use of additive fabrication for rigorous prototyping and testing will help preserve mainstream rapid prototyping as a viable option. Improvements in materials with one or more properties that simulate production materials will maintain the appeal of mainstream systems. However, as 3-D printers gain ground in both accuracy and material selection, they will take some of this market away from mainstream systems. In response, mainstream systems will be increasingly focused on rapid manufacturing markets.

The next frontier is to apply the technology to rapid manufacturing. Considering the array of possibilities, the market potential is enormous. However, it will take years for it to develop. In the meantime, compelling examples of RM will stimulate the development of the next generation of machines. These machines will eventually affect a wide range of industries and applications around the world. Product ideas that were once impractical due to tooling costs will become a reality.

Acknowledgments

The author appreciates the individuals and organizations that contributed to this report.

Related Content

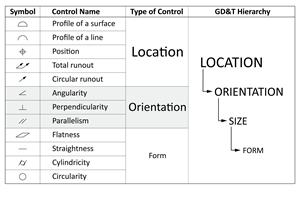

Tolerancing in Mold Design, Part 2: Using GD&T to Address Conventional Tolerancing Issues

Mold designers can achieve a single interpretation of workpiece functionality when following the American Society of Mechanical Engineers Geometric Dimensioning and Tolerancing standard.

Read MoreFour Micro Tooling Considerations

Issues involving gating, ejection, mold splits and direction of pull are of special concern when it comes to micro tooling.

Read MoreThree Good Reasons to Switch from Three- to Five-Axis Machining in Moldmaking

Five-axis machining technology is a great tool in the moldmaker toolbox.

Read MoreHow to Analyze and Optimize Cutting Conditions to Reduce Cycle Time

Plastic injection mold design and manufacturing company puts NC program optimization software module to the test. The results were surprising.

Read MoreRead Next

The Impact and Evolution of Additive Fabrication

SAn executive summary of the annual Wohlers Report that provides quantitative and qualitative analysis on the additive fabrication industry worldwide.

Read MoreIntegrating Rapid Prototyping With the Shop Floor

The CNC-based RP process works to complement existing production techniques.

Read MoreAdditive Fabrication Technology

Why you should be aware of it and where it’s headed.

Read More