The Impact and Evolution of Additive Fabrication

SAn executive summary of the annual Wohlers Report that provides quantitative and qualitative analysis on the additive fabrication industry worldwide.

Additive fabrication (AF) technology encompasses a wide range of applications, including design review, concept modeling, prototyping, fit and function testing, pattern making and tooling. It also is applied to the manufacture of fixtures, assembly aids and test rigs, as well as parts that end up in final products.

Unlike machining processes, which are subtractive in nature, AF systems join together liquid, powder or sheet materials to form objects. Parts that may be difficult or impossible to fabricate by any other method can be produced by additive fabrication. Based on thin, horizontal cross sections taken from a 3-D computer model, AF systems produce plastic, metal, ceramic or composite parts, layer upon layer.

Industry Growth

By most measures, additive fabrication has developed and evolved impressively. The impact it is having on new product development continues to capture the attention of entrepreneurs, investors, government agencies, researchers and others around the world. The following estimates provide perspective on the past and, hopefully, some insight into the future.

- In the past four years (2004–2007), products and services for additive fabrication grew by an estimated $612 million. Put another way, the industry grew by 116 percent during this period.

- Annual unit sales grew by more than 31 times from 1993 to 2007.

- The installed base of CAD solid modeling seats for commercial use has nearly doubled since 2003.

- The ratio of CAD solid modeling seats (for commercial use) to AF system installations is about 83 to 1.

- AF systems were sold in 67 countries in 2007, with an estimated 71 percent of them being installed in the top six countries.

- 3-D printers sold over the past four years (2004–2007) represent about 72 percent of the total number of additive systems installed during this period.

- Nearly 58 percent of the Stratasys and Z Corp. installed base (combined) was shipped in the past three years (2005–2007).

These numbers may be impressive, yet there is tremendous untapped potential, especially when considering the role that AF could play in manufacturing. Producing end-use parts is much more challenging than building parts for modeling and prototyping, so this application will require time to develop. Yet, rapid manufacturing has caught the attention of many. Wohlers Associates expects it to become the largest application of AF technology in the future.

Service Providers

Service providers, also referred to as service bureaus, offer part-building services to design and manufacturing organizations as an outsourced service. In addition to part building, many offer design, CAD/CAM/CAE, data translation, tooling, urethane casting from silicone rubber molds, reverse engineering, and other engineering and manufacturing services.

For many years, Wohlers Associates has surveyed service providers to measure the state of the industry. This year, 58 organizations in 14 countries participated in the survey. Thirty-six were from the U.S., five from Germany, two each from Australia, Belgium, India, Italy and Turkey, and one each from Brazil, Canada, Japan, New Zealand, Sweden, South Africa and Thailand.

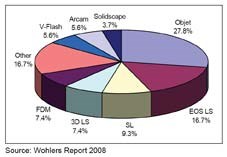

The survey asked many questions, including the following: If you were going to add new AF technology, which would you most likely acquire? Nineteen known technologies were listed. The results are shown in the Chart 1.

The most popular response was PolyJet from Objet Geometries, followed by laser sintering from EOS. Stereolithography was the third most accepted choice. Laser sintering from 3D Systems and FDM from Stratasys tied for the fourth most popular response.

System Manufacturers

Thirty-four manufacturers around the world produced and sold AF systems in 2007, compared to 35 in 2006. Last year, six of these manufacturers sold more than 100 systems each, the same number as in 2006. In 2007, 11 of the companies sold fewer than 10 systems each, also the same as the year before. Eight companies improved unit sales from 2006 to 2007, compared to 18 the year before.

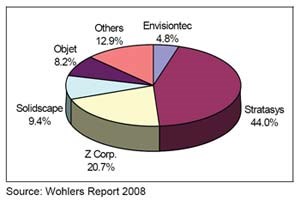

In 2007, Stratasys sold the most systems, the sixth consecutive year it has been the leader in unit sales. The number of systems sold grew by 25.9 percent to 2,169 systems. Wohlers Associates believes that an estimated 1,939 of them were Dimension systems.

Chart 2 shows the 2007 unit sales market shares among manufacturers worldwide. Z Corp. sold the second largest number of machines. It sold 1,022 systems, up from 777 systems in 2006 and 687 in 2005.

Asia and Europe

The number of system installations in the Asia/Pacific region grew by 4.7 percent to 1,198 machines in 2007. This is down from growth of 17.3 percent in 2006. The cumulative installed base for the region now stands at an estimated 7,596 systems through the end of 2007.

Europe experienced very strong growth in 2007 as measured by new system installations. The number of new systems in Europe grew by 33.7 percent, compared to 12.4 percent in 2006. Through the end of 2007, an estimated 5,205 systems were installed in Germany, France, Italy and the UK. This is up 23 percent from 2006.

3-D Printer Growth

A 3-D printer is a less costly variation of additive fabrication technology that is often used as a tool to create relatively inexpensive models early in the design cycle. The systems are typically office friendly and easier to use than their more expensive counterparts.

Wohlers Associates estimates that Stratasys, Z Corp., 3D Systems, Objet Geometries, Envisiontec, and Solido (formerly Solidimension) sold 3-D printers valued at $135.7 million in 2007, up 19 percent from 2006.

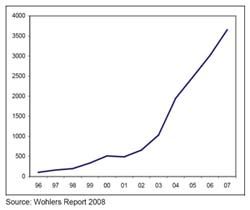

3-D printer unit sales grew by 21 percent in 2007. This compares to growth of 21.7 percent in 2006 and 27.3 percent in 2005. The average growth of 3-D printer unit sales from 1996 through 2007 was 40.4 percent. Graph 1 illustrates the growth of 3-D printer sales from 1996 through 2007.

Rapid Manufacturing

Rapid Manufacturing (RM), also referred to as direct digital manufacturing (DDM), is the production of end-use parts using additive fabrication processes. Recent advances in AF technologies and materials allow the manufacture of parts for a variety of production applications. Among them are: custom products, replacement parts, special edition products, short-run production and series manufacturing.

Historically, most RM applications have been based on the manipulation of polymeric materials, though metals for RM have grown in significance in recent years. This is mainly because of a new generation of metallic powder-based systems that are able to process more metal materials such as stainless steel, titanium and cobalt–chrome.

Rapid manufacturing has enormous potential. Many see it as one of the most important emerging approaches that will drive the future manufacturing economy. Because RM uses layer-wise manufacturing, traditional design for manufacture (DFM) principles no longer need apply. RM parts can be manufactured with undercuts and with highly complex internal and re-entrant features—complexities that are unheard of in conventional manufacturing. RM also allows for significant part consolidation, which reduces tooling, manufacturing, inventory, assembly, maintenance and inspection costs.

The adoption of RM can lead to many business benefits. Among them is the reduction or elimination of fixed assets such as tooling and assembly aids, which reduces capital investment. RM also has the potential to greatly reduce or eliminate many stages of the traditional supply chain, reducing leadtimes, inventory, and supply chain transaction and logistics.

Materials

The range of material choices for users of AF technologies continues to increase. Most new material developments over the past year have focused on delivering parts with properties that are closer to production or end-use properties, to be used for rigorous prototyping and rapid manufacturing applications.

Metal powders will be used increasingly for parts that would otherwise be machined or cast. The most practical application in the foreseeable future is the production of small parts that are highly complex. As the cost of metal systems declines and system speeds improve, larger and less complex parts will become viable candidates.

Over the past few years, several coatings and treatments have been developed and successfully applied to parts. These special treatments aim to improve surface aesthetics, mechanical properties, thermal conductivity, EMC-shielding capability and electrical conductivity.

The Future

Methods of lean manufacturing and additive fabrication, coupled with a growing market for limited edition and one-of-a-kind products, are forcing companies to rethink the way products are brought to market. Also, a new type of manufacturer is emerging, one that may be operating out of his or her home, garage or college dormitory, producing custom and personalized products on demand. Consequently, several interesting trends are emerging that will have an impact on the future of product development and manufacturing.

Designers instinctively design products that can be manufactured. They take into account the limitations of available manufacturing processes and avoid designing products that would be difficult or impossible to create. With layer-wise AF processes, however, many of the limitations of existing manufacturing processes are removed, enabling a much wider range of design options. As AF systems improve and are increasingly used for manufacturing, expect to see new products that previously would have been extremely difficult or impossible to manufacture.

A second industrial revolution is beginning to unfold. People located almost anywhere can affordably manufacture products in low volumes that meet special needs and interests. The late Larry Rhoades once said, “This revolution will enable people to live where they’d like and produce what they need locally. People will pay for the plans and not the product.”

Volume manufacturing of standard products will not disappear, nor will most conventional methods of manufacturing. However, many new kinds of products will surface as people uncover the vast capabilities of additive fabrication.

Acknowledgements

The author appreciates the individuals and organizations that contributed to the 240-page report on which this summary is based.

Related Content

Moldmakers Deserve a Total Production Solution

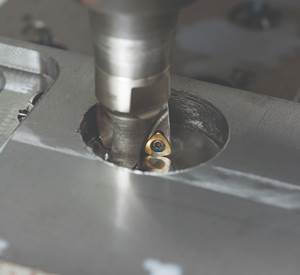

Stability, spindle speed and software are essential consideration for your moldmaking machine tool.

Read MoreTreatment and Disposal of Used Metalworking Fluids

With greater emphasis on fluid longevity and fluid recycling, it is important to remember that water-based metalworking fluids are “consumable” and have a finite life.

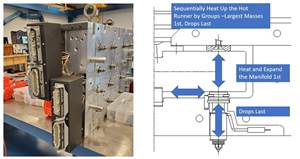

Read MoreThe Ins and Outs of Hot Runner Temperature Control

A training checklist that explains the why and how of proper hot runner temperature control and system management.

Read More6 Ways to Optimize High-Feed Milling

High-feed milling can significantly outweigh potential reliability challenges. Consider these six strategies in order to make high-feed milling successful for your business.

Read MoreRead Next

Integrating Rapid Prototyping With the Shop Floor

The CNC-based RP process works to complement existing production techniques.

Read MoreAdditive Fabrication Technology

Why you should be aware of it and where it’s headed.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More