Wall Street Sees Growth in the Packaging Industry

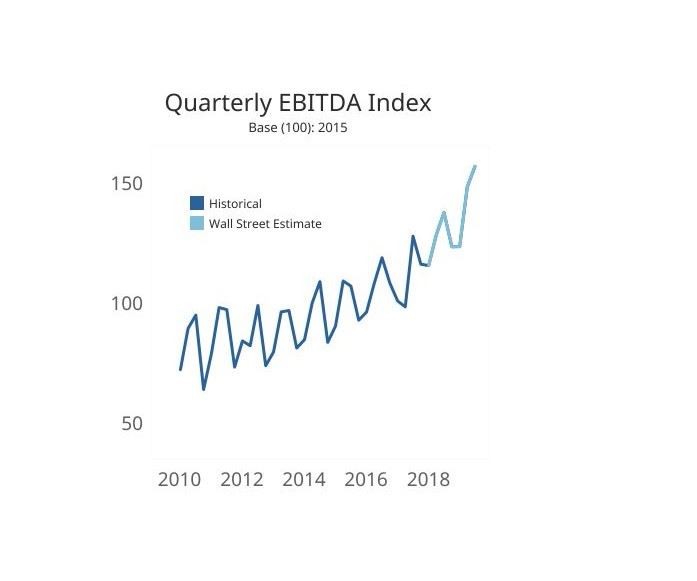

Equities analysts predict 2018 and 2019 double-digit EBITDA growth.

It is difficult to directly measure data on packaging and containers because of the permeation of packaging and containers products in everyday consumer activities and because of the permeation of those products along many—if not most—supply chains in a multitude of industries. Therefore, Gardner Intelligence has built customized tools that collect and analyze the quarterly business results of publicly-traded firms in the plastics and containers industry to provide those serving this industry with more up-to-date information.

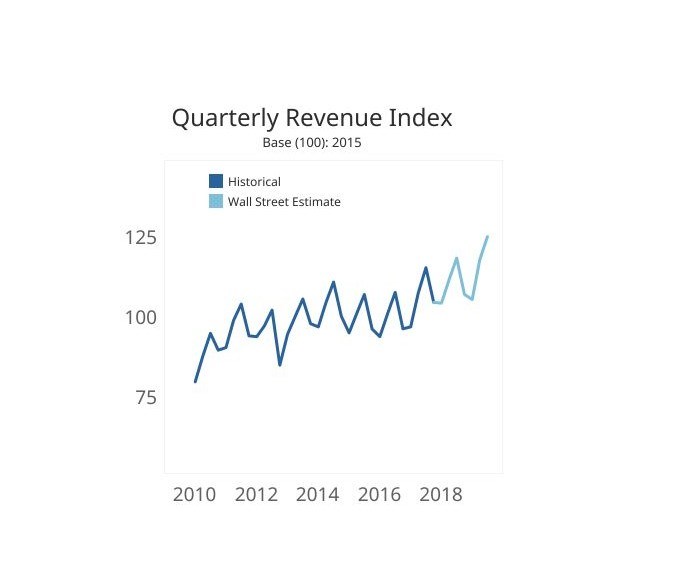

In examining the financial data of publicly traded U.S. packaging and container manufacturers of plastic and rubber products, it is apparent that revenues for the group grew 7.1 percent between the third quarter of 2016 (3Q2016) and the third quarter of 2017 (3Q2017). Appending Wall Street estimates to this historical data, revenues are expected to increase 2.6 percent and 6.1 percent respectively for the 12-month periods ending in 3Q2018 and in 3Q2019. Taking an extended look at inflation-adjusted (or “real”) historical and forecasted revenues for the period from 2000 to 2020, one will see that the growth rate of real revenues increased around 2012 and is projected to continue to grow at that faster rate through at least early 2019. Forecasted financial values are natively reported in nominal terms. All metrics that are defined in ‘real’ terms have been adjusted to 2015-dollar terms. Gardner Intelligence applies a 2.5-percent annual deflator to forecasted values to more accurately blend inflation-adjusted historical and forecasted figures.

Revenues for publicly traded U.S. packaging and container manufacturers of plastic and rubber products grew 7.1 percent between the third quarter of 2016 and the third quarter of 2017.

Additionally, examining Wall Street consensus projections for Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), we see that these same packaging firms are predicted to see EBITDA growth of 5.1 percent between 3Q2017 and 3Q2018 and an impressive 11.1 percent between 3Q2018 and 3Q2019. Gardner pays close attention to EBITDA because of the importance of end-users’ profitability in determining their ability to purchase capital equipment. Gardner attributes these robust forecasts to the expected strength of the U.S. and world economies, driven by strong consumer spending and low unemployment over the forecasted period.

About the Contributor

Michael Guckes

Michael Guckes is the chief economist for Gardner Intelligence, a division of Gardner Business Media. He has performed economic analysis, modeling and forecasting work for nearly 20 years among a range of industries. He is available at mguckes@gardnerweb.com.

Related Content

-

R&D Drives Innovation and Problem-Solving at Michigan Blow Mold Builder

Mid-America Machining focuses on reshaping designs, “right weight" initiatives, continuous improvement and process refinement to enhance moldmaking efficiency.

-

MMT Chats: Digitalizing Mold Lifecycle and Process Performance

MMT catches up with Editorial Advisory Board member Bob VanCoillie senior manager of Kenvue’s mold management center of excellence outside of Philadelphia to discuss mold management via tooling digitalization and OEM expectations and opportunities.

-

Hammonton Mold, ADOP France Forge Strategic Partnership in Injection Blow Moldmaking

Hammonton Mold Inc., a leading full-service mold shop based in New Jersey specializing in injection blow molds (IBM), proudly announces its official partnership with ADOP France, a prominent IBM mold manufacturer based in Normandy, France.

.jpg;width=70;height=70;mode=crop)