The recent second quarter advance in U.S. real gross domestic product (GDP) has outperformed economists’ forecasts, demonstrating the economy’s resilience and defying recession expectations. While GDP serves as a lagging indicator, providing insight into past economic performance rather than future developments, the positive sentiment was echoed by Jerome Powell, the U.S. Federal Reserve Chair, who stated that Fed staff no longer predicts a recession during a press conference on July 26, 2023. Such a favorable economic outlook raises the question of whether this positive trend will also reflect in the prospects for moldmakers for plastics.

Upward Revisions in Molds Production Are in Order

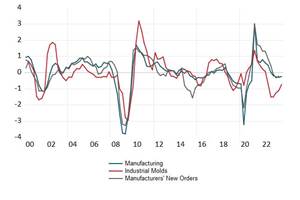

The Q2 2023 Plastics Quarterly Forecast by PLASTICS, a publication encompassing macroeconomic, plastics end markets and plastics industry outlook, adjusted the molds for plastics production growth forecast for 2023 to increase by 1.6%. This is a significant improvement compared to the previous projection of a 3.6% decrease. It is important to acknowledge that economic forecasts are subject to changes based on emerging data and evolving market conditions.

Examining the automotive market, two critical aspects warrant attention. The first is the level of production, which has faced challenges due to the broad-based supply chain disruptions resulting from the COVID-19 pandemic. However, since the end of the COVID-19 recession, motor vehicle and parts manufacturing have exhibited a noteworthy increase in production. In June 2023, the production of motor vehicles and parts grew by 9.5% from the previous year, indicating a positive trend.

The upward revisions in molds production and the positive trajectory of key plastics end markets, particularly in the automotive industry, bode well for the prospects of molds for plastics manufacturing.

If You Build Them, Will They Buy?

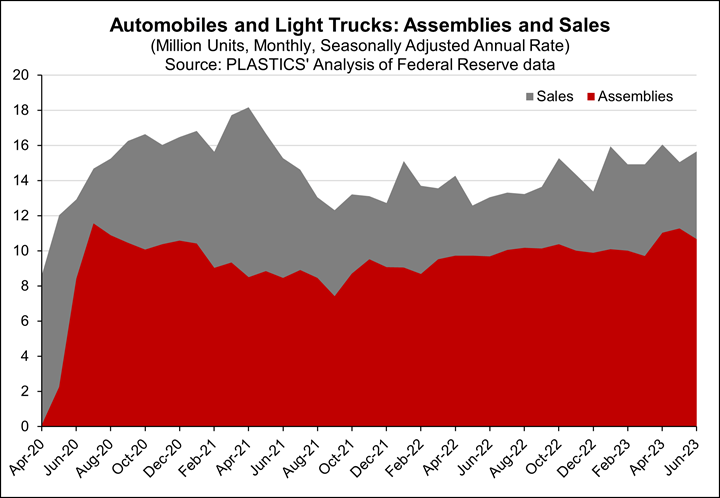

The second aspect is vehicle demand, which has remained relatively stable despite higher vehicle financing rates because of the Federal Reserve’s monetary policy tightening to combat inflation. Since the end of the COVID-19 recession, auto and light truck sales have experienced steady growth, reaching a peak of 18.2 million units on a seasonally adjusted annual rate in April 2021. Though sales faced challenges in meeting demand earlier, sales only dipped to 12.3 million units in September 2021, and have continued to rise, reaching 15.7 million units in June 2023. PLASTICS has revised its light vehicle sales forecast to 15.4 million units this year, possibly reaching 15.8 million units — an upward revision from the previous expectation of 15.2 million units.

Motor vehicle assemblies, including automobiles and lighter trucks, have grown significantly since bottoming out at 7.4 million units on a seasonally adjusted annual rate in September 2021, reaching 10.7 million units in June 2023. Remarkably, every month in the second quarter saw motor vehicle assemblies surpassing 10.0 million units, with April and May recording 11.0 and 11.3 million units, respectively.

Moreover, North American light vehicle production (including the U.S., Mexico and Canada) experienced an impressive 8.0% increase during the first half (H1) of 2023 compared to the same period in the previous year.

Photo Credit: PLASTICS’ analysis of Federal Reserve data.

“Health is Wealth”… Ralph Waldo Emerson

Plastic materials and products have become integral to the healthcare industry, with an impressive 25.8% of the final consumption of plastic products in 2021 being used in various services, including healthcare, food services, retail and wholesale trade and other services (Plastics Size & Impact, 2022). Healthcare spending stands out as a stable component within the economy’s personal consumption expenditure (PCE), consistently remaining within the 15% to 17% range. Much like the demand for essential goods and services, the demand for healthcare exhibits price inelasticity, indicating that consumers remain insensitive to price changes, and their buying patterns remain constant despite fluctuations in the business cycle. In fact, during economic slowdowns, consumption tends to shift more toward necessities. The average annual growth in real PCE on healthcare services in the U.S. hovers around 2.5%.

Also, demographics play a pivotal role in shaping the demand for healthcare. In June of this year, the U.S. Census reported that the nation’s median age increased by 0.2 to 38.9 years between 2021 and 2022. The Kaiser Family Foundation estimated that in 2021, 16.9% of Americans were 65 years and older, and this percentage jumps to 30.0% when considering those aged 55 to 64 years. The aging population’s impact on healthcare demands underpins an optimistic outlook for healthcare goods and services from the supply side.

The second quarter advance in U.S. real GDP growth has surpassed expectations, signaling the economy’s resilience and defying recession concerns.

Keeping Moldmaking Alive

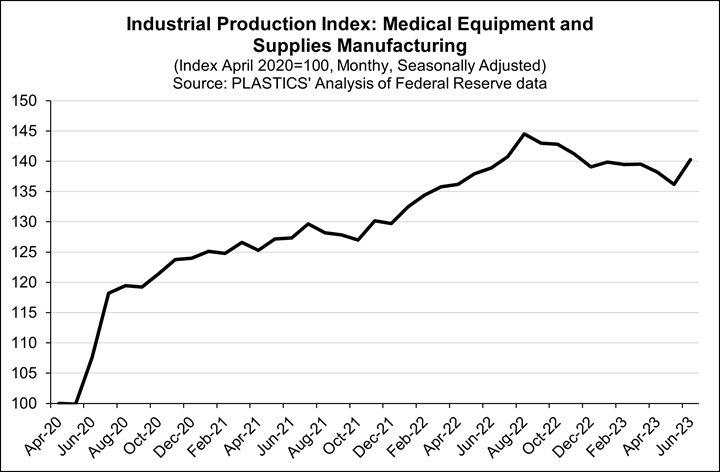

In medical device manufacturing, the U.S. witnessed an estimated 1,076 establishments in 2022, with projections indicating a 6.6% increase by 2025 (IBISWorld). Taking a broader measure of production — the Industrial Production Index on medical equipment and supplies manufacturing — one finds an impressive 40.2% increase since the end of the COVID-19 recession in April 2020. The first half of 2023 concluded with medical equipment and supplies manufacturing marking a 3.0% rise compared to the close of H1 2022.

These data and trends demonstrate the pivotal role of plastic materials in the healthcare industry, along with the potential growth and stability this sector can offer, considering changing demographics and evolving medical technology. The healthcare industry is poised for promising opportunities, attracting businesses involved in medical device manufacturing and catering to the needs of an aging population. Taken together, these factors should support the demand for molds. As healthcare remains an indispensable aspect of consumers’ lives, its steady demand and potential for growth make it a crucial sector for moldmakers to watch in the medium to long term.

Photo Credit: PLASTICS’ analysis of Federal Reserve data

Summing it Up

While GDP is a lagging indicator, the recent positive developments and statements from the U.S. Federal Reserve Chair inspire confidence in the overall economic outlook. The upward revisions in molds production and the positive trajectory of key plastics end markets, particularly in the automotive industry, bode well for the prospects of molds for plastics manufacturing.

Additionally, the stable demand for healthcare goods and services and the aging population reinforce an optimistic outlook for the healthcare industry. With these encouraging trends and indications, businesses in these sectors, including moldmakers for plastics, are poised for potential growth. However, changing economic conditions and evolving market dynamics render forecasts subject to adjustments based on new data and events.

Related Content

How to Successfully Reshore Tooling

Sloan Valve and Pyramid Molding Group shed light on the dynamics and challenges surrounding the shift toward domestic mold sourcing and the advantages of collaborating with a U.S. supplier to bring tooling back stateside.

Read MoreNavigating Economic Resilience and Consumer Trends

Consumer behavior provides mold builders insight into the evolving market dynamics of goods and services that helps strategic planning.

Read MoreUnited Grinding Precision Summit to Feature 16 Machines, Technical Sessions

The first ever Precision Summit is happening in Miamisburg, Ohio on May 24-25, 2023.

Read MoreWhat is Driving Mold Lifecycle Management Digitalization?

OEMs are looking to partner with suppliers to share and track data across the supply chain for advanced intervention and process management.

Read MoreRead Next

Internal and External Factors Continue to Impact U.S. Moldmaking

Sustainable growth remains in the forecast as economic conditions continue to progress.

Read MoreU.S. Economic Fundamentals Impacting Moldmaking

The economy continues to downshift, capping growth in moldmaking.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More