Navigating Economic Resilience and Consumer Trends

Consumer behavior provides mold builders insight into the evolving market dynamics of goods and services that helps strategic planning.

The Industrial Production Index on manufacturing holds significant implications for moldmaking, considering molds are integral components in product manufacturing. Source: CoPilot

Moldmaking is a crucial element of manufacturing, playing a pivotal role in the production of numerous goods using industrial molds. In the U.S., the estimated value added by the manufacturing sector reached $2.3 trillion in the third quarter of 2023. Molds are integral to the consumption of goods and services within the economy, as they are extensively employed in the manufacturing process of various products. Additionally, molds contribute significantly to the production of goods used in the services sector.

Last year, the moldmaking industry retraced some of its gains from the preceding three years. Moreover, in 2023, the economy demonstrated resilience, especially within the household sector, despite the higher cost of borrowing. This resilience is evident in the 2.2% increase in personal consumption expenditures, reaching $15.4 trillion, indicating that the economy’s household sector sustained robust spending for a more extended period than initially anticipated.

Given that the primary customer base for moldmakers is the manufacturing sector, an effective strategy involves turning to a high-frequency indicator as a clear signal indicating the prevailing trends.

Also, consumer spending exhibited a divergence. Durable goods consumption saw a notable increase of 4.3% in 2023, while nondurable goods consumption experienced a more modest growth of 0.9%. Services consumption, on the other hand, rose by 2.3% during the same period. While consumption maintained its momentum in 2023, the business sector, particularly in manufacturing, faced a different scenario for many.

Business-fixed investment spending experienced a modest 0.5% growth in 2023, marking the smallest increase since the 7.1% surge observed in 2021. Despite a notable 12.7% rise in nonresidential investment spending on structures during the past year, there was a slight 0.1% dip in equipment investment spending. This decline in equipment investment aligns with the contraction in manufacturing, as indicated by the Industrial Production Index on manufacturing, which recorded a 0.5% decrease following increases of 5.0% and 3.0% in 2021 and 2022, respectively.

Roadmapping for 2024

For moldmakers catering to the plastics industry, it is crucial to recognize the pervasive presence of plastics and plastic products in various aspects of household consumption, including durable goods, nondurable goods and services. The consumption outlook for 2024 serves as a valuable indicator for moldmaking strategies.

To begin with, it is anticipated that retail sales, excluding food services, will see a modest increase of 2.4% this year, slightly lower than the 3.2% growth observed in the previous year. This could imply two potential scenarios. First, there might be a quicker depletion of retail inventories and/or an uptick in production. Given that around 14.5% of retail sales are estimated to be returned in 2023, contributing to inventory levels, meeting consumer demand is likely to rely on a combination of existing inventories and production. However, it is improbable that new production will fully address the demand, except for instances involving new products or updated models, as seen in the automotive industry.

Consequently, in plastics product manufacturing, a continued robust demand can be anticipated from the automobile and light trucks end market. The Plastics Industry Association (PLASTICS) currently forecasts a 2.6% increase in the production of automobiles and light-duty motor vehicles this year. Also, an additional 2.2% increase is expected in motor vehicles and parts production. Light vehicle sales at 15.89 million units in 2023 surpassed the 15.45 million units forecasted. In 2024, light vehicle sales could total 15.72 million units.

Products with shorter life cycles, such as computers and electronic products, necessitate more frequent new production. PLASTICS predicts a 4.0% increase in the production of computer and electronic products in 2024. As for nondurable goods consumption, a modest 0.8% increase is projected for the same year.

In the realm of services consumption, it is anticipated that the sector will outpace nondurable goods with a projected 1.5% increase in 2024, compared to the 0.8% increase in nondurable goods. Plastics and plastic products used in the services sector may experience a surge in demand. Given that returns in service-based industries often take the form of refunds or cancellations, their impact on inventory is typically less significant.

Also, services consumption encompasses diverse businesses, such as travel, which includes air travel, hotels, food services and more. This implies that a certain level of inventory is expected to be maintained over time for services to function efficiently. Therefore, plastics and plastic products in the services sector could remain a growth area throughout the year.

Consumer behavior serves as a valuable guide for understanding the dynamics of goods and services circulating in the market over time, offering pertinent insights for moldmakers. However, given that the primary customer base for moldmakers is the manufacturing sector, an effective strategy involves turning to a high-frequency indicator as a clear signal indicating the prevailing trends. This indicator becomes a telltale sign, helping moldmakers discern the direction in which the industry is heading.

Despite facing challenges, the moldmaking industry displayed resilience and the intricacies of consumer spending revealed notable divergences.

Monitoring the Economic Manufacturing Pulse

In their paper “Forecasting Industrial Production: The Role of Information and Methods” (BIS IFC Bulletin No. 33, 2010), Bulligan, Golinelli and Parigi argued that “the index of industrial production is probably the most important and widely analyzed high-frequency indicator, given the relevance of manufacturing activity as a driver for the whole business cycle.” In a similar vein, one could propose that the Industrial Production Index on manufacturing holds significant implications for moldmaking, considering molds are integral components in product manufacturing.

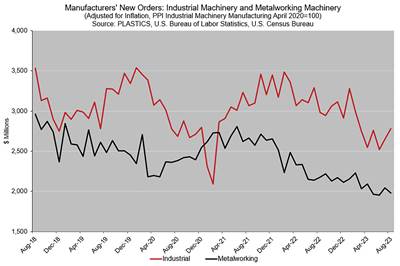

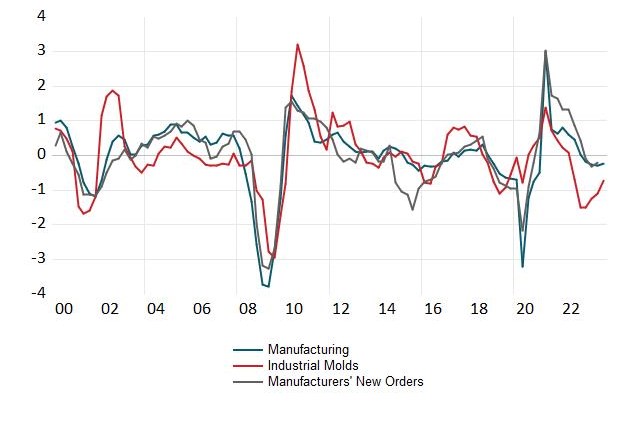

Following the projected 0.5% decrease in the Industrial Production Index on manufacturing, as indicated by PLASTICS, it is now anticipated that manufacturing will continue to retract in 2024, with a current forecasted decline of 0.3%. The accuracy of the 2023 forecast underscores the close relationship between the manufacturing index and PLASTICS’ proprietary data on industrial molds production. Notably, trends in industrial molds production align closely with manufacturers’ new orders in manufacturing, with both variables exhibiting synchronous movement.

Industrial Production Indices: Manufacturing, industrial molds and manufacturers’ new orders in total manufacturing (% change, annual). Source: Plastics Industry Association (PLASTICS)

Analyzing the year-on-year change in the Industrial Production Index on manufacturing, the Industrial Production Index on industrial molds and the year-on-year change in the dollar-value of manufacturers’ new orders in manufacturing — using a zero-centered normalization, which allows better comparison between data — reveals the interconnectedness of these three variables as shown in the graph above. This interconnectedness is particularly pronounced during economic contractions, such as the 2001 recession, the Great Recession in 2008-09 and the COVID-19 recession of 2020.

Wrapping it Up

Moldmaking continues to play a vital role in the dynamic landscape of manufacturing, contributing significantly to the overall economic framework. Despite facing challenges, the moldmaking industry displayed resilience and the intricacies of consumer spending revealed notable divergences. While durable goods consumption saw a substantial increase, manufacturing experienced a decline in the Industrial Production Index, signaling a potential retraction in 2024.

Moldmakers, particularly in the plastics industry, must navigate nuanced demands and anticipate shifts in retail sales and production trends. The strategic alignment of moldmaking with high-frequency indicators, like the Industrial Production Index, remains essential for informed decision-making in the ever-evolving economic landscape.

Related Content

How Hybrid Tooling Accelerates Product Development, Sustainability for PepsiCo

The consumer products giant used to wait weeks and spend thousands on each iteration of a prototype blow mold. Now, new blow molds are available in days and cost just a few hundred dollars.

Read MoreHammonton Mold, ADOP France Forge Strategic Partnership in Injection Blow Moldmaking

Hammonton Mold Inc., a leading full-service mold shop based in New Jersey specializing in injection blow molds (IBM), proudly announces its official partnership with ADOP France, a prominent IBM mold manufacturer based in Normandy, France.

Read MoreInternational Partnership Improves IBM Preform Precision

Hammonton Mold Co. and ADOP France team up to bring injection blow mold preform design and service to the next level.

Read MoreDomestic Collaboration Yields Efficiency and Budget Gains For Innovative Tooling Project

Pyramid Molding Group and Lettuce Grow partner to develop optimal tooling for a compact Hydroponic Farmstand.

Read MoreRead Next

Resilience and Reflections: Moldmaking in the Evolving Economic Landscape

As moldmakers navigate this complex year marked by fluctuating business activities, and approach the upcoming year with cautious optimism, three key considerations should guide their decisions.

Read MoreU.S. Economy Indicates Prospects for Moldmakers

An examination of the U.S. economy suggests its resilience against a recession, yet a mixed outlook for moldmaking and plastics persists.

Read MoreU.S. Economic Fundamentals Impacting Moldmaking

The economy continues to downshift, capping growth in moldmaking.

Read More