Succession planning is something every company should implement, but many small businesses, like mold manufacturing companies, can be remiss when it comes to proactively thinking through the steps necessary to maintain continuity in the event of retirement, illness or worse, an untimely passing. It is a challenge, albeit not an exciting one (like solving a mold or molding issue). Still, succession planning is important.

MoldMaking Technology asked a few mold manufacturing business owners to share their succession plan experiences, including when and how the plans were developed, how they have evolved over time and lessons learned.

Several companies were asked to participate. Of these, there were some who said that they do not have a formal succession plan. Instead, it has simply been understood by those involved that ownership and management of the companies would pass from one generation to the next, through legal channels of course, and that is it. However, the three companies whose experiences we share here have taken more in-depth actions for succession planning and following are their stories.

Promoting From Within

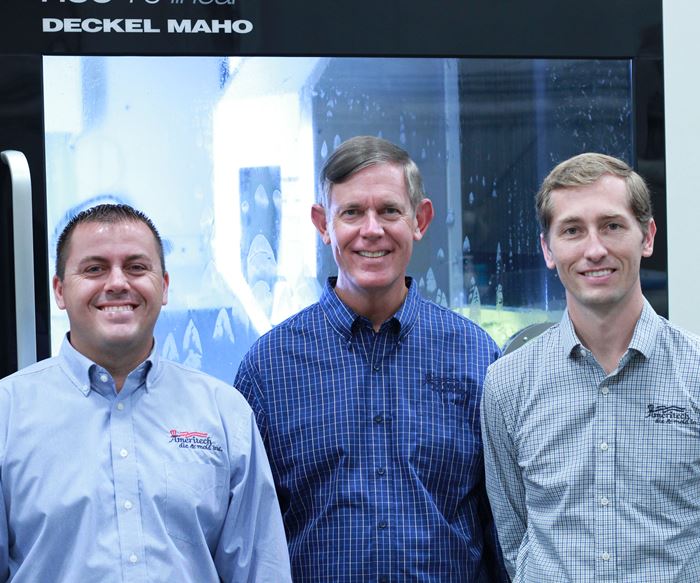

Steve Rotman is enjoying the idea of easing into retirement and spending more time in Florida, where he can enjoy fishing while also overseeing operations at his Ormond Beach moldmaking plant. But first, he must work on how best to pass on the leadership and responsibilities of running Ameritech Die & Mold (ADM) North, his Mooresville, North Carolina, mold manufacturing facility, to his son Mark, program/design manager, and DJ Easter, plant manager. Both gentlemen are 34 years old.

I am taking them on as partners in the business where they will be buying equity.

“When I first began working on a succession plan, I had never considered trying to bring any of my three kids into ADM,” Rotman says. In 2006, he realized that there could be an opportunity for his oldest son, Mark, to join the ADM team. At the time, Mark was just getting ready to graduate with a four-year degree in Business/Finance from Appalachian State University. “When I proposed the idea to him, explaining what his employment might be like being the owner’s son, Mark accepted the challenge. He started out on the floor and worked his way up to running and programming our CNC machines, wire EDMs and working in the assembly department.”

In 2014, Rotman was given an opportunity to put his hope and plan into action. “We encountered several vacancies in the management staff that needed to be filled in order to not disrupt our operations or customer relations.” Among the employees considered for the positions, Mark and DJ enthusiastically stepped up to the plate, ensuring that no ripple effect was ever felt in the transition. Since then, they have become a strong team, complimenting each other well, he says.

Today, Rotman is working on developing a contract that would give Mark and DJ equity positions in ADM North, enabling them to begin what Rotman calls “the real journey.” “I am taking them on as partners in the business where they will be buying equity,” he says. “While the contract is not ready to be signed yet, I have been discussing the plan with Mark and DJ and grooming them to become partners in the business. I will continue to be present and support them for the next three to five years while they slowly gain equity and get comfortable with making administrative/financial decisions. Eventually, when enough equity is built, they will take over the full banking/financial responsibilities.”

Asked about his plans for ADM South, the Ormond Beach, Florida, facility, Rotman says nothing concrete has been formed regarding his exit strategy there. “My first priority is to get Mark and DJ on solid ground in North Carolina, and then see what might happen with South,” he says. “The slower sale of South also fits with my exit strategy. I can still have some involvement in a company and in the one that I have not been as involved with day to day before I step out completely. It also supports my goal to be in Florida a little more, particularly during the winter months. It’s a softer landing for me, with those strategies for both North and South, than just abruptly retiring and going fishing 24/7!”

My goal is to leave Ameritech in sound financial shape.

As for lessons learned, Rotman says he would not have changed any of the steps he has taken to ensure continuity for ADM North. “Building from within the company goes along with our strong apprenticeship model,” he says. “With Mark and DJ moving up, there is a vacuum behind them to fill that will allow others to step up to management positions.

“My goal is to leave Ameritech in sound financial shape, as well as give the company the financial strength to afford the buyout without affecting all the great employees that support it every day,” Rotman concludes. “ADM will continue to look and feel like a family owned business, and a strong, proud American moldmaking company.”

Partnerships: A Meeting of the Minds

Ryan Katen, general manager at Micro Mold Co. in Erie, Pennsylvania, says there are different ways to go about succession planning, depending on the specifics of the individuals involved and the company that is transitioning its leadership. For Micro Mold, Katen says the initial succession plan involved cooperation between two owner-partners, Timothy Katen (Ryan’s father) and David Mead, who cofounded the mold manufacturing company in November 1978.

Katen and his older brother Philip, who is now general manager and president, joined the Micro Mold team in 2007. He says the succession transition process began in 2009. At that time, Ryan, Philip and one of Mead’s sons were made junior partners in the company. The transition was completed in 2011 when Tim and Dave fully retired. Eventually, the Katens bought out Mead’s son, and today, they lead the company along with another junior partner.

First and foremost, meet with all shareholders to ensure that you understand what each person's individual goals are and what their visions are for the company.

Katen notes that he and Philip were not involved in developing the first succession plan, but more recently, they did participate in planning for the future transition of ownership for Micro Mold and sister company, Plastikos Inc., a custom molding company that was established in 1989 by Tim Katen, Dave Mead and a third partner, Gary McConnell. He shares some important insights based on his experience with the process where multiple shareholders are involved.

“First and foremost, before talking to an attorney, meet with all shareholders to ensure that you understand what each person's individual goals are and what their visions are for the company,” Katen says. “This should be treated like any problem or challenge in that you work together to develop a plan that you can all get behind.” Some factors to consider include the age at which each shareholder wishes to retire, and what happens if something unexpected occurs. For example, Micro Mold’s succession plan stipulates that should a shareholder become unable to work full time, the other shareholders would buy him out over a set number of years.

Regardless of how a company passes the torch, Katen says the shareholders must have a cohesive plan and vision that will not financially cripple the company. “I've seen that happen to other companies,” he says, stressing that while the previous owner deserves to reap the financial benefits from building and running the company, it is also in his best interest to not cause the company to fail because huge monthly buyout payments prevent the new shareholders from reinvesting in the business.

We try to revisit our plan every five years.

Katen says that once a plan is in place, an attorney and an accountant should be consulted to make sure that the plan makes sense from not only a legal standpoint but tax-wise as well. “For example, there are differences in how you are paid for your shares based on how the company is incorporated. You might pay more in taxes, too. The plan should protect you legally and tax-wise.”

Additionally, because aspects of the plan can change over time, it is crucial to revisit it every so many years. An example is a shareholder changing his mind about when to retire. Company visions and goals also can change over time. “We try to revisit our plan every five years,” Katen says, adding that everyone must understand and agree with what they are signing because if something happens, that document is legally what is going to be acted upon.

“Partnerships are like a marriage,” he concludes. “You’re not always going to see eye to eye because you have different ideas or desires than your partners have. It’s important to try to respect each other and allow a little bit of give and take in order to ultimately come up with a plan everyone can live with.”

For more on Micro Mold click here to listen to this

MoldMaking Technology/Manufacturing Alliance Podcast.

Laying A Solid Foundation for Succession

Legacy Precision Molds in Grand Rapids, Michigan, is a family-owned company in the truest sense. Tom VanRee, president, founded the company in 1995. His wife, Mary, worked alongside him, serving as bookkeeper and providing administrative support – a role she continues to play today. Fifteen years ago, son Tyler entered the family business right out of high school and is now vice president and a co-owner. He was followed by his brother, Seth, who came on board 10 years ago. Seth is a three- and five-axis CNC operator.

“My parents went through an extensive, year-long process of working through both their estate and business succession plans, finalizing the details by early 2013,” Tyler VanRee says. “They partnered with a professional who was experienced in all facets, including estate planning, business sale and acquisition, succession planning, tax planning and accounting. He helped develop a solid plan with several options that worked well for everyone involved.”

First off, I had to bare my soul, basically.

In a podcast interview with MoldMaking Technology’s Editorial Director Christina Fuges on The Manufacturing Alliance, Tom VanRee shares his thoughts on the process of building a succession plan. “First off, I had to bare my soul, basically,” he says. “We started from the ground up, figuring out all the dynamics of how we are going to do this for the rest of family. But it has been an eye opener, too. At the tail end of the process, we brought Tyler in, and we met with him as a team and made him a partner.” While son Seth is not a partner, that could change in the future.” Tyler says that at the time, his brother did not have an interest in ownership. “But he plays an important and vital role in the business, and there is a lot of value in that,” he says.

While Tom and Mary VanRee did not involve Tyler in the finite business of working with the consultant, they did make sure to explain to him what they had in mind and ask him if he was comfortable with the plan that was developed. “I applaud them because after that was all done they called a family meeting around a dinner table and mom and dad basically said, ‘hey, this is how it's all going to unravel over the next five, 10, 15 or 20 years, and this is what we've done to make sure it's fair for everyone involved.”

“Communication is critical,” Tom says. “I’ve seen businesses implode due to lack of communication.”

Asked what advice he would give to a fellow business owner who has not yet ventured into creating a succession plan, Tom says, “Just do it. Get started. It’s a big step. I thought about it for two years. Once you start going through the process, you learn a lot about yourself and your business and how they tie together.” He adds that even for those who may not have a son or daughter to take the business on, it is important to put one’s affairs in order such that it would make the business entity look more attractive to a potential outside buyer.

Once you start going through the process, you learn a lot about yourself and your business and how they tie together.

Tyler says the consultant raised another important consideration that was eye opening. “He said that before the transition between dad and me fully takes effect, it's wise for me to already have a succession plan in place. I was thinking to myself why in the world would I want that? Why wouldn't I just wait 20 years and figure that out when I'm about to retire? But tomorrow is never guaranteed for anybody, and if I'm going to take ownership, I'm responsible for every team member I have out there. I'm supporting families, and if I don't do my due diligence to ensure that this business can be sustained without me, then I failed them.”

Related Content

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreMold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

Read MoreMMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreWhat is Driving Mold Lifecycle Management Digitalization?

OEMs are looking to partner with suppliers to share and track data across the supply chain for advanced intervention and process management.

Read MoreRead Next

Dealing with the Inevitable: Succession Planning

MoldMaking Technology editorial advisory board member Ryan Katen of Micro Mold Co. shares his perspective on succession planning based on personal experience.

Read MoreAdvice for Hitting the Moving Target of Succession Planning, Part 2

Steps companies can take to make the transition process smoother and easier.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read More