Mold builders must remain watchful of the expenditure on capital goods within the economy because an upswing may signify upcoming economic growth. Photo Credit: Thinkstock

In the third quarter, the U.S. economy continued to display resilience with GDP growth at an annual rate of 4.9%, an average unemployment rate of 3.7% and a headline inflation rate of 3.7% in September — a significant drop from the 8.2% recorded a year earlier.

This year is likely to be a memorable one for mold builders, as they outperformed other sectors in the plastics industry. While the plastics industry experienced a slowdown, driven by a shift in consumer spending from goods to services, moldmaking thrived despite the challenges posed by strong macroeconomic fundamentals.

Here are three considerations mold builders should use to guide their decisions in the coming year:

(1) Capital Goods Spending as an Economic Indicator

The economy’s investment in capital goods serves as a prominent indicator of economic growth. A surge in new orders for capital goods, encompassing machinery and equipment, signals increased business investment to meet near-term demand. Moldmakers should remain vigilant about the expenditure on capital goods, as an upswing in this area is more likely to signify forthcoming economic growth. Given that moldmaking is closely aligned with the overall economic landscape, particularly in the mature plastics industry, it tends to thrive in tandem with its expansion. However, capital investment spending is sensitive to higher costs of capital.

While the U.S. economy displayed resilience in the first three quarters of 2023, the exceptional 25.6% increase in manufacturers’ new orders for capital goods in June, compared to the previous year, was an anomaly. However, the subsequent two months showed more realistic figures, with increases of 3.6% in July and 3.7% in August, in sync with a weaker manufacturing outlook.

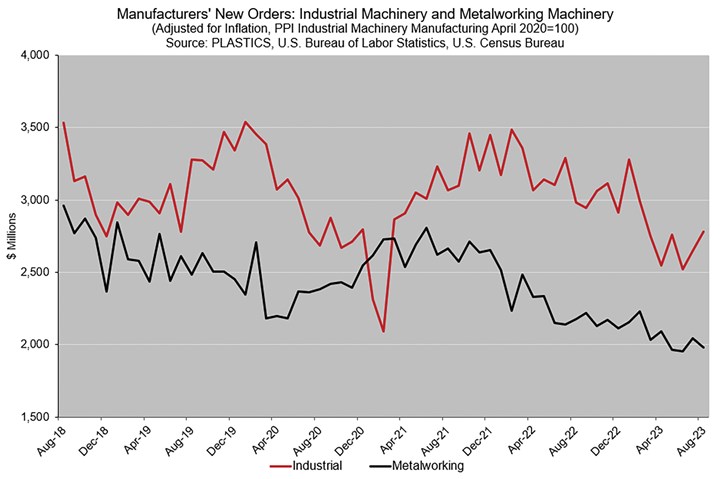

In addition to the headline figures that set the tone for the macroeconomy’s capital goods spending, moldmakers should closely monitor new orders for industrial and metalworking machinery — such as plastics machinery — as these changes impact industrial molds. In contrast to the upswing in capital goods spending in June 2023, new orders for industrial machinery and metalworking machinery specifically, experienced declines of 14.4% and 3.9%, respectively, year on year. July and August also saw a drop in new orders for industrial machinery by 16.6% and 3.1%, respectively, compared to the previous year. During the same period, metalworking machinery decreased by 1.0% in July and 5.5% in August.

When considering price volatility and using the Producer Price Index for industrial machinery manufacturing, reindexed to the end of the COVID-19 recession in April 2020, the impact of elevated inflation rates, which began in early 2021, becomes apparent (see graph below). However, when adjusted for inflation or analyzed in real terms, it reveals more significant year-on-year declines.

Impact of elevated inflation rates on industrial machinery manufacturing. Photo credit: PLASTICS, U.S. Bureau of Labor Statistics, U.S. Census Bureau

With the economic outlook for 2024 subdued, closely monitoring capital goods spending can provide valuable insights into the extent of the economic growth slowdown. If the restrained economic outlook for 2024 materializes, moldmakers should be prepared for the possibility of business growth being less robust than in 2023.

(2) Retail Sales as a Barometer of Consumer Engagement

The U.S. operates as a consumption-driven economy, making monthly retail sales a significant gauge of consumer engagement. A notable surge in retail sales can signify increased consumer confidence and spending, both of which are catalysts for economic growth. This uptick in retail sales results in a depletion of merchandise inventory, prompting the need for restocking and consequently affecting the entire upstream value chain. This ripple effect extends to elevated orders from wholesalers and distributors, leading to increased shipments, ex-factory and heightened production.

When adjusting retail sales for inflation using the Consumer Price Index, reindexed at the conclusion of the COVID-19 recession in April 2020, it becomes apparent that retail sales have, by and large, held steady following the pandemic surge. In real terms, retail sales in September 2023 stood at $510.6 billion, a marginal decrease of 0.7% compared to the previous year and a 0.2% drop from two years prior. While this data suggests ongoing consumer engagement due to relatively small decreases, it also points to inventory levels that are adjusting at a slower pace, resulting in weaker increases in merchandise production or imports upstream.

Innovation plays a pivotal role in bolstering retail sales, especially when it leads to the introduction of new products. Prior to the pandemic, Nielsen, a data and market measurement firm, reported an astounding statistic: A new product was introduced into the U.S. marketplace every two minutes. While the exact impact of the pandemic on this frequency remains uncertain, it is evident that the introduction of new products significantly enhances consumer engagement. Certain industries deliberately unveil new product models on an annual basis to maintain consumer interest. For example, the automobile sector regularly introduces fresh designs and technologies with each year’s new models. These new vehicle models offer automakers the opportunity to not only reach new customers but, more importantly, to foster brand loyalty among existing customers.

Clearly, moldmaking faces both challenges and opportunities, and it will be paramount to continue exploring innovative solutions to bridge the skilled labor gap while harnessing the power technology.

Nielsen data also suggests an annual average of approximately 30,000 new product introductions. Therefore, the availability of new tooling work is closely tied to the launch of new products each year. However, during periods of subdued economic growth, it is pragmatic to expect a reduced number of new product introductions, given their potential ties to overall economic conditions. If the economy experiences a slowdown in the coming year, it will impact personal income and, consequently, consumer spending.

Also, a declining personal savings rate, even during periods of strong labor markets, implies heightened consumer spending. The retail sales data corroborates this argument. In August, the personal savings rate was at 3.9%. This stands in contrast to the recent expansionary cycle of the U.S. economy, when the personal savings rate consistently remained above 5.0%. Elevated consumer spending and a low savings rate also indicate a higher level of consumer debt. The consumer debt service payments as a percentage of disposable income have remained above 5.8% since the first quarter of 2022, which is higher than the pre-COVID-19 pandemic levels.

(3) Navigating the Skilled Labor Shortage

Anticipate the persistent gap between the demand for skilled labor and its supply. A careful analysis of labor statistics from the Bureau of Labor Statistics reveals that the workforce in the industrial mold, cutting tool and machinery tool accessory sector (NAICS 333519) has been on a declining trajectory. According to the Bureau’s most recent estimate in August, the total number of employees was 13.4% lower than it was five years ago. Even within NAICS 333511, the category the Plastics Industry Assn (PLASTICS) employs in its quarterly employment forecast for molds, there is a discernible downward trend. Projections suggest that by the end of the third quarter of this year, the workforce will have experienced a 10.4% decrease compared to five years ago.

Mold builders must acknowledge these three considerations within the context of the challenges and opportunities they bring.

The decrease in the labor force has imposed significant challenges on U.S. moldmakers. This is particularly noteworthy because the broader manufacturing sector, where molds play a pivotal role, has not witnessed a substantial deceleration over the past five years. While there was a minor dip in U.S. manufacturing in 2023, the most recent data shows that manufacturing activity in the U.S. was only 2.0% lower in August compared to the figures from five years ago. It is reasonable to deduce that the increased productivity in moldmaking is a direct consequence of technological advancements, including automation, machine learning, artificial intelligence and the implementation of smart factory technologies.

In addition, advancements in prototyping technology have significantly reduced prototyping times, fostering innovation by enabling designers and engineers to test and refine multiple iterations of a product rapidly. This acceleration means that products can transition from the conceptual phase to production more expeditiously. The shortened prototyping times also play a pivotal role in bolstering the profitability of plastics processors by reducing time to market, enabling them to swiftly adapt to market trends and meet customer demands with agility.

The U.S. manufacturing sector has demonstrated resilience with only a 2.0% decrease in activity compared to five years ago. The resilience can be attributed to the ongoing technological advancements, including those in moldmaking. Clearly, moldmaking faces both challenges and opportunities, and it will be paramount to continue exploring innovative solutions to bridge the skilled labor gap while harnessing the power of technology.

Mold builders must acknowledge these three considerations within the context of the challenges and opportunities they bring. The specter of a U.S. recession has been continually postponed, much like a tin can kicked down the road. Nevertheless, it is vital to remember that the success or failure of businesses often depends on a range of factors beyond the current state of the economy’s business cycle.

Related Content

How to Foster Innovation Through a Culture of Education, Mentoring

Dynamic Tool Corp. shares its strategy for building a team with the right attitude and aptitude to deliver innovation that meets customer expectations.

Read MoreEden Tool and Eden Manufacturing: A Story of Resilience, Growth and Innovation

This critical parts manufacturer, founded on solid tooling fundamentals, didn’t get derailed with the unexpected passing of the owner because leadership was already building a solid business, not just a good tool shop. Here’s how they managed change incrementally… and they’re not finished yet.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreMaking Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreRead Next

Internal and External Factors Continue to Impact U.S. Moldmaking

Sustainable growth remains in the forecast as economic conditions continue to progress.

Read MoreU.S. Economy Indicates Prospects for Moldmakers

An examination of the U.S. economy suggests its resilience against a recession, yet a mixed outlook for moldmaking and plastics persists.

Read MoreU.S. Economic Fundamentals Impacting Moldmaking

The economy continues to downshift, capping growth in moldmaking.

Read More