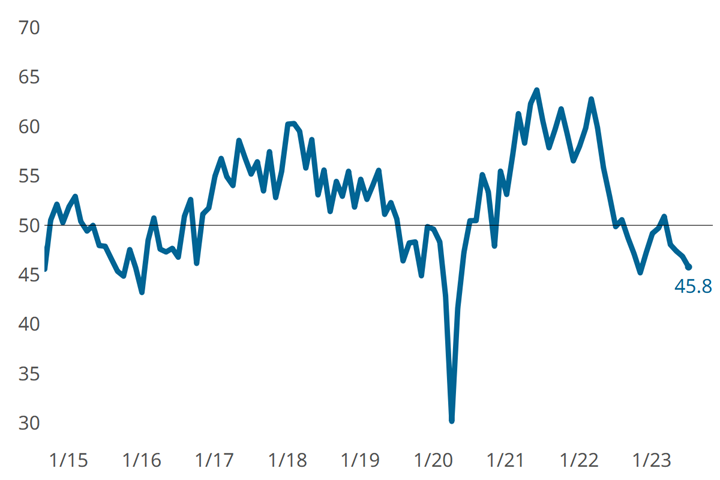

Moldmaking Industry GBI Contracts for Four Months Straight

The GBI Moldmaking ended the month at 45.8, down one point from June, with components contracting or nearing contraction activity.

The GBI Moldmaking ended at 45.8, marking contraction for four months straight. Photo Credit, all images: Gardner Business Intelligence

Moldmaking activity contracted again in July. The Gardner Business Index (GBI) Moldmaking ended the month at 45.8, down a full point from June. July earns an “A” for internal consistency — every component contracted or was about to contract for the month.

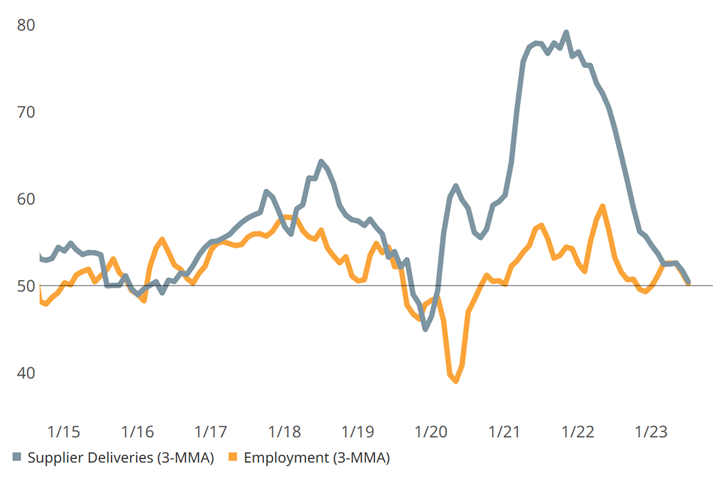

All components contracted or nearly contracted in July. (This graph moves on a three-month moving average.)

Supplier deliveries and employment followed steady lengthening and expansion, respectively, in March through May, both landing on the cusp of flat in July. Supplier deliveries have not been close to flat since early on during the COVID-19 pandemic — February 2020 — offering on indication that supply chain issues appear to no longer be at play. Employment, on the hand, was last flat as recently as January 2023.

New orders have been contracting for an entire year; production is doing the same, just lagging a little behind as expected. Also contracting for over one year, backlog has been trying to slow it down, and inch in the “right” direction, making limited progress in July. Exports remained the steadiest, contracting another month at a rate within a relatively tight range since January 2022.

The survey’s sentiment question, future business expectations, has shown declining optimism since March 2023.

Related Content

-

Moldmaking Activity Returns to Accelerated Contraction

February’s index dropped from the more positive readings seen in January, landing on par with July 2023 and remaining in contraction mode.

-

Moldmaking Accelerated Contraction in June

June’s moldmaking index took a relatively steep downward turn, landing at a new low for the year.

-

Moldmaking Sector Sees Future Optimism Despite Current Challenges Subhead

Strong future expectations signal potential rebound as automotive and medical sectors prepare for growth.