Moldmaking Activity Has Contracted in a Desirable Direction

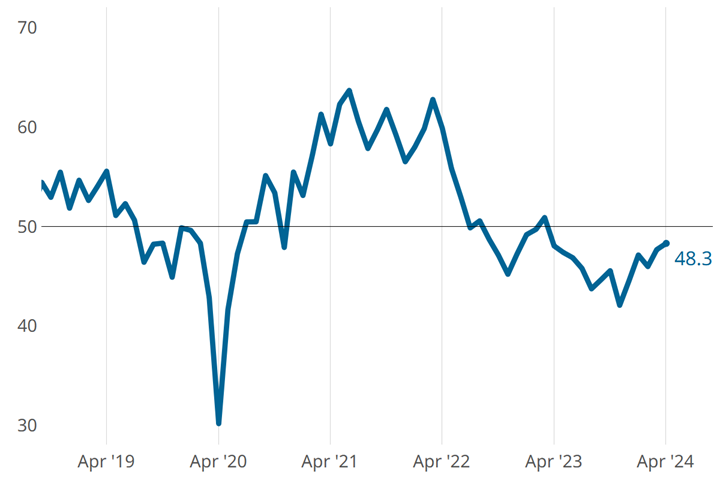

April’s moldmaking index contracted again but continued to inch toward a reading of 50 — the hurdle to cross before entering expansion.

The moldmaking index continues to inch toward a reading of 50, up 0.7 points in April. Photo Credit (All Images) | Gardner Intelligence

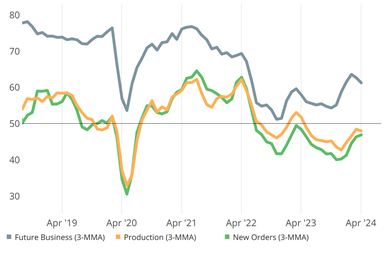

The Gardner Business Index (GBI) Moldmaking ended April at a reading of 48.3, up 0.7 points from March, indicating that moldmaking activity contracted at a slower rate. This was driven primarily by slowed contraction of key components, new orders and production.

These components were not the only ones experiencing slowed contraction, however. Backlog has maintained this activity for three months in a row now, and continues to do so at an increasing rate, which is not surprising given the nature of the metric (backlog generally lags new orders and production).

Employment and exports hummed along at steadily contracting rates while supplier deliveries lengthened just a little faster again in April.

April’s slowed contraction in new orders and production drove slowed contraction for the total index. (This graph shows three-month moving averages.)

A bit concerning is that in April, expectations for future business (not part of the GBI calculation), while still positive, and at a reading higher than it has been in almost two years, accelerated a little slower for the second month in a row.

Nevertheless, April remained a month with mostly positive signs in moldmaking activity, such that (once again) the overall index crossing into expansion should not be out of the realm of possibility in the near future.

Related Content

-

Moldmaking Sector Sees Future Optimism Despite Current Challenges Subhead

Strong future expectations signal potential rebound as automotive and medical sectors prepare for growth.

-

Moldmaking Activity Contracted a Bit Faster

May’s moldmaking index took a downward turn, departing from what had been a five-month path of slowing contraction, inching toward flat.

-

Moldmaking Activity Begins 2024 With Slowed Contraction

January index reading reflects February-March 2023 readings as it slinks toward a reading of 50. There are high hopes that it may continue on this path to sustained expansion for 2024.