Looking Back and Planning Forward

A review of a decade of global challenges and change.

Ten years ago, U.S. moldmakers were not by-and-large aware of the upcoming wave of competition about to hit our shores.

Sure, we’d seen tools from Portugal and Taiwan, along with Japanese tools for Japanese transplants, but these imports had not yet made a big dent. Back then, Canada was the source of 46 percent of imported molds, and China was barely on the map.

Most U.S. moldmakers did not feel, in 1998, that an influx of overseas tools would be such a big issue.

Youth and Money

A leading concern back then was that the average age of toolmakers was the mid to late fifties, which made the upcoming shortage of labor also a top concern.

However, the larger problem ahead could not be solved with a flood of young, new toolmakers, as it would not have driven down compensation costs to be at or below that of other countries.

Making the playing field further uneven was the changing state of global currencies. Not only were these lower labor cost markets, but 10 years ago a strengthening dollar meant that soon anything from outside the U.S. would cost less.

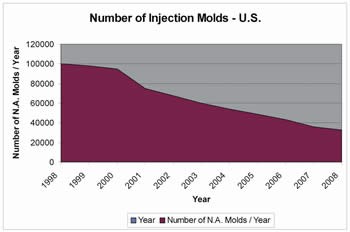

A combination of the Asia currency crisis of 1997, a global proliferation of CAD/CAM capability, young toolmakers cranking out of capable polytechnics, and the new connectivity of an Internet world where we are all in the same room at once resulted not in a cyclical downturn, but in a phenomenal shift that would affect the tooling industry. And a visit to a local Big Box retailer shows that the molding, assembling and packaging operations also followed.

Shift Happens

Over the course of a century, U.S. manufacturers did it to Europe. For the past half century, plastics did it to metals and glass. Perhaps it was ingrained in the mindsets of U.S. plastics manufacturers and toolmakers that life ahead would forever be on the offense.

As a result of the financial collapse in their home markets, fax machines frequently streamed introduction letters from Asian manufacturers desperate and hungry for sales. Meanwhile, OEMs such as Apple Computer, Fisher-Price, and Motorola worked extensively to develop Asian toolmakers with access to globally available steels, hot runners and components.

Roving Reporter

It’s easy to find reasons for not being out of the office for a couple weeks. However, there was one reason in 1997 I first journeyed to Asia: Know thy competition, and learn of the state of the competition to my U.S. customer base.

What was found at the time was that active mold builders exporting to the U.S. were “not there yet” in terms of building molds exactly to U.S. standards. But, in a short amount of time they would be. If not exactly, at least close enough in the eyes of tool buyers with mandates from above.

Turning what I saw into articles and presentations, and with hopes that the messenger wouldn’t be shot, the blunt truth was delivered:

“Yes, many Asian mold builders build junk, but there are also a select few building tools considered acceptable by their customers. Yes, these toolmakers have UniGraphics, and true 3-D design is more common than with many of their AutoCad wielding U.S. competitors. Yes, there is availability of Swedish steels, Canadian hot runner systems, and U.S. and German components. Yes, their local schools are churning out young workers familiar with molds, their governments recognize the profound value of tooling and are subsidizing apprentice training and picking up half of all expenses when mold exporters visit a U.S. or European trade show. Yes, they have a local market to serve, but the biggest, juiciest, lowest-lying fruit is ‘your’ customer. For us in the U.S., it is all going to be different in three to five years.”

On the Bus

Hoping that a reality check would jolt our mold brethren into action, I led a Society of the Plastics Industry (SPI) sponsored trade mission to Asia. Not with a “if you can’t beat them, join them” purpose. Rather, the message was “let’s feel the pressure first hand so that as we move forward we know what we should specialize in and what we should not.”

Promotional support from trade groups and magazines was outstanding. The SPI, SPE, and AMBA gave strong airplay to the upcoming trade mission. MoldMaking Technology completely understood the significance and splashed word of the mission throughout their publication.

Unfortunately, it was all met with a deafening silence. In October of 1998, the trade mission was cancelled, as only six companies had signed up, but after a second round of promotion, 18 companies were signed up for the trip for January 1999.

It was a great expedition, and I still frequently bump into many of the attendees. Those attendees have greatly outperformed the market in general, and not by “caving in to Asia”, but rather by turning their companies toward more lucrative specialties.

In Print

With hopes that more than just 18 companies in the U.S. could benefit from the trade mission, MoldMaking Technology published a four-part series, “Growth Strategies for the U.S. Moldbuilder” in early 2000, with the AMBA kind enough to hand out reprints at NPE 2000.

The message then was more than just awareness of Asia. Key parts of the series emphasized the benefits of focusing on one or more of the following:

- Become an expert in rapid technologies in order to become an extension of your customer’s new product development process.

- Keep your mandate-wielding customer off the plane by becoming the liaison for tools that they require to be from a lower cost country, and thereby have visibility of their programs in order to service more complex tools requiring U.S. manufacturing.

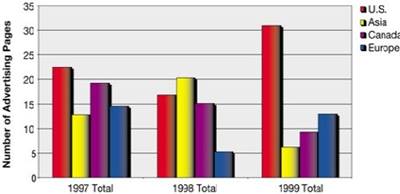

- Become nimble in promoting your company. Take your specialty, be it medical/packaging tools, two-shot molds, liquid silicone rubber tools, etc, and shout it from the mountaintops. A modest budget for ads, speaking opportunities with industry groups and technical articles in magazines all enable you to be seen as the expert that you are.

The message concluded with “This won’t get executed in a week … Set a strategic plan that charts milestones for the years ahead.”

Another SPI trade mission was added in January of 2002, to the Tex/Mex border, to present the selling opportunity to U.S. mold builders. Again with the arm twisting, again it had the support of the AMBA and MoldMaking Technology, again the minimum was barely met, and again those attending felt it was an incredible strategic value.

Uncle Sam

Surely Washington will ride to the rescue of our essential beloved industry, right? Wrong.

The SPI sponsored a fly-in in May of 2003, where attendees could hear from trade and government experts, and furthermore meet with key elected officials. The pinch of free trade was being felt, so this time it was a packed house.

I and an ever-optimistic Cyndi Petrucci (now Kustush) of Save American Manufacturing—U.S.A., met privately with Rep. Phil English (R-PA) who had a sympathetic ear towards Erie, PA-area toolmaking woes. We also met with my Representative, Phil Crane (R-IL), who, as the chairman of the House Ways and Means Committee, had ultimate clout in influencing the House’s agenda. After lukewarm responses to what we described, I told Cyndi as we left our nation’s capital, “We’re on our own, baby.”

With the advent of 9/11, getting any attention from Washington D.C. then got exponentially more difficult. We must keep the message going to Washington, but we’re still on our own.

Winners and Losers

We need not be rudderless, need not be tossed about by the continued foreign storm, and need not hope for the U.S. Cavalry to ride in and save the day.

Recently the weak U.S. dollar caused a leading German toolmaker to tell me, “We are now competing with a low cost country … the U.S.” Incoming tool buyers are increasingly less tooling experienced, and serving as a partner is an opportunity.

The winners in the 10 years ahead will have the discipline to plan and execute a strategy. One that is conceived for a two- to three-year period, and advanced by execution one week at a time.

With the signs now that some work truly is coming back, the winners will seize the opportunity to secure long-term viability.

Summary

There were signs 10 years ago that trouble was ahead. Some planned and remained viable, others did not. Many were somewhere in between.

There are opportunities now, and resources are available. Though no trade missions are underway or in the works, it’s easier now to research markets and visit new regions on our own.

We can take this opportunity, on MoldMaking Technology’s 10th anniversary, to reflect back and plan ahead. And although this publication, along with the AMBA, SPI, and SPE, can assist, we’re on our own and it’s up to us move forward.

Related Content

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreHow to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

Read MoreSteps for Determining Better Mold Prices

Improving your mold pricing requires a deeper understanding of your business.

Read MoreThe Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreRead Next

Growth Strategies for the U.S. Moldmaker - Understanding Your Competition - Here and Abroad

This article begins a four part series that will describe the current competitive conditions in the plastics tooling industry and what some companies are doing to grow their businesses amidst challenging conditions.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More