Growth Strategies for the U.S. Moldmaker - Understanding Your Competition - Here and Abroad

This article begins a four part series that will describe the current competitive conditions in the plastics tooling industry and what some companies are doing to grow their businesses amidst challenging conditions.

Those watching the climate of the mold building industry in North America have seen changes in recent times - rapidly evolving technologies, increasingly challenging customer criteria and continued concerns about tomorrow's workforce. But if that isn't making life interesting enough, add in concerns about foreign competition and you really have a collection of factors that can make even the bravest of hearts concerned about the future.

This article begins a four-part series that will describe the current competitive conditions in the plastics tooling industry and what some companies are doing to grow their businesses amidst challenging conditions.

Where Is It Going?

As one who grew up in and around the mold business, and now whose business is overwhelmingly linked to the fate of the U.S. moldmaker, there is more than just a passing interest in where this is all headed in the next five, 10 or 20 years.

In the spring of 1998, during a conversation with Jim Meinert, international sales director of Snider Mold (Mequon, WI), the issue of the future competitiveness of the moldmaking industry came up. "One thing's for sure, you won't learn anything sitting at your desk," Meinert said. "Buy a ticket and get on a plane."

There are several mold markets that have been promoting their competitiveness to U.S. OEMs and molders. These include Canada, Ireland, Italy and Portugal - along with many countries throughout Asia. Lately, the most promotion has been coming out of Taiwan, Hong Kong and China, so it was decided that in order to get an education on the competitive forces in the world, these would be the places to visit.

In a 10-day trip that included stops in Shanghai, Hong Kong and Shenzhen, a trade show was walked; a variety of molders were called upon; numerous mold building companies were visited; and a number of American tooling engineers who are sourcing tools in Asia shared their success and failure stories, while Asian moldmakers directly stated to what degree they planned on exponentially growing their business and from where that growth would be coming.

The Good and Bad News

Much can be learned from visiting an overseas mold building market. But to sum it up, it can be said that there is both good news and bad news for the U.S. moldmaker.

The good news for the U.S. mold builder is that your location is the envy of the world. You are in the biggest economy in the world with the most stable government. The largest OEMs on the earth are right here within reach. You can service what you sell. You speak the same language as your customer. You have an existing relationship. What better place in the world to be?

However, the bad news for the U.S. mold builder also is that your location is the envy of the world. Overseas moldmakers want what you have - to sell to the world's largest market and take in some of those stable American dollars. To achieve this, overseas moldmakers will use their lower-priced workforce and government subsidies to market to companies that may be feeling the global squeeze on their profit margins. And although a U.S. moldmaker may speak the language better, the overseas mold-maker knows that a potential customer will strain to comprehend what is being said - especially when the conversation is about savings.

So, knowing that this location is the envy of the world, will that turn out to be good news or bad news for a U.S. mold building company? The answer to that question depends on whether U.S. mold- makers correctly commit to using their location as an advantage.

What About Them?

What is an overseas moldmaker like? That's like asking what a North American restaurant is like. Do you describe a Manhattan bistro or a tortilla being flipped on the streets of Tijuana? One can find that same degree of difference in overseas moldmakers.

Walk into a top moldmaker in Taiwan or Singapore - which is gearing its work toward export - and you will see more that looks familiar than foreign. There are machining centers from Japan, mold steels from Germany, hot runner systems and components from Germany, U.S. and Canada, etc. Just as U.S. moldmakers have access to these products, so do moldmakers around the globe.

While per capita there may be fewer mold building companies that would be considered equivalent to a quality U.S. mold shop, capable companies do exist. We all hear horror stories from companies that have placed tools overseas, but then we also hear that large OEMs have successfully sourced tooling there for years. Which is true? Both.

Another factor to keep in mind is that the U.S. moldmaker is not alone when it comes to competitive concerns - you can speak with a moldmaker in Portugal concerned about "the cheap labor in Poland," a moldmaker in Singapore con-cerned about "the cheap labor in Malaysia" and a moldmaker in Taiwan concerned about "the cheap labor in China." Areas that are a concern to a U.S. mold builder contain their own fierce competitive climate within their market. Therefore, many of these overseas mold-makers are setting up production plants in Malaysia, China, etc., to be competitive in their own country. For example, there are state-of-the-art manufacturing facilities with 50 employees in Hong Kong - one of the most expensive cities in the world to live in - and that same company operating a lower-tech manufacturing facility in China containing hundreds of workers.

Although this could be a strong competitive combination, there are significant practical difficulties and cultural differences for companies that conduct business across that border. It's not as easy for them as one might think, and the moldmaking companies that are doing this well while also marketing to the U.S. are few.

Not a Bad Business to Be In

Taking an overall look at the world of manufacturing, one can see that plastics tooling is a great business with which to be involved. There are more and more con-sumers in the world and these consumers want more and more 'stuff' and plastics tooling is right there riding those coattails for growth - from computers and cars to better health care and bottled water. With that said, how can a U.S. moldmaker participate in that growth while fending off competitors who also recognize the opportunities?

Business Profiles From A to Z

After not only attending but exhibiting at trade shows in Asia and Europe and extensively visiting mold building companies throughout the world, I've seen certain patterns and characteristics emerge time and time again. Regardless of the mold builder's country of origin, an impartial observer can visit these companies and see a definite variety of mindsets, and subsequently, a variety of growth patterns and anticipated rates of success.

To illustrate this, let's examine two hypothetical companies. Company A is called "Always The Same Tool & Mold," while Company Z is called "Zooming Forward Industries, Inc."

Company A - as the name would imply - is not really open to adapting to the changing conditions in the market or to its customers' changing needs. This company will play it safe - if the customer wants what they have, fine, if not, oh well, why take chances. Minimal growth is expected here if conditions for this company's customers are changing.

Company Z - as the name implies - is very dynamic and open to change. This company will react to market conditions and competitive factors in order to meet its customers' changing requirements. Within this company, there will be a nearly limitless potential for growth. Hopefully, not too many of our companies sound like Company A, but at the same time not too many of us feel completely like Company Z every working day either. Most companies are somewhere in between, trying to get their business a little closer to Company Z every day, every year. It's definitely more profitable, more secure and more fun.

Growth Strategies

There are certain attributes and actions, which characterize a mold building company that resemble the latter of the two hypothetical examples. A growth strategy consists of paying attention to particular areas - enabling a competitive advantage. Of course, training apprentices, maintaining a safe and positive work environment, adding benefits to retain the workforce, etc. are essential strategies to a successful existence, but are not necessarily part of a strategy to excel past competitors.

A strategy for increasing competitiveness may contain a mix of the following factors:

- Harness time compression technologies.

More and more, time-to-market demands are driving required mold deliveries down. For those who are experts in time compression technology and pursuing the work that is benefited by it, the competitive playing field narrows greatly. - Utilize alliances to achieve maximum competitiveness.

Some companies are using overseas agents to sell their molds into overseas markets. Others are sourcing out portions of multiple tooling programs to overseas sources. Still others utilize a combination of both. Alliances also can be formed with other domestic moldmakers - as we are seeing now with some U.S. moldmakers merging, acquiring or forming an umbrella company so that they can offer their customers both full-service capabilities along with the expertise within a niche. - Market aggressively.

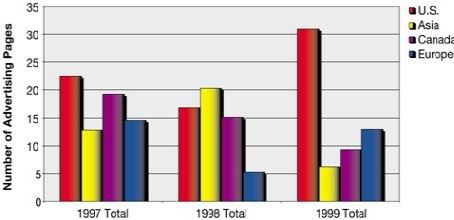

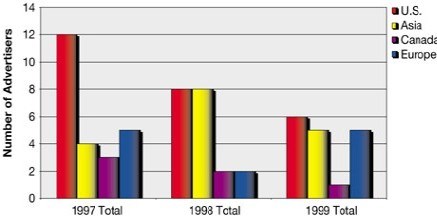

In leading plastics industry publications, moldmakers from outside of the U.S. as a whole are advertising at a rate that is relatively comparable to that of U.S. moldmakers. (see Charts Ia and b) Although in the past it could have been said that "I don't have to advertise," more and more companies are finding that if they don't promote their names and specialties to their customer base, the competition will. - Work a strategic plan.

This final point is the least spectacular, but the most important. A company can strongly benefit from having a real Board of Directors and consistently working a three- to five-year strategic plan. Step by step, a strategic plan can give the appropriate attention to the factors listed above, developing each in compliance with a documented, yet reviewable course.

Know The Competition

The more we know about our competition - both domestic and overseas - the better we can put together an effective strategy to grow. And because most moldmakers have more of a read on their domestic competitors than overseas, developing one's competitive knowledge may include "getting on a plane."

Overseas trade shows, which are listed in major publications, are a great place to begin and not as challenging or as costly to visit as one might think. In fact, after the trip many find it almost disturbing that it wasn't as difficult as they had expected it would be for them ... or how it might be for their customer. Even if one never intends to buy or sell anything from outside of U.S. borders, understanding overseas competitors will allow him/her to execute a strategic plan with confidence.

A Growth Industry in a Growing Market

As mentioned earlier, the plastics tooling industry is one of growth. The region of the market in which we are located within the U.S. is not a bad place to be. Whether our location will be used as an advantage or work against us as a disadvantage depends primarily on our mindset, and subsequently on our actions.

The bottom line is that we must meet our customers' needs by whatever means necessary to keep the primary contact - the tooling engineer - away from the competition.

Step by Step

Subsequent articles will examine:

- Rapid Technologies: How are companies profiting from this today?

- Overseas Exploration: Moldmakers participating in the global market.

- Positioning the Company: Formulate a three-year strategy - develop a marketing plan suited for any size mold building company.

If your responsibility is charting the path ahead for your mold building company, it is our hope that this series will be of interest and benefit to you, and not only provide an overview, but also the specifics to help you formulate a step-by-step growth strategy for your company.

Related Content

Hands-on Workshop Teaches Mold Maintenance Process

Intensive workshop teaches the process of mold maintenance to help put an end to the firefighting culture of many toolrooms.

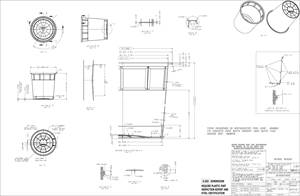

Read MoreHow to Determine the Proper Vent Depth

Vent depth is critical to optimizing mold performance, so here is one approach to finding that elusive right number.

Read MoreIt Starts With the Part: A Plastic Part Checklist Ensures Good Mold Design

All successful mold build projects start with examining the part to be molded to ensure it is moldable and will meet the customers' production objectives.

Read MoreSurface Finish: Understanding Mold Surface Lingo

The correlation between the units of measure used to define mold surfaces is a commonly raised question. This article will lay these units of measure side by side in a conversion format so that companies can confidently understand with what they are dealing.

Read MoreRead Next

Reasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read More.jpg;maxWidth=970;quality=90)

.jpg;maxWidth=300;quality=90)