Keeping Up with AM Technologies

A global review and analysis of the technologies and applications of additive manufacturing and 3-D printing.

The additive manufacturing industry was exceptionally active in the past year. New machines were introduced on both the high and low ends of the cost spectrum. Tougher plastic materials and new metal powders were commercialized. Manufacturers of systems that produce metal parts added quality control feedback capabilities to their offerings and experienced a new level of success in the marketplace. The economic recovery is well underway for the additive manufacturing industry.

System manufacturers and service providers reported an upswing in business activity in the latter part of 2010, and that positive trend has continued through the first half of 2011. All indications suggest that the Great Recession is behind us, and profitability has returned to the industry.

The demand for products and services from additive-manufacturing technology has been strong over its 23-year history. The compound annual growth rate (CAGR) of revenues produced by all products and services over this period worldwide is an impressive 26.2percent. The CAGR was 20.7percent over the past seven years.

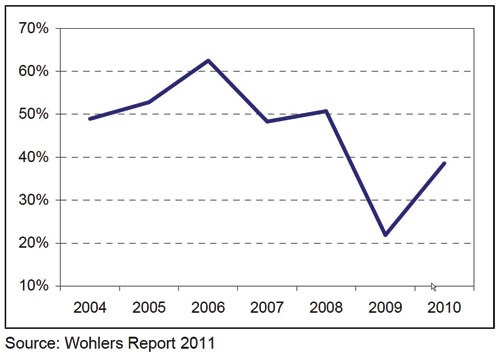

The market for additive manufacturing in 2010, consisting of all products and services worldwide, grew 24.1percent (CAGR) to $1.325 billon, up from $1.068 billion the year before. The industry declined 9.7percent in 2009 after growing by 3.7percent in 2008 and 16percent in 2007. Unit sales were exceptional in 2010, even when excluding the explosive growth of the very low-cost systems that originated from open-source machine development. Growth of the established, industry-proven additive manufacturing systems was stronger in 2010 than it had been for six years. Service providers rebounded strongly in 2010 after a difficult 2009.

Major Trend

An interesting development in the AM industry is the support it provides to the maker movement, a collection of activities in the large and growing do-it-yourself (DIY) community. In the digital age of 3-D modeling and 3-D printing, DIY has taken on a new meaning. Never before have “makers” and DIYers received so much attention. The catalyst for the maker movement has been the open-source systems and kits that range in price from about $750 to $4,000. These machines do not produce parts at industry standard levels of quality, but they provide access to an entirely new set of customers. The open-source RepRap project developed quickly, and became surprisingly popular. It was the genesis of Bits From Bytes (UK) in 2008 and MakerBot in 2009. These 3-D printers are variations of RepRap. The UP! machine from Delta Micro Factory Corp. (Beijing, China) was likely inspired by the RepRap work as well. Fab@Home is another open-source development, but it employs a syringe instead of a filament on a spool. Together, more than 10,000 assembled machines and kits are estimated to have been placed by these five developments. This is unprecedented, and to some, nothing short of astounding.

Other efforts have contributed to the growth of the DIY maker movement. Shapeways, a company launched by the Dutch electronics giant Philips and now headquartered in New York, offers an online marketplace for products made by additive manufacturing. The i.materialise division of Materialise (Leuven, Belgium) is attempting to bring AM and 3-D printing within everyone’s reach by supplying the tools and manufacturing for people with ideas. A third example is Ponoko (Wellington, New Zealand), a company that offers a “personal factory” for anyone wanting to create an object or product from an idea.

Foreign AM Activity Europe was once seen primarily as a customer of AM systems manufactured in the U.S. European organizations continue to purchase systems from U.S. manufacturers, but they have also come to rely on machines and materials now available from European companies. In fact, 13 companies in Europe now manufacture AM systems. Some of the most interesting AM developments in metals are coming from Europe. Arcam, EOS, Concept Laser, Irepa Laser, MTT Technologies, Phenix Systems, ReaLizer, and SLM Solutions manufacture machines that produce metal parts. When taking all of them into account, far more AM parts in metal are being produced on these systems than from other machines manufactured elsewhere in the world, including the U.S.

Chart 1 shows cumulative market shares through the end of 2010. The chart represents metal-based machine installations worldwide. SLM Solutions was excluded because it was a part of MTT Technologies until late 2010.

Service Provider Update

Service providers, also referred to as service bureaus, offer part building services to design and manufacturing organizations as an outsourced service. These services typically include AM parts as well as secondary services such as design, CAD, reverse engineering, cast urethane parts, custom painting, CNC, metal castings, and injection molding. For many years, Wohlers Associates has sought input from service providers to help determine the state of the industry. This year, 70 companies in 19 countries participated in a formal survey. Thirty-seven are from the U.S., six from Germany, four from India, three from Belgium and the UK, two each from Australia, Italy, and Turkey, and one each from Brazil, Canada, China, Greece, Japan, New Zealand, Portugal, South Africa, Spain, Sweden, and Thailand.

Most of the service providers offer services other than additive manufacturing. The most popular are design and CAD services, which are offered by 75percent of those surveyed. Urethane casting, sometimes referred to as vacuum casting, is the second most popular and offered by 68.8percent of the respondents. Engineering services, at 59.4percent, is third. Other popular services include injection mold tooling (45.3percent), 3-D scanning/reverse engineering (43.8percent), and injection molding (40.6percent). Only 26.6percent of the respondents offer metal casting.

Graph 1 shows the percentage of survey respondents that added additive manufacturing systems to their operations. Nearly 40percent added new machines in 2010, compared to less than 22percent the year before. In 2009, companies showed that they neither had the cash to invest in additional systems nor the confidence that business would be there if they did. Several companies sold off unused capacity to lower overhead and provide additional working capital. With an improving economy and increasing product development and manufacturing, the situation changed in 2010.

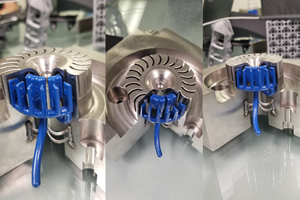

Direct Part Production The use of AM for production is having an impact on many industries. Among them are aerospace, military, medicine, dentistry, motorsports, automotive, and industrial machinery. As machines and materials improve, expect AM’s impact on manufacturing to become much greater. AM is also having an impact on the production of many consumer products. Among them are furniture, home accessories, art, jewelry, games and entertainment, and collectables. Also being produced are gifts, awards, trophies, and even fashion products.

ReaLizer GmbH is using its SLM 50 bench-top machine to produce gold jewelry. Meanwhile, Concept Laser has introduced the Mlab machine, which is capable of producing parts in gold alloys. Both companies are trying to gain a foothold in the large and lucrative jewelry market.

Iris van Herpen showed her Escapism couture collection during the haute couture week in Paris in early 2011. The collection of fashion products were produced in collaboration between Iris van Herpen, Daniel Wildrig, and the .MGX division of Materialise. An example is shown on the front cover of this report (see Figure 1, lower left).

The Future

Low-cost 3-D printers affect both the professional and consumer markets. The increased sale of these machines over the past few years has taken AM mainstream more than any other single development. 3-D printers have helped spread the technology and made it more accessible to students, researchers, do-it-yourself enthusiasts, inventors, and entrepreneurs. Designers and engineers are considering new approaches when developing products for additive manufacturing. The old habits of “design for manufacture” could become a thing of the past, as AM can make almost any shape or geometric feature. As AM systems and materials are used more frequently for manufacturing, expect to see new products that previously would have been very difficult or impossible to manufacture.

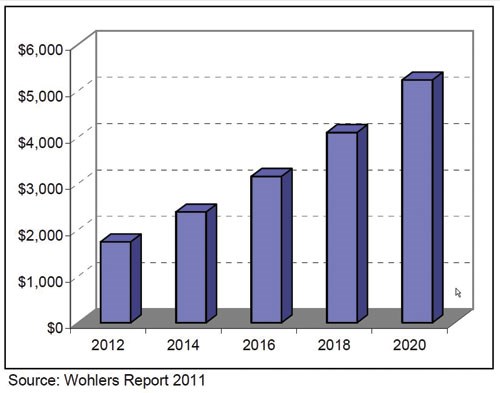

The additive manufacturing industry is expected to continue its double-digit growth over the next several years. By 2016, Wohlers Associates believes that the sale of AM products and services will exceed $3 billion worldwide, as shown in Graph 2. By 2020, the industry is expected to surpass the $5 billion mark. The numbers in the vertical axis are in millions of dollars.

Moving Forward

The future development with the greatest impact may be one that is impossible to anticipate. Terms such as “outlier” and “paradigm change” describe this phenomenon, an event or development from beyond our narrow vision that is difficult to predict and changes everything. In the context of the AM industry, this could be a new material, a new application, or some type of industry certification. Or it could be a development outside the industry, such as a web interface for product design, global security and trade issue, or an energy or climate crisis, to speculate on just a few possibilities.

Related Content

MMT Chats: 4 Keys to a Successful Mold-Building Operation: Innovation, Transparency, Accessibility and Relationship

MoldMaking Technology Editorial Director Christina Fuges chats with Steve Michon, co-owner of Zero Tolerance in Clinton Township, Michigan, about the excitement of solving problems, the benefits of showing gratitude, the real struggle with delegation and the importance of staying on top of technology. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MoreLarge Hybrid Steel Insert Solves Deformation, Dimensionality, Cycle Time Problems

DMLS printers using metal additive powders selected by Linear AMS to produce high-quality, accurate, consistent 3D-printed mold components with certification and traceability.

Read MorePrecision Meets Innovation at IMTS 2024

After attending IMTS, it's clear that the integration of advanced technologies is ready to enhance precision, efficiency and automation in mold manufacturing processes. It’s a massive event, so here’s a glimpse of what the MMT team experienced firsthand.

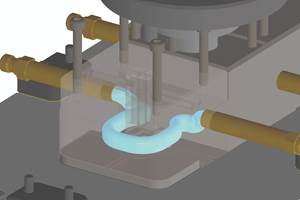

Read MoreHow to Supply Cooling to Additive Tooling

Additive tooling provides limitless options for cooling a mold’s difficult-to-cool areas.

Read MoreRead Next

Analysis of the Additive Manufacturing (AM) Industry Worldwide, Part I

After more than two decades of research, development and use, the additive manufacturing industry continues to expand with the introduction of new technologies, methods and applications. Additive processes have had a tremendous impact on design and manufacturing, and this impact will continue to grow in the coming years.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More