CAD Interoperability: Its Costs to Mold Design and Mfg

An industry survey reveals some real data on how CAD interoperability is affecting mold shops.

Imagine that you work at a large, multinational corporation. As a native English speaker, you consider English the “de facto” business language and don’t give it any further thought. However, as time progresses, you begin to realize that al-though you can communicate with foreign colleagues at a basic level, it is extremely difficult, and sometimes impossible, to translate larger, more abstract concepts or, for that matter, intricate details. Yet, these are the very concepts and details that are often critical to business success.

This situation exists in other departments throughout your company and impacts relationships with partners, suppliers and customers too. Now imagine that you’ve been forced to work in this manner for more than 20 years with no meaningful progress and no solution in the foreseeable future. This type of situation is sure to create intense frustration on all sides, and has negative effects on productivity and the company’s bottom line.

The CAD Challenge

This is the unfortunate reality of the CAD software industry, which has been working within the constraints of a major communication issue for the last 20 years. There is no lack of CAD vendors, each with their own language. CAD tools range from the more sophisticated, high-end to mid- and low-end—each varying in functionality and price point.

Large manufacturers have their own supply chains. So, for example, a large auto-motive manufacturer shares product data files internally and externally, with second and third tier suppliers all using the same CAD tool to view models created by others in the chain and make changes in them. Or, at least that’s what you would think, right?

In fact, while we’d all like to think sharing files with co-workers and chosen partners is easy, it is hard. Too hard. OEMs often try to require their suppliers to use the same tool they do in order to avoid complications and time costs. But, the fact is, these suppliers, usually small job shops, are likely to have multiple customers, each requiring a specific tool, none of which may be most appropriate to the task at hand.

The costs of this problem—from maintenance of and employee training on multiple CAD programs to time-to-market delays—are acknowledged by corporate managers, but the bottom line costs are hard to quantify, until now.

Bottom Line Cost Data

Recently two surveys1 were conducted as part of a continuing effort to determine the extent and cost of this problem. The first survey was broad—including CAD users from all industries and company sizes—and drew more than 1,250 respondents, mostly based in North America. About a third of the respondents were from large companies; the majority of responses were from small ones, such as mold shops.

While there was a wide range of responses across the 15 different industries represented, definite patterns appeared in the depth of interoperability issues. Specifically, the mold/tool/die industries ranked among the industries in having the most issues with file formats, and had the highest levels of file format disparity.

One of the most surprising interopera-bility issues the survey revealed is the over-all lack of standardization inside compan-ies, with only 30 percent of respondents always receiving CAD models from their coworkers in their preferred CAD format.

The situation worsens as data exchange with outside companies enters the picture. These results varied from industry to industry. In the mold/tool/die and forging industries, more than 90 percent of respondents said they receive only half or fewer models from other companies in their preferred CAD format, compared to a cross-industry rate of 75 percent (see Figure 1).

To further complicate matters, 42 percent of mold/tool/die/ and forging industry respondents reported they use four or more different CAD tools each month, compared to a cross-industry rate of 24 percent (see Figure 2).

| Figure 2 | |||||

| Rank |

Industry | Rank in external |

Rank in internal | Rank in # of tools | Average Rank |

| 1 | Consumer Products | 2 | 6 | 5 | 4.3 |

| 2 | Engineering and Design Services | 3 | 2 | 8 | 4.3 |

| 3 | Electric Utilities & Telecommunications | 8 | 1 | 6 | 5.0 |

| 4 | Industrial Components | 1 | 4 | 10 | 5.0 |

| 5 | Medical Devices & Equipment and Scientific & Measuring Equipment | 5 | 3 | 7 | 5.0 |

| 6 | Heavy Equipment & Construction and Metal Mining | 7 | 11 | 1 | 6.3 |

| 7 | Education | 12 | 5 | 3 | 6.7 |

| 8 | Aerospace & Defense | 9 | 9 | 4 | 7.3 |

| 9 | Chemical Manufacturing and Manufacturing | 6 | 7 | 9 | 7.3 |

| 10 | Electronics, Computing | 11 | 10 | 2 | 7.7 |

| 11 | Mold/Tool/Die/Forgings | 4 | 12 | 12 | 9.3 |

| 12 | Automotive and Transportation | 10 | 8 | 11 | 9.7 |

Challenges Job Shops Face

More than 500 respondents participated in a second survey2, which focused exclusively on companies exchanging CAD files with external clients only—primarily job shops, like mold manufacturers, and second- and third-tier suppliers. These companies generally have limited financial resources, yet their livelihood depends on being able to compete in a complex multi-CAD environment. This survey confirmed that the lack of CAD standardization is placing a heavy burden on these companies.

For example, over one-third of respondents (37 percent) said that their use of a particular CAD tool and ability to share files in a particular format was part of the reason they gained business in the first place, indicating that a high percentage of OEMs make it their business to ask about CAD usage during the decision making process.

The survey also revealed that almost two-thirds (63 percent) of respondents were required to receive CAD files in a specific format. Of those, over one-quarter (28 percent) had to return them in a different format. In addition, they may have to use STEP and IGES as go-between formats, creating a costly environment for these small companies—requiring them to buy multiple CAD tools and also expend valuable resources on training and support.

Shockingly, among all respondents, more than 20 different CAD tools were named as the tool the shops were most likely to use to receive files from clients. No single file format was used by more than 7 percent of respondents, reinforcing the picture of a fragmented industry.

Compounding the problem, an over-whelming number of respondents (84 percent) share CAD files with multiple clients, and 80 percent of those said that these customers all required different CAD formats, dramatically increasing the scope of the problem.

Perhaps most disturbing was the reve-lation that customer CAD requirements add significantly to business costs, with over one-quarter (28 percent) of respondents estimating they add more than 20 percent.

When broken down further, results showed that small and medium job shops are most affected by CAD interoperability issues. In particular, the majority of small shops experience a business cost increase of up to 10 percent, a significant amount for com-panies of this size (see Figure 3).

Summary

Companies are looking for answers to their interoperability problems, which per-sist even with the use of industry standards and translator tools. In the meantime, certain industry segments, like job shops, are shouldering a disproportionate amount of pressure and financial drain to secure new business and continue to meet client demands.

1,2 The surveys noted in this article, which were done as part of a continuing effort to determine the extent and cost of this problem were conducted by Kubotek USA (Marlborough, MA).

Related Content

What is Scientific Maintenance? Part 2

Part two of this three-part series explains specific data that toolrooms must collect, analyze and use to truly advance to a scientific maintenance culture where you can measure real data and drive decisions.

Read MoreHow to Select a Mold Temperature Controller

White paper shares how cooling channel analysis, which collects maximum pressure drop, total flow rate and heat dissipation, eases the performance evaluation of mold temperature controllers.

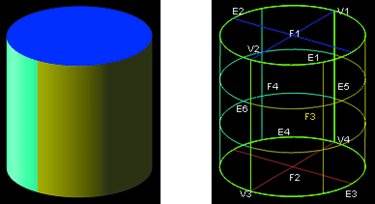

Read MoreHow to Manage Wall Thickness Changes in Your Mold Design

To ensure even filling and cooling, consider wall section transitions, corners and fillets, ribs and bosses, lip and rim designs and CAE flow simulation software.

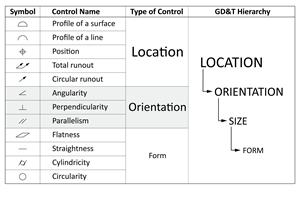

Read MoreTolerancing in Mold Design, Part 2: Using GD&T to Address Conventional Tolerancing Issues

Mold designers can achieve a single interpretation of workpiece functionality when following the American Society of Mechanical Engineers Geometric Dimensioning and Tolerancing standard.

Read MoreRead Next

Overcoming the Obstacles to Interoperability

Technical know-how and the right software can provide data transfer with a very high success rate.

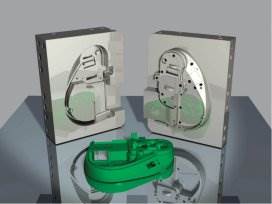

Read MoreHow to Overcome Interoperability Hurdles

CAD tools help moldmakers import and save information that may be lost in data translation from job to job.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read More