With a centuries-old glass-making tradition that crossed naturally over into creating molds for plastics parts in the 1940s, Portugal today is a hotbed of moldmaking and exporting, and molds from Portugal can be found in almost every major end market for plastics.

Portugal’s moldmaking hot spots, Marinha Grande and Oliveira de Azeméis, are located just 130 and 270 kilometers north of Lisbon, respectively. The regions combine more than 500 tool and moldmaking companies, many of them in walking distance from one another. The industry in these two regions employs a good 10,500 people, bringing the local unemployment rate down to less than four percent, according to Rui Feteira, commercial manager at a technical plastics company in Marinha Grande.

“Highly skilled people are difficult to find, so like many companies in the region, we invest in automation,” the commercial manager says. The company produces injection-molded parts to many Tier-1 suppliers to the automotive industry, which makes up 95 percent of the business. All of the molds that the company needs annually are made by local moldmakers. Five of them are in walking distance, producing high-quality molds in increasingly paperless production environments using the latest five-axis machines with pallet changers and other automation equipment.

Investments in R&D, Automation

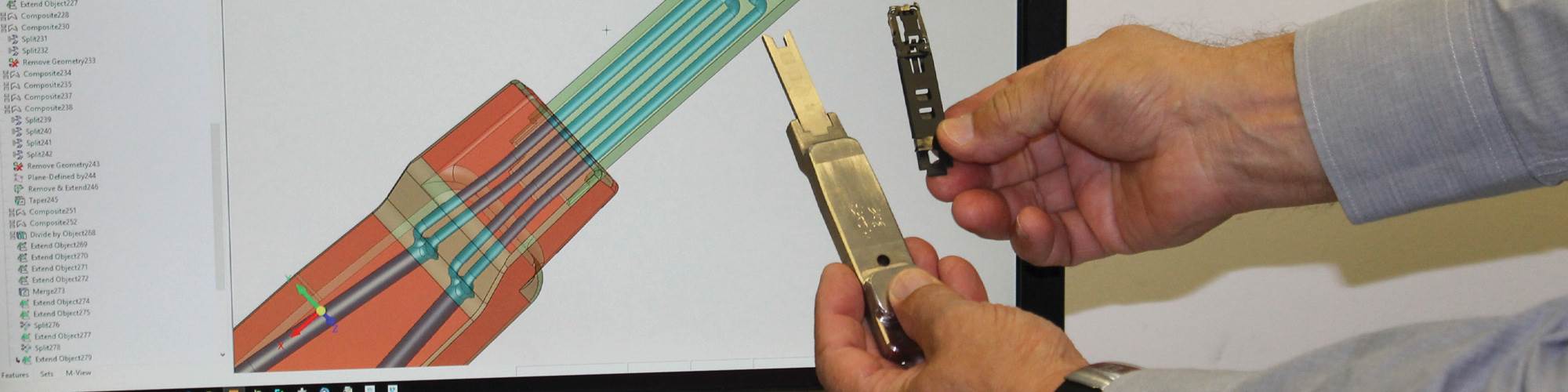

Most companies in this region report that they have invested in or have plans to invest in new five-axis machines, software, paperless production, lean management and automation equipment. Some companies also have invested heavily in new, modern buildings and work environments that are sure to attract the best talent in town.

So, what has happened since the GFC, when competition from low-cost countries and the sharp depreciation of the U.S. dollar against the euro combined to wreak havoc on the economy of the small European nation? By 2012, for example, mold exports to North America reached a historic low of just two percent of Portugal’s total mold exports. Today, exports to North America have risen to 10 percent, including Mexico, according to Cefamol, the National Association for the Molds Industry.

One reason is government funding through the “Portugal 2020” strategy, which is part of “Europe 2020,” a European strategy to foster productivity and employment, among other things. Portugal will receive about 25 billion euros until 2020 to reach the goals defined by the European strategy, such as decreasing the unemployment rate and stimulating the growth of businesses.

The other reasons are new and emerging markets, a strong automotive industry (82 percent of Portugal’s molds are for the automotive industry, followed by packaging (8 percent)) and the mold industry’s own efforts to retool itself.

About ten years ago, the sector’s local leaders, in close coordination with the Portuguese Ministry of Economy and Innovation, founded the private, nonprofit Pool-Net Association to manage the Portuguese engineering and tooling cluster. Formally recognized as a legal entity by the Portuguese government in 2009, the cluster’s goal is to drive innovation and coordinate firms in the manufacturing supply chain that are engaged in industrial design, engineering and product development, prototyping, tooling, plastic and metal parts production.

Sharp Rise in Product Exports

All this led to Portugal’s moldmaking industry being busy with work and realizing a sharp rise in product exports. “We are very proud of this industry, which experienced a growth of 8 percent last year,” Portugal’s Minister for Economic Affairs, Manuel Caldeira Cabral, says. “Portugal currently exports over 85 percent of production to 86 countries. In 2017, exports reached a value of 675 million euros. Exports and employment have doubled in the last 10 years. Europe is the main export zone, although exports to North America and Mexico are increasing.”

He says, “Our mold exports to the United States are increasing because of a growing demand for molds from various industries. However, in contrast to many other markets such as Mexico, our companies have no local production yet. But, there are very interesting possibilities in the development of relationships with companies in the United States.”

The Minister adds that while Portuguese moldmakers are much more integrated into the European supply chain, it is about finding the right way and the right opportunities in that value chain in other export markets (mainly automotive, which accounts for about 70 percent of production).

But tapping into new markets like Mexico is easier said than done, even though Mexico currently is the seventh largest location in the world for automotive production, and original equipment manufacturers (OEMs) will increase their capacities further to meet growing demand. Many of the Portuguese mold shops are supplying their products to all major OEMs as Tier-1 or Tier-2 suppliers, but since the majority of shops are too small to build up capacities to establish local subsidiaries, some of them have decided joined forces.

Key Collaboration

In contrast to many countries’ moldmaking industries, collaboration and cooperative manufacturing is common practice in Portugal—which is what five moldmakers (TJ Moldes, Ribermold, Moldit, Mold World and A. Silva Godinho) have done to service their Mexican customers.

“The companies decided to join forces to establish a factory for mold service, repair, maintenance and new molds in Mexico because Mexico is a growing market and local service for mold changes and repair is not sufficient,” Cefamol President João Faustino says. Plans are in place to establish a technical center in Mexico similar to Centimfe (Technological Center for the Moldmaking, Special Tooling and Plastic Industries) in Portugal. Moreover, the companies have already been training 14 Mexicans since June 2018 for their new production facility in Mexico.

In Portugal, business is good, Faustino says, but OEM investments are moderate because people are anxious about current changes in the automotive market, like e-mobility, “Dieselgate” and growing competition from China. As a result, prices for molds and tools decreased in 2018, and companies like his own in Marinha Grande, which earn 80 percent of their turnover from the automotive industry, have to adjust and develop strategies to optimize production. Therefore, Faustino has already introduced a paperless factory—similar to many companies in Portugal—lean principles such as 5s and plans to reorganize his production, which currently is divided into several factories according to mold size. In the future, Faustino will organize his factory by type of machining. That is to say, all roughing and finishing operations will be joined under separate roofs.

Additionally, Faustino has invested in eight new machining centers, which will be delivered next year, all five-axis with pallet systems and some with two tables to optimize set-ups and increase the degree of automation. “The goal is to be able to run the machines 24/7 unattended,” Faustino says.

About the Author

Barbara Schulz

Barbara Schulz is Gardner Business Media’s European correspondent. She can be reached at bschulz@gardnerweb.com.

Related Content

Mold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

Read MoreThink Safety: Eliminate Hazards Throughout the Shop

The tooling community is taking advantage of new products for safer mold shops and molding facilities.

Read MoreEditorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

Read MoreThe Critical Role of Management Representatives in ISO 9001

In ISO 9001 quality management systems, the Management Representative (MR) plays a crucial role. While the 2015 version of ISO 9001 no longer mandates this position, having a trusted management member serve as an MR remains vital for streamlining operations and maintaining quality standards.

Read MoreRead Next

Establishing a Production Startup in Mexico

In 2014, German moldmaker Siebenwurst established a subsidiary company in Querétaro, Mexico. It not only provides support to other German companies in the region but also uses its extensive machine park to produce new molds for a growing customer base.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.JPG;width=700;quality=80)

.JPG;width=860)

.JPG;width=860)

.JPG;width=860)

.jpg;maxWidth=150;quality=70)

.jpg;maxWidth=400;quality=70)