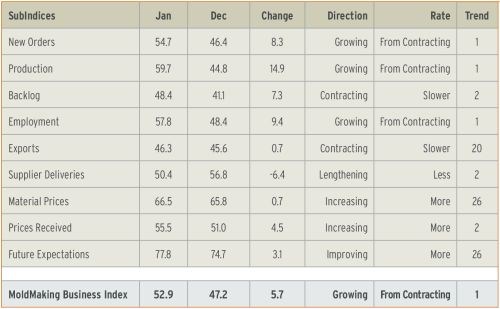

With a reading of 52.9, Gardner’s MBI showed that the moldmaking industry grew in January at its fastest rate since July 2012. The industry has grown in three of the previous four months. In addition, January’s index was 6.2 percent higher than it was last January—the fourth straight month that the index has been higher than it was one year earlier. This is a significant indication that the state of the moldmaking industry has improved.

New orders grew for the third time in four months, and the rate of growth was consistent with the first half of 2013. The production index reached its highest level since June 2012 and has grown four of the previous five months. Backlogs are still contracting, but the rate of contraction has been slowing. This is an indication that capacity utilization in the industry should improve in 2014. Hiring jumped noticeably in January, as the employment index hit its highest level since June 2012. Exports continue to contract, and continued tapering by the Federal Reserve means that it is likely that exports will continue to do so. Supplier deliveries continued to lengthen, and the rate of lengthening generally has been increasing since August 2013.

Materials prices continued to grow in January at a rate faster than most of 2013. Prices received have increased at a substantially faster rate, too; however, material prices continue to increase at a faster rate than prices received. Future business expectations have steadily improved since November 2012 and are at their second highest level in the history of the survey.

After contracting hard in December, custom processors (molders) returned to growth in January. However, for the previous three months, the index for metalcutting job shops (moldmakers) has been at a higher level than the index for custom processors. Metalcutting job shops have grown two of the previous three months.

The West North Central region grew at the fastest pace in January, the first time this region has grown since July 2013. The region with the second fastest growth was the East

North Central, which grew for the third time in four months. It was followed by the South Atlantic, which grew for the third consecutive month, while the Middle Atlantic contracted after growing the previous two months.

Future capital spending plans were 9.4 percent higher than they were in January 2013. This is the second time in three months that the average spending per plant was higher than it was one year earlier. Also, future spending plans in January were at the third highest level since the index began in December 2011.

To see the historical breakdown of our business index and each of its subindices, visit gardnerweb.com/forecast/moldmaking.htm.

Related Content

-

How to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

-

MMT Chats: 4 Keys to a Successful Mold-Building Operation: Innovation, Transparency, Accessibility and Relationship

MoldMaking Technology Editorial Director Christina Fuges chats with Steve Michon, co-owner of Zero Tolerance in Clinton Township, Michigan, about the excitement of solving problems, the benefits of showing gratitude, the real struggle with delegation and the importance of staying on top of technology. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

-

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

.JPG;width=70;height=70;mode=crop)