State of Mold Manufacturing in Portugal

Portugal boasts some of the most advanced and innovative moldmaking businesses that have nearly doubled their export and production rate over the past ten years.

The largest wave ever surfed by a human rolled into Nazaré, Portugal in 2011. It rose to 78 feet and was ridden by surfer Garret McNamara. Nazaré has become world-famous for the giant waves that hit the coast every winter from October to February attracting surfers and spectators from all over the world.

We made just a short stop in Nazaré during our recent road trip in Portugal, because the reason for the participating trade journalists to visit the country, which sits on the edge of Europe in relative obscurity – especially when compared to neighboring Spain and France – was to explore Portugal’s moldmaking hot spots, Marinha Grande and Oliveira de Azeméis, arelocated just 130 km and 270 km north of Lisbon respectively, the regions combine more than 500 tool and moldmaking companies, many of them in walking distance.

The reason for the evolution of this “hotbed of moldmaking” date back to a centuries-old glass-making tradition that crossed naturally over into creating molds for plastic parts. At the beginning of the 20th century, Marinha Grande began producing molds for glassware, having previously imported them from Germany and Austria. This was the foundation for the growth of the plastics molds industry today. Aníbal H. Abrantes, a partner and lathe-worker in the first pressed glass molds plant in Marinha Grande, established the first molds plant for Bakelite products in 1944. Two years later, Abrantes produced Portugal's first plastic injection mold. Other plastic mold companies began to open in Marinha Grande and Oliveira de Azeméis.

Today, the mold industry in these two regions employs a good 10,500 people, bringing the local unemployment rate down to less than four percent, a Commercial Manager at a technical plastics company in Marinha Grande explains.

“Highly skilled people are difficult to find, so like many companies in the region we invest in automation,” he says. The company produces injection-molded parts to many Tier-1 suppliers to the automotive industry, which makes up 95% of the business. All of the molds annually needed by the company are made by local moldmakers; five of them are in walking distance, producing high-quality molds in increasingly paperless production environments using the latest five-axis machines with pallet changers and other automation equipment.

Investments in R&D, Automation

Most companies in this region report they have invested in or have plans to invest in new five-axis machines, software, paperless production, lean management and automation equipment. Some companies have also heavily invested in new, modern buildings and work environments which are sure to attract the best talent in town.

So, what has happened since the GFC, when competition from low-cost countries, and the sharp depreciation of the U.S. dollar against the euro combined to wreak havoc on the economy of the small European nation. For example, by 2012, mold exports to North America reached a historic low of just two percent of Portugal’s total; today, exports to North America rose to 10% including Mexico, according to Cefamol, the National Association for the Molds Industry.

One reason is government funding through the “Portugal 2020” strategy, which is part of “Europe 2020”, a European strategy to foster productivity and employment among other things. Portugal will receive about 25 billion euros until 2020 in order to reach the goals defined by the European strategy such as decreasing the unemployment rate and stimulating the growth of businesses.

The other reasons are new and emerging markets, a strong automotive industry (82% of Portugal’s molds go into automotive, followed by packaging (8%)) and the mold industry’s own efforts to retool itself.

About ten years ago, the sector’s local leaders, in close coordination with the Portuguese Ministry of Economy and Innovation, founded the private, non-profit Pool-Net Association to manage the Portuguese engineering and tooling cluster. Formally recognized as a legal entity by the Portuguese government in 2009, the cluster’s goal is to drive innovation and coordinate firms in the manufacturing supply chain that are engaged in industrial design, engineering and product development, prototyping, tooling, plastic and metal parts production.

Sharp Rise in Product Exports

All this led to Portugal’s moldmaking industry being busy with work and realizing a sharp rise in product exports. “We are very proud of this industry, which experienced a growth of 8% last year,” Portugal’s Minister for Economic Affairs, Manuel Caldeira Cabral, says. “Portugal currently exports over 85 percent of production to 86 countries. In 2017, exports reached a value of 675 million euros. Exports as well as employment has doubled in the last ten years. Europe is the main export zone, although exports to North America and Mexico are increasing.”

“Our mold exports to the U.S. are increasing, because there is a growing demand for molds from various industries, but in contrast to many other markets such as Mexico, our companies have no local production there yet. But there are very interesting possibilities in the development of relationships with companies in the United States.”

While Portuguese moldmakers are much more integrated into the European supply chain, it’s about finding the right way and opportunities in that value chain (mainly automotive, which accounts for about 70 percent of production) in other export markets, the Minister adds.

But tapping into new markets such as Mexico is easier said than done, even though Mexico currently is the seventh largest location in the world for automotive production and OEMS will further increase their capacities to meet growing demand. Many of the Portuguese mold shops are supplying their products to all major OEMs as Tier1 or Tier2 suppliers but since the majority of shops is too small to build up capacities to establish local subsidiaries, some of them decided joined forces.

Collaboration is Key

In contrast to many countries’ moldmaking industries, collaboration and cooperative manufacturing is common practice in Portugal – which is what five moldmakers have done to service their Mexican customers.

“The companies decided to join forces to establish a factory for mold service, repair, maintenance and new molds in Mexico because Mexico is a growing market and local service for mold changes and repair is not sufficient,” says João Faustino, president of Cefamol. There are plans to establish a technical center in Mexico similar to the one in Portugal, Centimfe (Technological Center for the Moldmaking, Special Tooling and Plastic Industries). Moreover, the companies have already been training 14 Mexicans since June 2018 for their new production facility in Mexico.

In Portugal, business is good, Faustino says, but investment activities by OEMs are currently moderate because people are anxious about current changes in the automotive market such as e-mobility, “Dieselgate” and growing competition from China. As a result, prices for molds and tools decreased in 2018, and companies like his own in Marinha Grande, who earn 80% of their turnover from the automotive industry, have to adjust and develop strategies to optimize production. Therefore, Faustino has already introduced a paperless factory, lean principles such as 5s and plans to re-organize his production which is currently divided into several factories according to mold size. In future, Faustino will organize his factory divided by the type of machining, i.e. all roughing and finishing operations will be joined under separate roofs.

Faustino has also invested in eight new machining centers to be delivered next year, all five-axis with pallet systems and some with two tables to optimize set-ups and increase the degree of automation. “The goal is to be able to run the machines 24/7 unattended,” Faustino says.

Complete Machining, Metal AM and Paperless

The trend to five-axis complete machining is evident in many shops in this region, including one of the major players in blow molds for the glass industry producing around 30,000 cavities per year. All new investments in the company’s machine park will be five-axis complete machining; ten machines have already been installed.

Five-axis milling machines from DMG Mori combined with automation systems from Erowa as well as automated EDM machines from OPS Ingersoll with a robot handling workpieces an electrodes dominated the mold production at a mold shop driven by VW, Audi and Porsche, employing more than 400 people in Marinha Grande. The company has already established plants in Mexico and Brazil and decided to organize its workforce by what it calls “superspecialization”, which means employees are dedicated to either EDM, milling, assembly or prototyping. “We don’t hire management people, we build them up here,” is the General Manager’s credo.

To create a great work environment, the company has built new buildings in a very modern design, including recreational areas such as a gym, canteen and a park with a walking trail. Moreover, designers are free to design other things than molds and participate in global arts competitions with 3D-printed plastics parts (the company installed the first 3D-printer in 1994).

3D-printing or more specifically metal additive manufacturing is certainly what makes a Bathalha-based company stand out from the crowd. According to the Production Manager, the company was the first in Portugal to run an M3 Linear Laser Cusing machine from Concept laser to offer customers the opportunity to integrate complex conformal cooling channels into their molds. This year, the company has complemented the laser sintering capabilities with another machine from Concept Laser, an M2 Laser Cusing machine with one laser. “I believe in running machines with one laser as there is less heat and hence less warpage produced,” he says.

Despite the shopfloor – boasting wire and die sinking EDM machines, some connected to Röders HSC systems, deep-boring machines, four CMMs, ten new five-axis machines as well as a brand new DMU 270P gantry, as well as an in-house mold shop with 30 injection molding machines, the Production Manager is most proud of the company’s in-house developed software, which has ensured a digital, paperless manufacturing environment for more than 20 years now.

“All data of all molds and products are in the system,” he explains. “If you need to have a look at one of the 2,000 parts making up a mold, you simply click on it and have all the information including CAD data available. Everyone can see what’s happening in real-time and put in new information or required changes.”

Related Content

Treatment and Disposal of Used Metalworking Fluids

With greater emphasis on fluid longevity and fluid recycling, it is important to remember that water-based metalworking fluids are “consumable” and have a finite life.

Read MoreSolving Mold Alignment Problems with the Right Alignment Lock

Correct alignment lock selection can reduce maintenance costs and molding downtime, as well as increase part quality over the mold’s entire life.

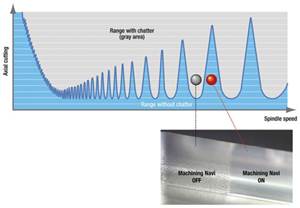

Read MoreHow to Eliminate Chatter

Here are techniques commonly used to combat chatter and guidelines to establish a foundation for optimizing the moldmaking process.

Read MoreAdvantages and Disadvantages of Copper and Graphite Electrodes

Both copper and graphite provide approximately the same end result, so it is important for a shop to consider the advantages and disadvantages of each material in order to discover what would work best in their shop floor environment.

Read MoreRead Next

Reasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

.JPG;width=700;quality=80)

.JPG;width=860)

.JPG;width=860)

.JPG;width=860)

.JPG;width=860)

.JPG;width=860)

.JPG;width=860)

.JPG;width=860)

.JPG;width=860)

.JPG;width=860)

.JPG;width=860)

.JPG;width=860)