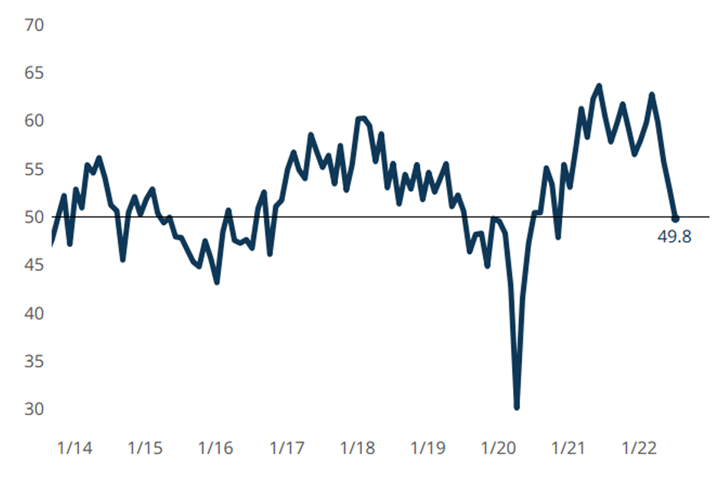

Moldmaking Industry GBI Perpetuates Deceleration Trend into July

Every component experienced contraction in July, led by enduring supply chain disruptions.

GBI: Moldmaking continued its downward trend in July, landing at an Index that hints of contraction (<50).

The Gardner Business Index (GBI): Moldmaking closed July at 49.8, down three points from the previous month. The Index has not dipped this close to “50” — signaling “flat” or little to no growth — since November 2020. Alternately, trends above 50 reflect industry growth. The greater the degree it moves away from “50,” the faster and more positive that growth is.

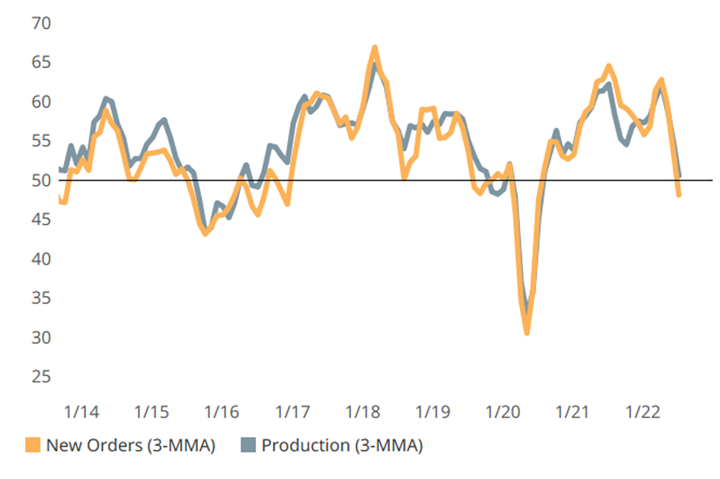

Every component decelerated in July — new orders the most — showing contraction for the first time in nearly two years. Production, backlog and employment threaten to join new orders and exports in contracting if their downward paths persist. Supplier deliveries continue to lengthen, but at continually slowing rates. Given the enduring supply disruption, the relationship between supplier deliveries and other GBI components is atypical, even loose, at best.

Most components experienced slowed growth in July, with new orders just crossing into contraction. Production declined hand-in-hand with new orders, putting it on the verge of “flat” or no growth. (This graph is on a three-month moving average.)

Related Content

-

Moldmaking Activity Returns to Accelerated Contraction

February’s index dropped from the more positive readings seen in January, landing on par with July 2023 and remaining in contraction mode.

-

November GBI Saw a Drop in Moldmaking Activity

The moldmaking index experienced a high degree of accelerated contract, primarily driven by production, new orders and backlog readings.

-

Contraction in Moldmaking Activity Slowed According to GBI

The moldmaking index almost bounced back to November’s reading but stopped one point shy, as most components slowed or stabilized contraction in December.