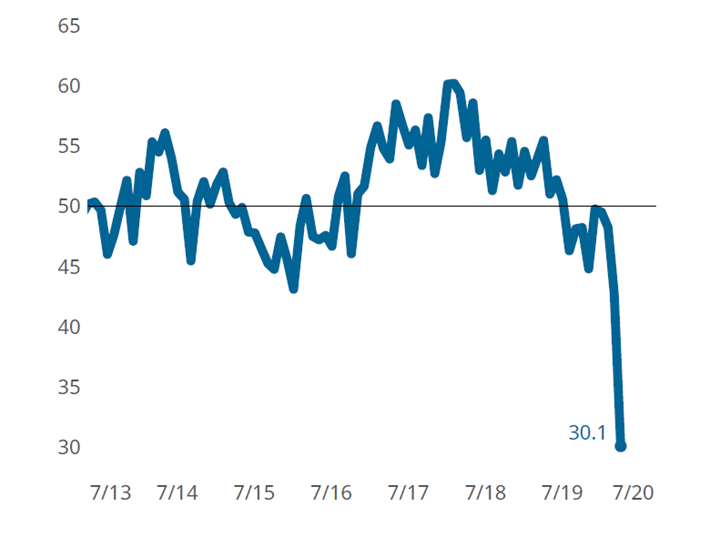

Moldmaking Index Registers April Collapse in Business Activity

Survey respondents report collapse in new orders, driving the Moldmaking Index down 13 points for April 2020.

The GBI: Moldmaking fell a further 13 points in April after reporting a near record low in March. Gardner Intelligence’s review of the underlying index observed that the Index — calculated as an average of its components — experienced a virtual collapse in new orders, production and exports. That these components are leading indicators of employment and backlog activity suggests further challenges ahead for the industry. April’s sub-20 reading for new orders activity was matched by a similar reading for production activity. It is important to remember that these readings represent the breadth of change occurring within the moldmaking industry. These low readings indicate only that a large proportion of respondents reported a decreased level of business activity without quantifying the magnitude of the downward change.

The reading for supplier deliveries was elevated for a second month. As we reported last month, the supplier delivery question is asked with the response options being ‘slower’, ‘same’ and ‘faster’. In normal times when demand for upstream goods is high, supply chains cannot keep pace with these orders. The result is a growing backlog of supplier orders which lengthen delivery times from the perspective of moldmakers. Our survey therefore interprets slowing deliveries as a sign of economic strength. In the current situation, efforts to slow the spread of COVID-19 have significantly disrupted supply chains and slowed deliveries. It is this disruption, as opposed to growing backlogs for upstream products, that is elevating the supplier deliveries reading.

Moldmakers reported a drastic fall in new orders activity, which sent production and backlogs lower. All components except for supplier deliveries registered significantly lower readings for April.

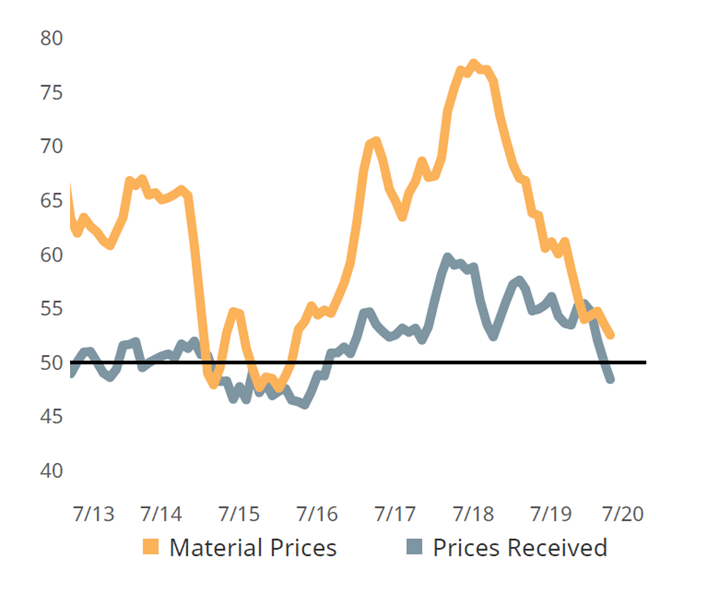

April’s survey results reported that a greater proportion of molders received the same or lower prices for their products for the first time since mid-2016. This was coupled with an above-50 reading for material prices. The combination of these results implies that margins — which were already signaling stress in prior months — weakened at an accelerating rate in April. Survey results for prices received and material prices are not used in the calculation of the Moldmaking Index.

Survey data tracking prices received registered its third consecutive reading below 50 in April, indicating weakening pricing power for moldmakers. Conversely, the reading for material prices remained above 50, the results collectively imply growing pressure on profit margins.

Related Content

-

Moldmaking Activity Returns to Accelerated Contraction

February’s index dropped from the more positive readings seen in January, landing on par with July 2023 and remaining in contraction mode.

-

Moldmaking Industry GBI Contracts for Four Months Straight

The GBI Moldmaking ended the month at 45.8, down one point from June, with components contracting or nearing contraction activity.

-

GBI: Moldmaking Undertakes Slightly Slowing Contraction

While most component activities remained unchanged in September, employment and supplier deliveries indicate a brief let-up from the contraction trend.

.jpg;width=70;height=70;mode=crop)